LISTING SUPPLEMENT $189000000 Class A-1 Notes $342100000 ...

LISTING SUPPLEMENT $189000000 Class A-1 Notes $342100000 ...

LISTING SUPPLEMENT $189000000 Class A-1 Notes $342100000 ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The Indenture Trustee will represent the interests of the noteholders and will have the<br />

right to access appropriate and relevant information relating to the assets of the Trust.<br />

First Marblehead Data Services, Inc. (the “Administrator”), as administrator of the Trust,<br />

may resign upon 60 days notice, in which event a successor administrator must be appointed.<br />

The Administrator may also be removed (i) if the Administrator ceases to be eligible to continue<br />

as administrator under the Administration Agreement dated as of June 10, 2004 among the<br />

Administrator, the Trust, the Owner Trustee and the Indenture Trustee, (ii) if the Administrator<br />

becomes insolvent or (iii) without cause upon 60 days notice. No resignation or removal of the<br />

Administrator shall take effect until (a) a successor administrator has been appointed and (b)<br />

after each Rating Agency has declared in writing that such appointment will not result in a<br />

reduction or withdrawal of the then current rating of the notes offered by the Trust. U.S. Bank<br />

National Association has entered into a Back-up Note Administration Agreement dated as of<br />

June 10, 2004 with the Trust, the Owner Trustee and the Administrator to perform the duties and<br />

obligations of the administrator if First Marblehead Data Services, Inc. ceases to provide<br />

administrative services.<br />

So long as any of the Listed <strong>Notes</strong> are outstanding, copies of the following documents<br />

will be available for inspection at the offices of the Irish Paying Agent and at the registered<br />

office of the Trust:<br />

(1) Trust Agreement;<br />

(2) Indenture;<br />

(3) Administration Agreement;<br />

(4) Servicing Agreements;<br />

(5) Guaranty Agreements; and<br />

(6) Deposit and Security Agreement.<br />

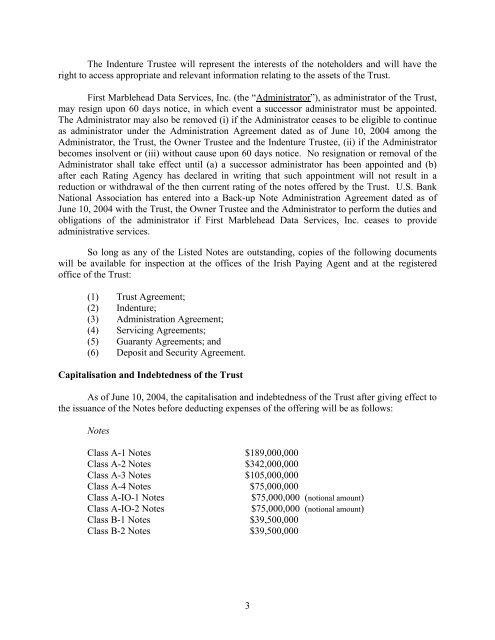

Capitalisation and Indebtedness of the Trust<br />

As of June 10, 2004, the capitalisation and indebtedness of the Trust after giving effect to<br />

the issuance of the <strong>Notes</strong> before deducting expenses of the offering will be as follows:<br />

<strong>Notes</strong><br />

<strong>Class</strong> A-1 <strong>Notes</strong> $189,000,000<br />

<strong>Class</strong> A-2 <strong>Notes</strong> $342,000,000<br />

<strong>Class</strong> A-3 <strong>Notes</strong> $105,000,000<br />

<strong>Class</strong> A-4 <strong>Notes</strong> $75,000,000<br />

<strong>Class</strong> A-IO-1 <strong>Notes</strong><br />

$75,000,000 (notional amount)<br />

<strong>Class</strong> A-IO-2 <strong>Notes</strong><br />

$75,000,000 (notional amount)<br />

<strong>Class</strong> B-1 <strong>Notes</strong> $39,500,000<br />

<strong>Class</strong> B-2 <strong>Notes</strong> $39,500,000<br />

3