INFORMATION MEMORANDUM DATED 9 JULY 2009 ...

INFORMATION MEMORANDUM DATED 9 JULY 2009 ...

INFORMATION MEMORANDUM DATED 9 JULY 2009 ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Excluding this unit, net allocations for loans in the remaining area increased steadily with business,<br />

securing twin-figure growth in net operating income. Amid this scenario, write-down activity has<br />

given Santander Consumer Finance a non-performing loans ratio of 4.6% as compared with 3.1 per<br />

cent. in 2007 and a hedge ratio of 86.1%. Doubtful assets amounted to €2,291 million at 31 December<br />

2008, as compared with €1,357 million at 31 December 2007.<br />

Profit before taxes in 2008 was €537.1 million, or €398.03 after taxes (€378 million excluding<br />

minority interests). Profit before taxes in 2007 was €812.1 million and includes extraordinary results.<br />

From the management point of view inside the Santander Group, the 2008 net attributable profit<br />

attributable to the Consumer Group was €696 million (this includes other managed companies, for<br />

example Santander Consumer USA, a Texan subsidiary of the Santander Group which is also<br />

dedicated to financing vehicles in the US).<br />

New Business of the Issuer in 2008<br />

The volume of business grew in 2008 to €23.419 million, a decrease of €800 million with respect to<br />

2007.<br />

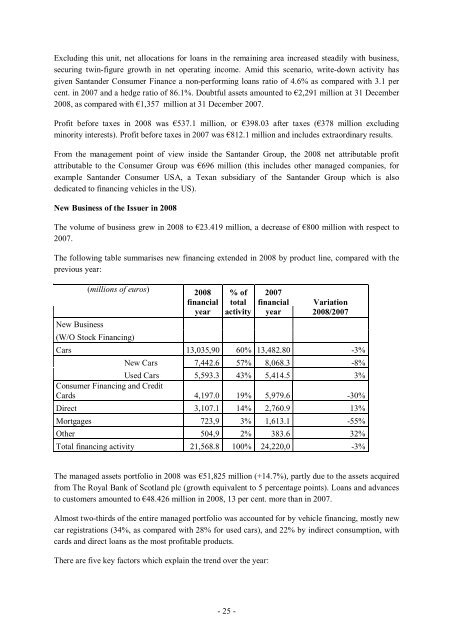

The following table summarises new financing extended in 2008 by product line, compared with the<br />

previous year:<br />

New Business<br />

(millions of euros) 2008<br />

financial<br />

year<br />

(W/O Stock Financing)<br />

% of<br />

total<br />

activity<br />

2007<br />

financial<br />

year<br />

Variation<br />

2008/2007<br />

Cars 13,035,90 60% 13,482.80 -3%<br />

New Cars 7,442.6 57% 8,068.3 -8%<br />

Used Cars 5,593.3 43% 5,414.5 3%<br />

Consumer Financing and Credit<br />

Cards 4,197.0 19% 5,979.6 -30%<br />

Direct 3,107.1 14% 2,760.9 13%<br />

Mortgages 723,9 3% 1,613.1 -55%<br />

Other 504,9 2% 383.6 32%<br />

Total financing activity 21,568.8 100% 24,220,0 -3%<br />

The managed assets portfolio in 2008 was €51,825 million (+14.7%), partly due to the assets acquired<br />

from The Royal Bank of Scotland plc (growth equivalent to 5 percentage points). Loans and advances<br />

to customers amounted to €48.426 million in 2008, 13 per cent. more than in 2007.<br />

Almost two-thirds of the entire managed portfolio was accounted for by vehicle financing, mostly new<br />

car registrations (34%, as compared with 28% for used cars), and 22% by indirect consumption, with<br />

cards and direct loans as the most profitable products.<br />

There are five key factors which explain the trend over the year:<br />

- 25 -