INFORMATION MEMORANDUM DATED 9 JULY 2009 ...

INFORMATION MEMORANDUM DATED 9 JULY 2009 ...

INFORMATION MEMORANDUM DATED 9 JULY 2009 ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

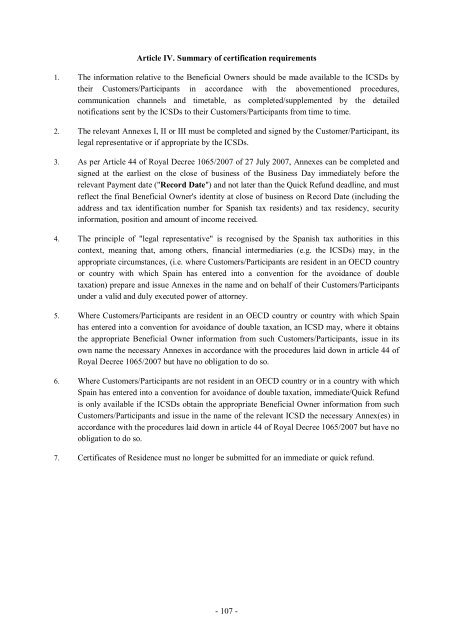

Article IV. Summary of certification requirements<br />

1. The information relative to the Beneficial Owners should be made available to the ICSDs by<br />

their Customers/Participants in accordance with the abovementioned procedures,<br />

communication channels and timetable, as completed/supplemented by the detailed<br />

notifications sent by the ICSDs to their Customers/Participants from time to time.<br />

2. The relevant Annexes I, II or III must be completed and signed by the Customer/Participant, its<br />

legal representative or if appropriate by the ICSDs.<br />

3. As per Article 44 of Royal Decree 1065/2007 of 27 July 2007, Annexes can be completed and<br />

signed at the earliest on the close of business of the Business Day immediately before the<br />

relevant Payment date ("Record Date") and not later than the Quick Refund deadline, and must<br />

reflect the final Beneficial Owner's identity at close of business on Record Date (including the<br />

address and tax identification number for Spanish tax residents) and tax residency, security<br />

information, position and amount of income received.<br />

4. The principle of "legal representative" is recognised by the Spanish tax authorities in this<br />

context, meaning that, among others, financial intermediaries (e.g. the ICSDs) may, in the<br />

appropriate circumstances, (i.e. where Customers/Participants are resident in an OECD country<br />

or country with which Spain has entered into a convention for the avoidance of double<br />

taxation) prepare and issue Annexes in the name and on behalf of their Customers/Participants<br />

under a valid and duly executed power of attorney.<br />

5. Where Customers/Participants are resident in an OECD country or country with which Spain<br />

has entered into a convention for avoidance of double taxation, an ICSD may, where it obtains<br />

the appropriate Beneficial Owner information from such Customers/Participants, issue in its<br />

own name the necessary Annexes in accordance with the procedures laid down in article 44 of<br />

Royal Decree 1065/2007 but have no obligation to do so.<br />

6. Where Customers/Participants are not resident in an OECD country or in a country with which<br />

Spain has entered into a convention for avoidance of double taxation, immediate/Quick Refund<br />

is only available if the ICSDs obtain the appropriate Beneficial Owner information from such<br />

Customers/Participants and issue in the name of the relevant ICSD the necessary Annex(es) in<br />

accordance with the procedures laid down in article 44 of Royal Decree 1065/2007 but have no<br />

obligation to do so.<br />

7. Certificates of Residence must no longer be submitted for an immediate or quick refund.<br />

- 107 -