Sukuk & Capital Market - Islamic Finance News

Sukuk & Capital Market - Islamic Finance News

Sukuk & Capital Market - Islamic Finance News

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

feature<br />

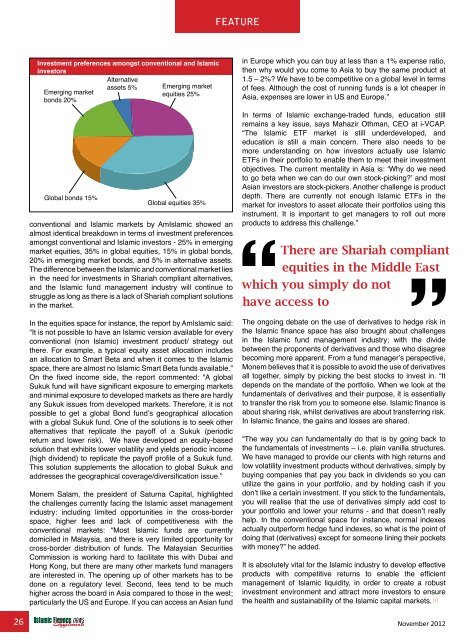

Investment preferences amongst conventional and <strong>Islamic</strong><br />

investors<br />

Alternative<br />

assets 5%<br />

Emerging market<br />

bonds 20%<br />

Global bonds 15%<br />

Emerging market<br />

equities 25%<br />

Global equities 35%<br />

conventional and <strong>Islamic</strong> markets by Am<strong>Islamic</strong> showed an<br />

almost identical breakdown in terms of investment preferences<br />

amongst conventional and <strong>Islamic</strong> investors - 25% in emerging<br />

market equities, 35% in global equities, 15% in global bonds,<br />

20% in emerging market bonds, and 5% in alternative assets.<br />

The difference between the <strong>Islamic</strong> and conventional market lies<br />

in the need for investments in Shariah compliant alternatives,<br />

and the <strong>Islamic</strong> fund management industry will continue to<br />

struggle as long as there is a lack of Shariah compliant solutions<br />

in the market.<br />

In the equities space for instance, the report by Am<strong>Islamic</strong> said:<br />

“It is not possible to have an <strong>Islamic</strong> version available for every<br />

conventional (non <strong>Islamic</strong>) investment product/ strategy out<br />

there. For example, a typical equity asset allocation includes<br />

an allocation to Smart Beta and when it comes to the <strong>Islamic</strong><br />

space, there are almost no <strong>Islamic</strong> Smart Beta funds available.”<br />

On the fixed income side, the report commented: “A global<br />

<strong>Sukuk</strong> fund will have significant exposure to emerging markets<br />

and minimal exposure to developed markets as there are hardly<br />

any <strong>Sukuk</strong> issues from developed markets. Therefore, it is not<br />

possible to get a global Bond fund’s geographical allocation<br />

with a global <strong>Sukuk</strong> fund. One of the solutions is to seek other<br />

alternatives that replicate the payoff of a <strong>Sukuk</strong> (periodic<br />

return and lower risk). We have developed an equity-based<br />

solution that exhibits lower volatility and yields periodic income<br />

(high dividend) to replicate the payoff profile of a <strong>Sukuk</strong> fund.<br />

This solution supplements the allocation to global <strong>Sukuk</strong> and<br />

addresses the geographical coverage/diversification issue.”<br />

Monem Salam, the president of Saturna <strong>Capital</strong>, highlighted<br />

the challenges currently facing the <strong>Islamic</strong> asset management<br />

