LISTING SUPPLEMENT $189000000 Class A-1 Notes $342100000 ...

LISTING SUPPLEMENT $189000000 Class A-1 Notes $342100000 ...

LISTING SUPPLEMENT $189000000 Class A-1 Notes $342100000 ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The Education Resources Institute, Inc. and Subsidiary<br />

Supplemental Consolidating Statement of Activities and Changes in Net Assets<br />

Year Ended June 30, 2003<br />

TERI's guarantee agreements require lenders to follow certain credit origination policies and due<br />

diligence guidelines for a loan to be eligible for claim payment. TERI may refuse to pay a default<br />

claim if these requirements have not been met. When a borrower defaults and a default claim is<br />

paid, TERI assumes the position of the lender and has full rights and recourse against all<br />

borrowers on the note.<br />

TERI provides a reserve against possible loss exposure in its portfolio using several assumptions<br />

based on actuarial studies, historical experience of other similar portfolios of student loans, and<br />

management's assessment of the creditworthiness of different types of loans. The assumptions<br />

used in determining the reserve against possible loss exposure includes estimated loan recovery<br />

levels consistent with historical performance, but which have not yet been achieved with respect<br />

to more recently defaulted loan cohorts. Accordingly, the evaluation of the provision for loan<br />

loss reserves is inherently subjective as it requires material estimates that may be susceptible to<br />

significant changes.<br />

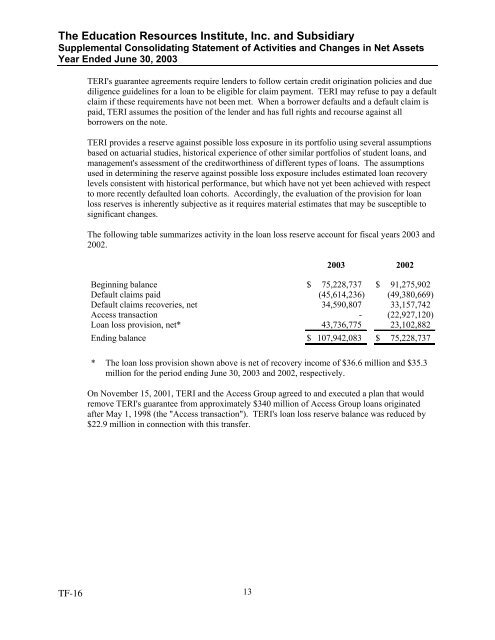

The following table summarizes activity in the loan loss reserve account for fiscal years 2003 and<br />

2002.<br />

2003 2002<br />

Beginning balance $ 75,228,737 $ 91,275,902<br />

Default claims paid (45,614,236) (49,380,669)<br />

Default claims recoveries, net 34,590,807 33,157,742<br />

Access transaction - (22,927,120)<br />

Loan loss provision, net* 43,736,775 23,102,882<br />

Ending balance $ 107,942,083 $ 75,228,737<br />

* The loan loss provision shown above is net of recovery income of $36.6 million and $35.3<br />

million for the period ending June 30, 2003 and 2002, respectively.<br />

On November 15, 2001, TERI and the Access Group agreed to and executed a plan that would<br />

remove TERI's guarantee from approximately $340 million of Access Group loans originated<br />

after May 1, 1998 (the "Access transaction"). TERI's loan loss reserve balance was reduced by<br />

$22.9 million in connection with this transfer.<br />

TF-16<br />

13