GST: A Guide on Exports (Eleventh Edition) - IRAS

GST: A Guide on Exports (Eleventh Edition) - IRAS

GST: A Guide on Exports (Eleventh Edition) - IRAS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

A GUIDE ON EXPORT – GOODS HAND-CARRIED OUT OF SINGAPORE<br />

7 Goods Hand-carried out of Singapore<br />

The Comptroller recognises that there are instances where goods sold to overseas<br />

customers (excluding tourists who are eligible for a refund unde r the Tourist<br />

Refund Scheme) are hand-carried out of Singapore by individuals.<br />

Zero-rating is allowed irrespective of who hand-carries the goods out of Singapore.<br />

The pers<strong>on</strong> who hand-carries the goods out of Singapore (referred to as the “carrier”<br />

in this paragraph) can be:<br />

(a)<br />

(b)<br />

(c)<br />

the local supplier X himself;<br />

the overseas customer Y himself; or<br />

a pers<strong>on</strong> who is appointed and authorised by X or Y to bring the goods out of<br />

Singapore (e.g. employee or representative).<br />

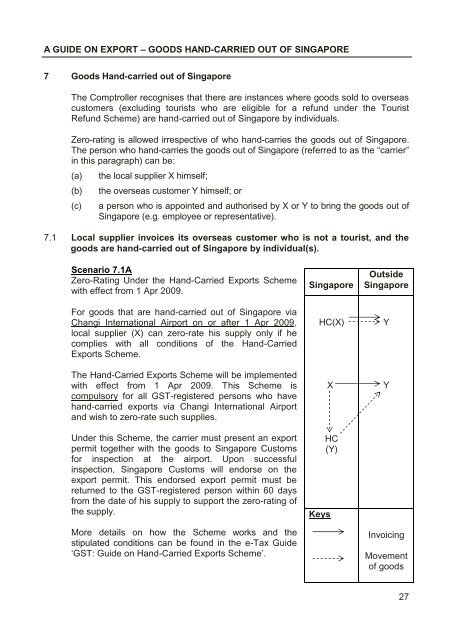

7.1 Local supplier invoices its overseas customer who is not a tourist, and the<br />

goods are hand-carried out of Singapore by individual(s).<br />

Scenario 7.1A<br />

Zero-Rating Under the Hand-Carried <strong>Exports</strong> Scheme<br />

with effect from 1 Apr 2009.<br />

For goods that are hand-carried out of Singapore via<br />

Changi Internati<strong>on</strong>al Airport <strong>on</strong> or after 1 Apr 2009,<br />

local supplier (X) can zero -rate his supply <strong>on</strong>ly if he<br />

complies with all c<strong>on</strong>diti<strong>on</strong>s of the Hand-Carried<br />

<strong>Exports</strong> Scheme.<br />

The Hand-Carried <strong>Exports</strong> Scheme will be implemented<br />

with effect from 1 Apr 2009. This Scheme is<br />

compulsory for all <str<strong>on</strong>g>GST</str<strong>on</strong>g>-registered pers<strong>on</strong>s who have<br />

hand-carried exports via Changi Internati<strong>on</strong>al Airport<br />

and wish to zero-rate such supplies.<br />

Under this Scheme, the carrier must present an export<br />

permit together with the goods to Singapore Customs<br />

for inspecti<strong>on</strong> at the airport. Up<strong>on</strong> successful<br />

inspecti<strong>on</strong>, Singapore Customs will endorse <strong>on</strong> the<br />

export permit. This endorsed export permit must be<br />

returned to the <str<strong>on</strong>g>GST</str<strong>on</strong>g>-registered pers<strong>on</strong> within 60 days<br />

from the date of his supply to support the zero-rating of<br />

the supply.<br />

More details <strong>on</strong> how the Scheme works and the<br />

stipulated c<strong>on</strong>diti<strong>on</strong>s can be found in the e-Tax <str<strong>on</strong>g>Guide</str<strong>on</strong>g><br />

‘<str<strong>on</strong>g>GST</str<strong>on</strong>g>: <str<strong>on</strong>g>Guide</str<strong>on</strong>g> <strong>on</strong> Hand-Carried <strong>Exports</strong> Scheme’.<br />

Singapore<br />

HC(X)<br />

X<br />

Keys<br />

HC<br />

(Y)<br />

Outside<br />

Singapore<br />

Y<br />

Y<br />

Invoicing<br />

Movement<br />

of goods<br />

27