LISTING SUPPLEMENT $189000000 Class A-1 Notes $342100000 ...

LISTING SUPPLEMENT $189000000 Class A-1 Notes $342100000 ...

LISTING SUPPLEMENT $189000000 Class A-1 Notes $342100000 ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The Education Resources Institute, Inc. and Subsidiary<br />

Supplemental Consolidating Statement of Activities and Changes in Net Assets<br />

Year Ended June 30, 2003<br />

Management makes significant estimates and assumptions regarding the collection of accounts<br />

and student loans receivable and the providing of the loan loss reserves at the date of the<br />

consolidated statements of financial position. These estimates and assumptions are based upon<br />

historical and current experience and expectations of future performance on the part of TERI, the<br />

economy, actuarial studies performed by outside parties, and other factors. It is possible that the<br />

actual collection of accounts and student loans receivable or payment of defaults will differ from<br />

these estimates.<br />

Fair Value of Financial Instruments<br />

The estimated fair values of TERI's financial instruments have been determined, where<br />

practicable, by using appropriate valuation methodologies. Due to their short-term nature, cash<br />

equivalents are carried at cost. Marketable securities are reported at quoted market prices derived<br />

from recognized national publications. Receivables for guarantee fees and residual interest are<br />

recorded at their estimated net realizable value. Student loans receivables are recorded at their<br />

current outstanding principal balance, while receivables recoverable on claims payments are<br />

based on management's estimate of amounts recoverable.<br />

Reclassification<br />

Certain prior year amounts have been reclassified to conform to the current year presentation.<br />

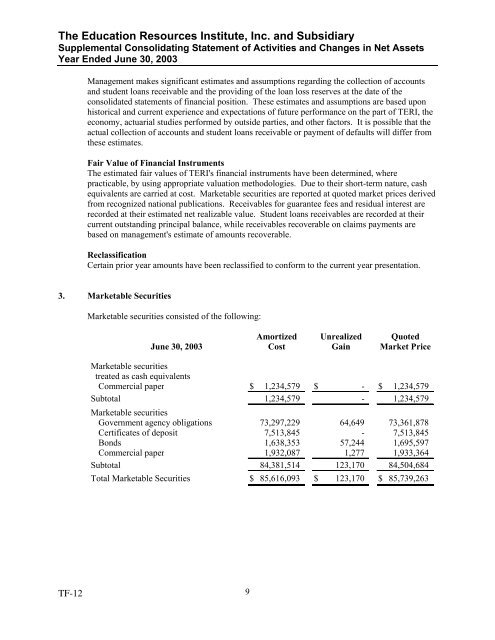

3. Marketable Securities<br />

Marketable securities consisted of the following:<br />

Amortized Unrealized Quoted<br />

June 30, 2003 Cost Gain Market Price<br />

Marketable securities<br />

treated as cash equivalents<br />

Commercial paper $ 1,234,579 $ - $ 1,234,579<br />

Subtotal 1,234,579 - 1,234,579<br />

Marketable securities<br />

Government agency obligations 73,297,229 64,649 73,361,878<br />

Certificates of deposit 7,513,845 - 7,513,845<br />

Bonds 1,638,353 57,244 1,695,597<br />

Commercial paper 1,932,087 1,277 1,933,364<br />

Subtotal 84,381,514 123,170 84,504,684<br />

Total Marketable Securities $ 85,616,093 $ 123,170 $ 85,739,263<br />

TF-12<br />

9