GST: A Guide on Exports (Eleventh Edition) - IRAS

GST: A Guide on Exports (Eleventh Edition) - IRAS

GST: A Guide on Exports (Eleventh Edition) - IRAS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

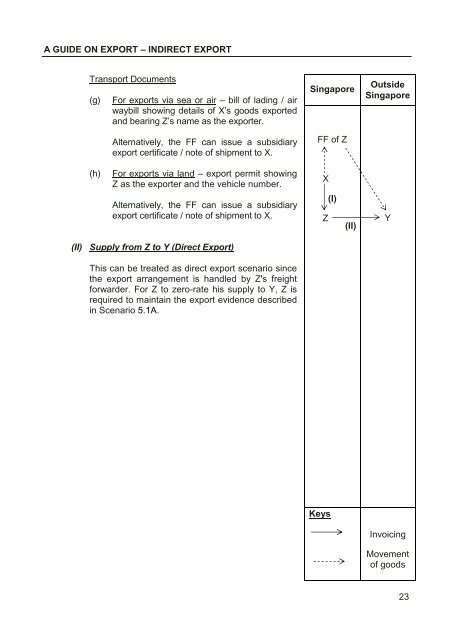

A GUIDE ON EXPORT – INDIRECT EXPORT<br />

Transport Documents<br />

(g)<br />

For exports via sea or air – bill of lading / air<br />

waybill showing details of X’s goods exported<br />

and bearing Z’s name as the exporter.<br />

Alternatively, the FF can issue a subsidiary<br />

export certificate / note of shipment to X.<br />

Singapore<br />

FF of Z<br />

Outside<br />

Singapore<br />

(h)<br />

For exports via land – export permit showing<br />

Z as the exporter and the vehicle number.<br />

X<br />

Alternatively, the FF can issue a subsidiary<br />

export certificate / note of shipment to X.<br />

Z<br />

(I)<br />

(II)<br />

Y<br />

(II)<br />

Supply from Z to Y (Direct Export)<br />

This can be treated as direct export scenario since<br />

the export arrangement is handled by Z's freight<br />

forwarder. For Z to zero-rate his supply to Y, Z is<br />

required to maintain the export evidence described<br />

in Scenario 5.1A.<br />

Keys<br />

Invoicing<br />

Movement<br />

of goods<br />

23