industry: including limited opportunities in the cross-border<br />

space, higher fees and lack of competitiveness with the<br />

conventional markets: “Most <strong>Islamic</strong> funds are currently<br />

domiciled in Malaysia, and there is very limited opportunity for<br />

cross-border distribution of funds. The Malaysian Securities<br />

Commission is working hard to facilitate this with Dubai and<br />

Hong Kong, but there are many other markets fund managers<br />

are interested in. The opening up of other markets has to be<br />

done on a regulatory level. Second, fees tend to be much<br />

higher across the board in Asia compared to those in the west;<br />

particularly the US and Europe. If you can access an Asian fund<br />

in Europe which you can buy at less than a 1% expense ratio,<br />

then why would you come to Asia to buy the same product at<br />

1.5 – 2%? We have to be competitive on a global level in terms<br />

of fees. Although the cost of running funds is a lot cheaper in<br />

Asia, expenses are lower in US and Europe.”<br />

In terms of <strong>Islamic</strong> exchange-traded funds, education still<br />

remains a key issue, says Mahazir Othman, CEO at i-VCAP.<br />

“The <strong>Islamic</strong> ETF market is still underdeveloped, and<br />

education is still a main concern. There also needs to be<br />

more understanding on how investors actually use <strong>Islamic</strong><br />

ETFs in their portfolio to enable them to meet their investment<br />

objectives. The current mentality in Asia is: ‘Why do we need<br />

to go beta when we can do our own stock-picking?’ and most<br />

Asian investors are stock-pickers. Another challenge is product<br />

depth. There are currently not enough <strong>Islamic</strong> ETFs in the<br />

market for investors to asset allocate their portfolios using this<br />

instrument. It is important to get managers to roll out more<br />

products to address this challenge.”<br />

There are Shariah compliant<br />

equities in the Middle East<br />

which you simply do not<br />

have access to<br />

The ongoing debate on the use of derivatives to hedge risk in<br />

the <strong>Islamic</strong> finance space has also brought about challenges<br />

in the <strong>Islamic</strong> fund management industry; with the divide<br />

between the proponents of derivatives and those who disagree<br />

becoming more apparent. From a fund manager’s perspective,<br />

Monem believes that it is possible to avoid the use of derivatives<br />

all together, simply by picking the best stocks to invest in. “It<br />

depends on the mandate of the portfolio. When we look at the<br />

fundamentals of derivatives and their purpose, it is essentially<br />

to transfer the risk from you to someone else. <strong>Islamic</strong> finance is<br />

about sharing risk, whilst derivatives are about transferring risk.<br />

In <strong>Islamic</strong> finance, the gains and losses are shared.<br />

“The way you can fundamentally do that is by going back to<br />

the fundamentals of investments – i.e. plain vanilla structures.<br />

We have managed to provide our clients with high returns and<br />

low volatility investment products without derivatives, simply by<br />

buying companies that pay you back in dividends so you can<br />

utilize the gains in your portfolio, and by holding cash if you<br />

don’t like a certain investment. If you stick to the fundamentals,<br />

you will realise that the use of derivatives simply add cost to<br />

your portfolio and lower your returns - and that doesn’t really<br />

help. In the conventional space for instance, normal indexes<br />

actually outperform hedge fund indexes, so what is the point of<br />

doing that (derivatives) except for someone lining their pockets<br />

with money?” he added.<br />

It is absolutely vital for the <strong>Islamic</strong> industry to develop effective<br />

products with competitive returns to enable the efficient<br />

management of <strong>Islamic</strong> liquidity, in order to create a robust<br />

investment environment and attract more investors to ensure<br />

consulting www.<strong>Islamic</strong><strong>Finance</strong>Consulting.com<br />

www.<strong>Islamic</strong><strong>Finance</strong>Events.com<br />

the health and sustainability of the <strong>Islamic</strong> capital markets.<br />

www.<strong>Islamic</strong><strong>Finance</strong><strong>News</strong>.com<br />

www.<strong>Islamic</strong><strong>Finance</strong>Training.com<br />

www.MIFmonthly.com<br />

www.MIFtraining.com<br />

26 www.REDmoneyBooks.com<br />

November 2012<br />

www.MIFforum.com