ROCKALL CLO B.V. - Irish Stock Exchange

ROCKALL CLO B.V. - Irish Stock Exchange

ROCKALL CLO B.V. - Irish Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SUMMARY<br />

The following summary ("Summary") does not purport to be complete and is qualified in its entirety by reference<br />

to the detailed information appearing elsewhere in this Offering Circular and related documents referred to<br />

herein. Capitalised terms not specifically defined in this Summary have the meanings set out in Condition 1<br />

(Definitions) of the section of this Offering Circular headed "Terms and Conditions" or the "Market Valuation<br />

Manual" included herein or are defined elsewhere in this Offering Circular. References to a "Condition" are to the<br />

specified Condition in the section of this Offering Circular headed "Terms and Conditions" below. For a<br />

discussion of certain risk factors to be considered in connection with an investment in the VF Notes or the Notes,<br />

see the section of this Offering Circular headed "Risk Factors".<br />

Issuer<br />

Collateral Manager<br />

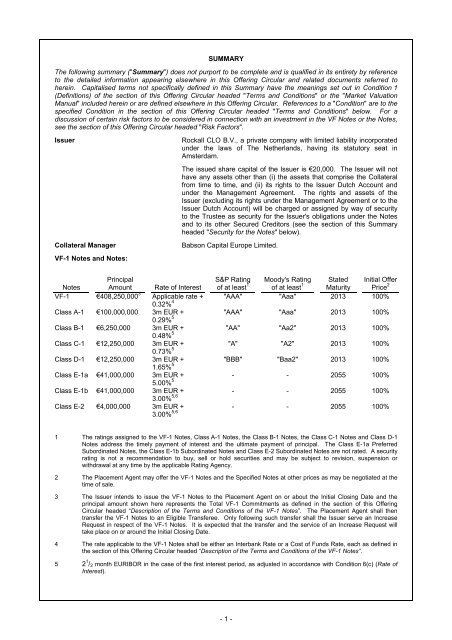

VF-1 Notes and Notes:<br />

Rockall <strong>CLO</strong> B.V., a private company with limited liability incorporated<br />

under the laws of The Netherlands, having its statutory seat in<br />

Amsterdam.<br />

The issued share capital of the Issuer is €20,000. The Issuer will not<br />

have any assets other than (i) the assets that comprise the Collateral<br />

from time to time, and (ii) its rights to the Issuer Dutch Account and<br />

under the Management Agreement. The rights and assets of the<br />

Issuer (excluding its rights under the Management Agreement or to the<br />

Issuer Dutch Account) will be charged or assigned by way of security<br />

to the Trustee as security for the Issuer's obligations under the Notes<br />

and to its other Secured Creditors (see the section of this Summary<br />

headed "Security for the Notes" below).<br />

Babson Capital Europe Limited.<br />

Notes<br />

Principal<br />

Amount Rate of Interest<br />

S&P Rating<br />

of at least 1<br />

Moody's Rating<br />

of at least 1<br />

Stated<br />

Maturity<br />

Initial Offer<br />

Price 2<br />

VF-1 €408,250,000 3 Applicable rate + "AAA" "Aaa" 2013 100%<br />

0.32% 4<br />

Class A-1 €100,000,000 3m EUR +<br />

"AAA" "Aaa" 2013 100%<br />

0.29% 5<br />

Class B-1 €6,250,000 3m EUR +<br />

"AA" "Aa2" 2013 100%<br />

0.48% 5<br />

Class C-1 €12,250,000 3m EUR +<br />

"A" "A2" 2013 100%<br />

0.73% 5<br />

Class D-1 €12,250,000 3m EUR +<br />

"BBB" "Baa2" 2013 100%<br />

1.65% 5<br />

Class E-1a €41,000,000 3m EUR +<br />

- - 2055 100%<br />

5.00% 5<br />

Class E-1b €41,000,000 3m EUR +<br />

- - 2055 100%<br />

3.00% 5,6<br />

Class E-2 €4,000,000 3m EUR +<br />

3.00% 5,6 - - 2055 100%<br />

1 The ratings assigned to the VF-1 Notes, Class A-1 Notes, the Class B-1 Notes, the Class C-1 Notes and Class D-1<br />

Notes address the timely payment of interest and the ultimate payment of principal. The Class E-1a Preferred<br />

Subordinated Notes, the Class E-1b Subordinated Notes and Class E-2 Subordinated Notes are not rated. A security<br />

rating is not a recommendation to buy, sell or hold securities and may be subject to revision, suspension or<br />

withdrawal at any time by the applicable Rating Agency.<br />

2 The Placement Agent may offer the VF-1 Notes and the Specified Notes at other prices as may be negotiated at the<br />

time of sale.<br />

3 The Issuer intends to issue the VF-1 Notes to the Placement Agent on or about the Initial Closing Date and the<br />

principal amount shown here represents the Total VF-1 Commitments as defined in the section of this Offering<br />

Circular headed “Description of the Terms and Conditions of the VF-1 Notes”. The Placement Agent shall then<br />

transfer the VF-1 Notes to an Eligible Transferee. Only following such transfer shall the Issuer serve an Increase<br />

Request in respect of the VF-1 Notes. It is expected that the transfer and the service of an Increase Request will<br />

take place on or around the Initial Closing Date.<br />

4 The rate applicable to the VF-1 Notes shall be either an Interbank Rate or a Cost of Funds Rate, each as defined in<br />

the section of this Offering Circular headed “Description of the Terms and Conditions of the VF-1 Notes”.<br />

5 2 1 / 2 month EURIBOR in the case of the first interest period, as adjusted in accordance with Condition 6(c) (Rate of<br />

Interest).<br />

- 1 -