ROCKALL CLO B.V. - Irish Stock Exchange

ROCKALL CLO B.V. - Irish Stock Exchange

ROCKALL CLO B.V. - Irish Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

comprising Excess Issuer Investments (see the section of this Summary<br />

headed "Portfolio Excesses" below).<br />

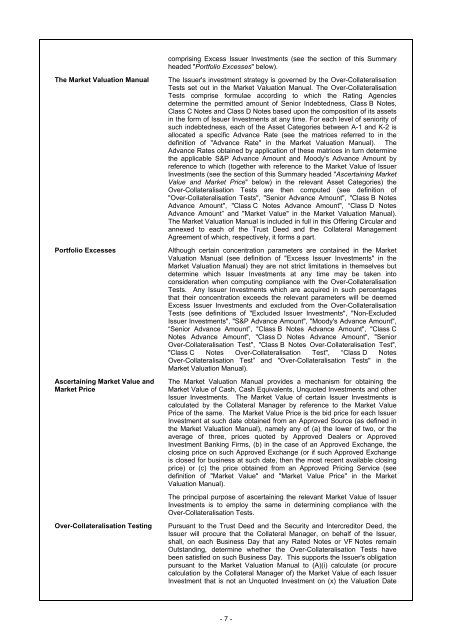

The Market Valuation Manual<br />

Portfolio Excesses<br />

Ascertaining Market Value and<br />

Market Price<br />

Over-Collateralisation Testing<br />

The Issuer's investment strategy is governed by the Over-Collateralisation<br />

Tests set out in the Market Valuation Manual. The Over-Collateralisation<br />

Tests comprise formulae according to which the Rating Agencies<br />

determine the permitted amount of Senior Indebtedness, Class B Notes,<br />

Class C Notes and Class D Notes based upon the composition of its assets<br />

in the form of Issuer Investments at any time. For each level of seniority of<br />

such indebtedness, each of the Asset Categories between A-1 and K-2 is<br />

allocated a specific Advance Rate (see the matrices referred to in the<br />

definition of "Advance Rate" in the Market Valuation Manual). The<br />

Advance Rates obtained by application of these matrices in turn determine<br />

the applicable S&P Advance Amount and Moody's Advance Amount by<br />

reference to which (together with reference to the Market Value of Issuer<br />

Investments (see the section of this Summary headed "Ascertaining Market<br />

Value and Market Price" below) in the relevant Asset Categories) the<br />

Over-Collateralisation Tests are then computed (see definition of<br />

"Over-Collateralisation Tests", "Senior Advance Amount", "Class B Notes<br />

Advance Amount", "Class C Notes Advance Amount", “Class D Notes<br />

Advance Amount” and "Market Value" in the Market Valuation Manual).<br />

The Market Valuation Manual is included in full in this Offering Circular and<br />

annexed to each of the Trust Deed and the Collateral Management<br />

Agreement of which, respectively, it forms a part.<br />

Although certain concentration parameters are contained in the Market<br />

Valuation Manual (see definition of "Excess Issuer Investments" in the<br />

Market Valuation Manual) they are not strict limitations in themselves but<br />

determine which Issuer Investments at any time may be taken into<br />

consideration when computing compliance with the Over-Collateralisation<br />

Tests. Any Issuer Investments which are acquired in such percentages<br />

that their concentration exceeds the relevant parameters will be deemed<br />

Excess Issuer Investments and excluded from the Over-Collateralisation<br />

Tests (see definitions of "Excluded Issuer Investments", "Non-Excluded<br />

Issuer Investments", "S&P Advance Amount", "Moody's Advance Amount",<br />

“Senior Advance Amount”, "Class B Notes Advance Amount", "Class C<br />

Notes Advance Amount", "Class D Notes Advance Amount", "Senior<br />

Over-Collateralisation Test", "Class B Notes Over-Collateralisation Test",<br />

"Class C Notes Over-Collateralisation Test", “Class D Notes<br />

Over-Collateralisation Test” and "Over-Collateralisation Tests" in the<br />

Market Valuation Manual).<br />

The Market Valuation Manual provides a mechanism for obtaining the<br />

Market Value of Cash, Cash Equivalents, Unquoted Investments and other<br />

Issuer Investments. The Market Value of certain Issuer Investments is<br />

calculated by the Collateral Manager by reference to the Market Value<br />

Price of the same. The Market Value Price is the bid price for each Issuer<br />

Investment at such date obtained from an Approved Source (as defined in<br />

the Market Valuation Manual), namely any of (a) the lower of two, or the<br />

average of three, prices quoted by Approved Dealers or Approved<br />

Investment Banking Firms, (b) in the case of an Approved <strong>Exchange</strong>, the<br />

closing price on such Approved <strong>Exchange</strong> (or if such Approved <strong>Exchange</strong><br />

is closed for business at such date, then the most recent available closing<br />

price) or (c) the price obtained from an Approved Pricing Service (see<br />

definition of "Market Value" and "Market Value Price" in the Market<br />

Valuation Manual).<br />

The principal purpose of ascertaining the relevant Market Value of Issuer<br />

Investments is to employ the same in determining compliance with the<br />

Over-Collateralisation Tests.<br />

Pursuant to the Trust Deed and the Security and Intercreditor Deed, the<br />

Issuer will procure that the Collateral Manager, on behalf of the Issuer,<br />

shall, on each Business Day that any Rated Notes or VF Notes remain<br />

Outstanding, determine whether the Over-Collateralisation Tests have<br />

been satisfied on such Business Day. This supports the Issuer's obligation<br />

pursuant to the Market Valuation Manual to (A)(i) calculate (or procure<br />

calculation by the Collateral Manager of) the Market Value of each Issuer<br />

Investment that is not an Unquoted Investment on (x) the Valuation Date<br />

- 7 -