INDIANA UNIVERSITY SOUTH BEND Course Descriptions

INDIANA UNIVERSITY SOUTH BEND Course Descriptions

INDIANA UNIVERSITY SOUTH BEND Course Descriptions

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

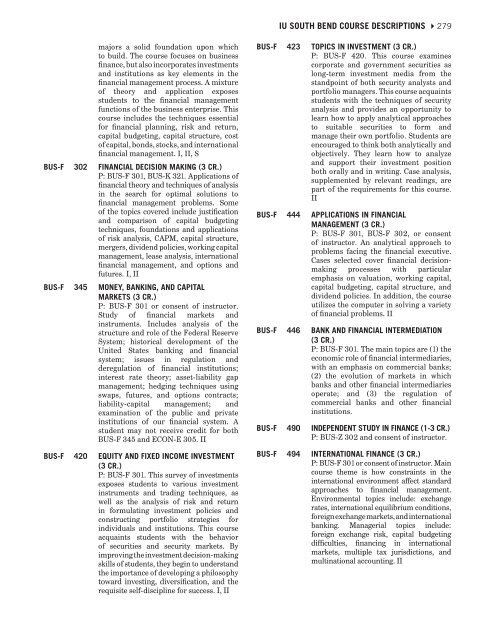

IU <strong>SOUTH</strong> <strong>BEND</strong> COURSE DESCRIPTIONS 4279<br />

majors a solid foundation upon which<br />

to build. The course focuses on business<br />

finance, but also incorporates investments<br />

and institutions as key elements in the<br />

financial management process. A mixture<br />

of theory and application exposes<br />

students to the financial management<br />

functions of the business enterprise. This<br />

course includes the techniques essential<br />

for financial planning, risk and return,<br />

capital budgeting, capital structure, cost<br />

of capital, bonds, stocks, and international<br />

financial management. I, II, S<br />

BUS-F 302 FINANCIAL DECISION MAKING (3 CR.)<br />

P: BUS-F 301, BUS-K 321. Applications of<br />

financial theory and techniques of analysis<br />

in the search for optimal solutions to<br />

financial management problems. Some<br />

of the topics covered include justification<br />

and comparison of capital budgeting<br />

techniques, foundations and applications<br />

of risk analysis, CAPM, capital structure,<br />

mergers, dividend policies, working capital<br />

management, lease analysis, international<br />

financial management, and options and<br />

futures. I, II<br />

BUS-F 345 MONEY, BANKING, AND CAPITAL<br />

MARKETS (3 CR.)<br />

P: BUS-F 301 or consent of instructor.<br />

Study of financial markets and<br />

instruments. Includes analysis of the<br />

structure and role of the Federal Reserve<br />

System; historical development of the<br />

United States banking and financial<br />

system; issues in regulation and<br />

deregulation of financial institutions;<br />

interest rate theory; asset-liability gap<br />

management; hedging techniques using<br />

swaps, futures, and options contracts;<br />

liability-capital management; and<br />

examination of the public and private<br />

institutions of our financial system. A<br />

student may not receive credit for both<br />

BUS-F 345 and ECON-E 305. II<br />

BUS-F 420 EQUITY AND FIXED INCOME INVESTMENT<br />

(3 CR.)<br />

P: BUS-F 301. This survey of investments<br />

exposes students to various investment<br />

instruments and trading techniques, as<br />

well as the analysis of risk and return<br />

in formulating investment policies and<br />

constructing portfolio strategies for<br />

individuals and institutions. This course<br />

acquaints students with the behavior<br />

of securities and security markets. By<br />

improving the investment decision-making<br />

skills of students, they begin to understand<br />

the importance of developing a philosophy<br />

toward investing, diversification, and the<br />

requisite self-discipline for success. I, II<br />

BUS-F 423 TOPICS IN INVESTMENT (3 CR.)<br />

P: BUS-F 420. This course examines<br />

corporate and government securities as<br />

long-term investment media from the<br />

standpoint of both security analysts and<br />

portfolio managers. This course acquaints<br />

students with the techniques of security<br />

analysis and provides an opportunity to<br />

learn how to apply analytical approaches<br />

to suitable securities to form and<br />

manage their own portfolio. Students are<br />

encouraged to think both analytically and<br />

objectively. They learn how to analyze<br />

and support their investment position<br />

both orally and in writing. Case analysis,<br />

supplemented by relevant readings, are<br />

part of the requirements for this course.<br />

II<br />

BUS-F 444 APPLICATIONS IN FINANCIAL<br />

MANAGEMENT (3 CR.)<br />

P: BUS-F 301, BUS-F 302, or consent<br />

of instructor. An analytical approach to<br />

problems facing the financial executive.<br />

Cases selected cover financial decisionmaking<br />

processes with particular<br />

emphasis on valuation, working capital,<br />

capital budgeting, capital structure, and<br />

dividend policies. In addition, the course<br />

utilizes the computer in solving a variety<br />

of financial problems. II<br />

BUS-F 446 BANK AND FINANCIAL INTERMEDIATION<br />

(3 CR.)<br />

P: BUS-F 301. The main topics are (1) the<br />

economic role of financial intermediaries,<br />

with an emphasis on commercial banks;<br />

(2) the evolution of markets in which<br />

banks and other financial intermediaries<br />

operate; and (3) the regulation of<br />

commercial banks and other financial<br />

institutions.<br />

BUS-F 490 INDEPENDENT STUDY IN FINANCE (1-3 CR.)<br />

P: BUS-Z 302 and consent of instructor.<br />

BUS-F 494 INTERNATIONAL FINANCE (3 CR.)<br />

P: BUS-F 301 or consent of instructor. Main<br />

course theme is how constraints in the<br />

international environment affect standard<br />

approaches to financial management.<br />

Environmental topics include: exchange<br />

rates, international equilibrium conditions,<br />

foreign exchange markets, and international<br />

banking. Managerial topics include:<br />

foreign exchange risk, capital budgeting<br />

difficulties, financing in international<br />

markets, multiple tax jurisdictions, and<br />

multinational accounting. II