ROCKALL CLO B.V. - Irish Stock Exchange

ROCKALL CLO B.V. - Irish Stock Exchange

ROCKALL CLO B.V. - Irish Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

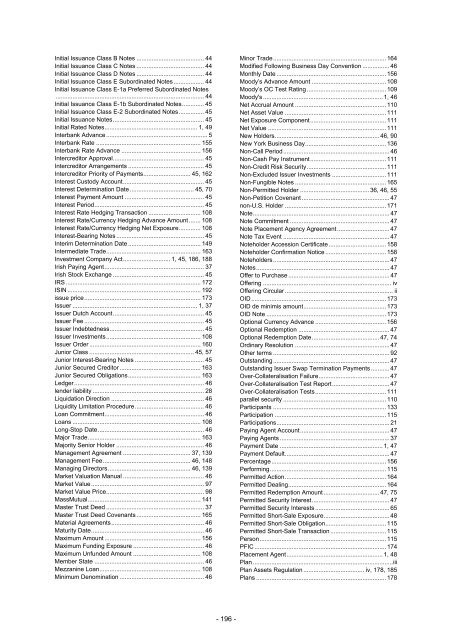

Initial Issuance Class B Notes ........................................ 44<br />

Initial Issuance Class C Notes ........................................ 44<br />

Initial Issuance Class D Notes ........................................ 44<br />

Initial Issuance Class E Subordinated Notes .................. 44<br />

Initial Issuance Class E-1a Preferred Subordinated Notes<br />

........................................................................................ 44<br />

Initial Issuance Class E-1b Subordinated Notes............. 45<br />

Initial Issuance Class E-2 Subordinated Notes............... 45<br />

Initial Issuance Notes...................................................... 45<br />

Initial Rated Notes....................................................... 1, 49<br />

Interbank Advance ............................................................ 5<br />

Interbank Rate .............................................................. 155<br />

Interbank Rate Advance ............................................... 156<br />

Intercreditor Approval...................................................... 45<br />

Intercreditor Arrangements ............................................. 45<br />

Intercreditor Priority of Payments............................ 45, 162<br />

Interest Custody Account................................................ 45<br />

Interest Determination Date ...................................... 45, 70<br />

Interest Payment Amount ............................................... 45<br />

Interest Period................................................................. 45<br />

Interest Rate Hedging Transaction ............................... 108<br />

Interest Rate/Currency Hedging Advance Amount ....... 108<br />

Interest Rate/Currency Hedging Net Exposure............. 108<br />

Interest-Bearing Notes .................................................... 45<br />

Interim Determination Date ........................................... 149<br />

Intermediate Trade........................................................ 163<br />

Investment Company Act............................ 1, 45, 186, 188<br />

<strong>Irish</strong> Paying Agent........................................................... 37<br />

<strong>Irish</strong> <strong>Stock</strong> <strong>Exchange</strong> ...................................................... 45<br />

IRS ................................................................................ 172<br />

ISIN ............................................................................... 192<br />

issue price..................................................................... 173<br />

Issuer .......................................................................... 1, 37<br />

Issuer Dutch Account...................................................... 45<br />

Issuer Fee ....................................................................... 45<br />

Issuer Indebtedness........................................................ 45<br />

Issuer Investments........................................................ 108<br />

Issuer Order .................................................................. 160<br />

Junior Class .............................................................. 45, 57<br />

Junior Interest-Bearing Notes ......................................... 45<br />

Junior Secured Creditor ................................................ 163<br />

Junior Secured Obligations........................................... 163<br />

Ledger............................................................................. 46<br />

lender liability .................................................................. 28<br />

Liquidation Direction ....................................................... 46<br />

Liquidity Limitation Procedure......................................... 46<br />

Loan Commitment........................................................... 46<br />

Loans ............................................................................ 108<br />

Long-Stop Date............................................................... 46<br />

Major Trade................................................................... 163<br />

Majority Senior Holder .................................................... 46<br />

Management Agreement ........................................ 37, 139<br />

Management Fee.................................................... 46, 148<br />

Managing Directors................................................. 46, 139<br />

