Directors' Report and Financial Statements Structures and Statistics ...

Directors' Report and Financial Statements Structures and Statistics ...

Directors' Report and Financial Statements Structures and Statistics ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

52 ITB <strong>Financial</strong> <strong>Statements</strong> 1998–1999<br />

ITB <strong>Financial</strong> <strong>Statements</strong> 1998–1999<br />

53<br />

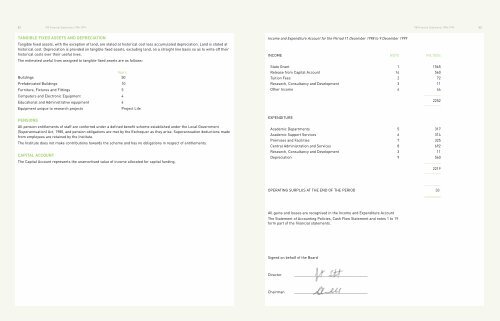

TANGIBLE FIXED ASSETS AND DEPRECIATION<br />

Tangible fixed assets, with the exception of l<strong>and</strong>, are stated at historical cost less accumulated depreciation. L<strong>and</strong> is stated at<br />

historical cost. Depreciation is provided on tangible fixed assets, excluding l<strong>and</strong>, on a straight line basis so as to write off their<br />

historical costs over their useful lives.<br />

The estimated useful lives assigned to tangible fixed assets are as follows:<br />

Years<br />

Buildings 50<br />

Prefabricated Buildings 10<br />

Furniture, Fixtures <strong>and</strong> Fittings 5<br />

Computers <strong>and</strong> Electronic Equipment 4<br />

Educational <strong>and</strong> Administrative equipment 4<br />

Equipment unique to research projects<br />

Project Life<br />

PENSIONS<br />

All pension entitlements of staff are conferred under a defined benefit scheme established under the Local Government<br />

(Superannuation) Act, 1980, <strong>and</strong> pension obligations are met by the Exchequer as they arise. Superannuation deductions made<br />

from employees are retained by the Institute.<br />

The Institute does not make contributions towards the scheme <strong>and</strong> has no obligations in respect of entitlements.<br />

CAPITAL ACCOUNT<br />

The Capital Account represents the unamortised value of income allocated for capital funding.<br />

Income <strong>and</strong> Expenditure Account for the Period 11 December 1998 to 9 December 1999<br />

INCOME NOTE IR£’000s<br />

State Grant 1 1565<br />

Release from Capital Account 14 560<br />

Tuition Fees 2 72<br />

Research, Consultancy <strong>and</strong> Development 3 11<br />

Other Income 4 44<br />

________<br />

EXPENDITURE<br />

2252<br />

________<br />

Academic Departments 5 317<br />

Academic Support Services 6 314<br />

Premises <strong>and</strong> Facilities 7 325<br />

Central Administration <strong>and</strong> Services 8 692<br />

Research, Consultancy <strong>and</strong> Development 3 11<br />

Depreciation 9 560<br />

________<br />

2219<br />

________<br />

________<br />

OPERATING SURPLUS AT THE END OF THE PERIOD 33<br />

________<br />

All gains <strong>and</strong> losses are recognised in the Income <strong>and</strong> Expenditure Account<br />

The Statement of Accounting Policies, Cash Flow Statement <strong>and</strong> notes 1 to 19<br />

form part of the financial statements.<br />

Signed on behalf of the Board<br />

Director<br />

____________________________________<br />

Chairman<br />

____________________________________