LISTING SUPPLEMENT $189000000 Class A-1 Notes $342100000 ...

LISTING SUPPLEMENT $189000000 Class A-1 Notes $342100000 ...

LISTING SUPPLEMENT $189000000 Class A-1 Notes $342100000 ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The Education Resources Institute, Inc. and Subsidiary<br />

Supplemental Consolidating Statement of Activities and Changes in Net Assets<br />

Year Ended June 30, 2003<br />

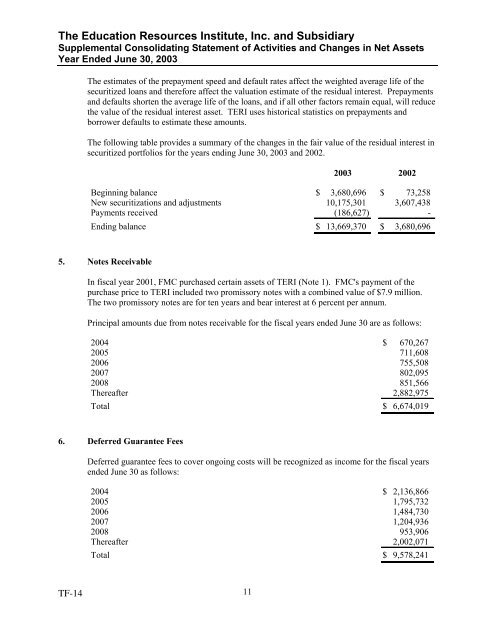

The estimates of the prepayment speed and default rates affect the weighted average life of the<br />

securitized loans and therefore affect the valuation estimate of the residual interest. Prepayments<br />

and defaults shorten the average life of the loans, and if all other factors remain equal, will reduce<br />

the value of the residual interest asset. TERI uses historical statistics on prepayments and<br />

borrower defaults to estimate these amounts.<br />

The following table provides a summary of the changes in the fair value of the residual interest in<br />

securitized portfolios for the years ending June 30, 2003 and 2002.<br />

2003 2002<br />

Beginning balance $ 3,680,696 $ 73,258<br />

New securitizations and adjustments 10,175,301 3,607,438<br />

Payments received (186,627) -<br />

Ending balance $ 13,669,370 $ 3,680,696<br />

5. <strong>Notes</strong> Receivable<br />

In fiscal year 2001, FMC purchased certain assets of TERI (Note 1). FMC's payment of the<br />

purchase price to TERI included two promissory notes with a combined value of $7.9 million.<br />

The two promissory notes are for ten years and bear interest at 6 percent per annum.<br />

Principal amounts due from notes receivable for the fiscal years ended June 30 are as follows:<br />

2004 $ 670,267<br />

2005 711,608<br />

2006 755,508<br />

2007 802,095<br />

2008 851,566<br />

Thereafter 2,882,975<br />

Total $ 6,674,019<br />

6. Deferred Guarantee Fees<br />

Deferred guarantee fees to cover ongoing costs will be recognized as income for the fiscal years<br />

ended June 30 as follows:<br />

2004 $ 2,136,866<br />

2005 1,795,732<br />

2006 1,484,730<br />

2007 1,204,936<br />

2008 953,906<br />

Thereafter 2,002,071<br />

Total $ 9,578,241<br />

TF-14<br />

11