Market Valuation Manual ................................................ 46<br />

Market Value................................................................... 97<br />

Market Value Price.......................................................... 98<br />

MassMutual................................................................... 141<br />

Master Trust Deed .......................................................... 37<br />

Master Trust Deed Covenants ...................................... 165<br />

Material Agreements....................................................... 46<br />

Maturity Date................................................................... 46<br />

Maximum Amount ......................................................... 156<br />

Maximum Funding Exposure .......................................... 46<br />

Maximum Unfunded Amount ........................................ 108<br />

Member State ................................................................. 46<br />

Mezzanine Loan............................................................ 108<br />

Minimum Denomination .................................................. 46<br />

Minor Trade................................................................... 164<br />

Modified Following Business Day Convention ................ 46<br />

Monthly Date ................................................................. 156<br />

Moody’s Advance Amount ............................................ 108<br />

Moody’s OC Test Rating ............................................... 109<br />

Moody's ....................................................................... 1, 46<br />

Net Accrual Amount ...................................................... 110<br />

Net Asset Value ............................................................ 111<br />

Net Exposure Component............................................. 111<br />

Net Value ...................................................................... 111<br />

New Holders.............................................................. 46, 90<br />

New York Business Day................................................ 136<br />

Non-Call Period............................................................... 46<br />

Non-Cash Pay Instrument............................................. 111<br />

Non-Credit Risk Security............................................... 111<br />

Non-Excluded Issuer Investments ................................ 111<br />

Non-Fungible Notes ...................................................... 165<br />

Non-Permitted Holder ......................................... 36, 46, 55<br />

Non-Petition Covenant .................................................... 47<br />

non-U.S. Holder ............................................................ 171<br />

Note................................................................................. 47<br />

Note Commitment ........................................................... 47<br />

Note Placement Agency Agreement ............................... 47<br />

Note Tax Event ............................................................... 47<br />

Noteholder Accession Certificate .................................. 158<br />

Noteholder Confirmation Notice .................................... 158<br />

Noteholders..................................................................... 47<br />

Notes............................................................................... 47<br />

Offer to Purchase ............................................................ 47<br />

Offering ............................................................................ iv<br />

Offering Circular ................................................................ ii<br />

OID................................................................................ 173<br />

OID de minimis amount................................................. 173<br />

OID Note ....................................................................... 173<br />

Optional Currency Advance .......................................... 156<br />

Optional Redemption ...................................................... 47<br />

Optional Redemption Date........................................ 47, 74<br />

Ordinary Resolution ........................................................ 47<br />

Other terms ..................................................................... 92<br />

Outstanding..................................................................... 47<br />

Outstanding Issuer Swap Termination Payments ........... 47<br />

Over-Collateralisation Failure.......................................... 47<br />

Over-Collateralisation Test Report.................................. 47<br />

Over-Collateralisation Tests.......................................... 111<br />

parallel security ............................................................. 110<br />

Participants ................................................................... 133<br />

Participation .................................................................. 115<br />

Participations................................................................... 21<br />

Paying Agent Account..................................................... 47<br />

Paying Agents ................................................................. 37<br />

Payment Date ............................................................. 1, 47<br />

Payment Default.............................................................. 47<br />

Percentage.................................................................... 156<br />

Performing..................................................................... 115<br />

Permitted Action............................................................ 164<br />

Permitted Dealing.......................................................... 164<br />

Permitted Redemption Amount ................................. 47, 75<br />

Permitted Security Interest.............................................. 47<br />

Permitted Security Interests ............................................ 65<br />

Permitted Short-Sale Exposure....................................... 48<br />

Permitted Short-Sale Obligation.................................... 115<br />

Permitted Short-Sale Transaction ................................. 115<br />

Person........................................................................... 115<br />

PFIC .............................................................................. 174<br />

Placement Agent......................................................... 1, 48<br />

Plan ...................................................................................iii<br />

Plan Assets Regulation .................................... iv, 178, 185<br />

Plans ............................................................................. 178<br />

- 196 -