Central London Market Report Q4 2012 - Jones Lang LaSalle

Central London Market Report Q4 2012 - Jones Lang LaSalle

Central London Market Report Q4 2012 - Jones Lang LaSalle

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

10 On Point • <strong>Central</strong> <strong>London</strong> <strong>Market</strong> • Fourth Quarter <strong>2012</strong><br />

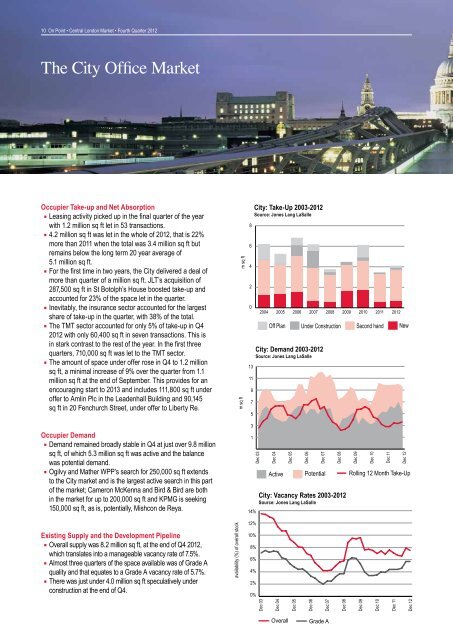

The City Office <strong>Market</strong><br />

Occupier Take-up and Net Absorption<br />

Leasing activity picked up in the final quarter of the year<br />

with 1.2 million sq ft let in 53 transactions.<br />

4.2 million sq ft was let in the whole of <strong>2012</strong>, that is 22%<br />

more than 2011 when the total was 3.4 million sq ft but<br />

remains below the long term 20 year average of<br />

5.1 million sq ft. West End: Take-Up 5 2001-2011 Q1<br />

For the first time in two years, Source: the <strong>Jones</strong> City <strong>Lang</strong> delivered <strong>LaSalle</strong> a deal of<br />

more than quarter West of End: a million 5 Take-Up sq ft. 2001-2011 JLT’s acquisition 4Q1<br />

of<br />

287,500 sq ft Source: in St Botolph’s <strong>Jones</strong> <strong>Lang</strong> House <strong>LaSalle</strong> boosted take-up and<br />

accounted for 5<br />

4<br />

3<br />

23% of the space let in the quarter.<br />

Inevitably, the insurance sector accounted for the largest<br />

4<br />

3<br />

2<br />

share of take-up in the quarter, with 38% of the total.<br />

The TMT sector accounted for only 5% of take-up in <strong>Q4</strong><br />

3<br />

2<br />

1<br />

<strong>2012</strong> with only 60,400 sq ft in seven transactions. This is<br />

in stark contrast<br />

2<br />

to the rest 1 of the year. In the 0 first three<br />

2002 2003<br />

quarters, 710,000 sq ft was let to the TMT sector.<br />

The amount 1of space under 0 offer rose in <strong>Q4</strong> to 1.2 million<br />

2002 2003 2004 2005 2006 2007<br />

sq ft, a minimal increase of 9% over the quarter from 1.1<br />

million sq ft 0at the end of September. This provides for an<br />

2002 2003 2004 2005 2006 2007 2008 2009<br />

encouraging start to 2013 City: and includes Demand 18<br />

111,800 2002-2011 sq ft Q2 under<br />

Source: <strong>Jones</strong> <strong>Lang</strong><br />

offer to Amlin Plc in the Leadenhall Building 16<strong>LaSalle</strong><br />

and 90,145<br />

sq ft in 20 Fenchurch City: Demand 18<br />

Street, 2002-2011 under offer Q2 14to Liberty Re.<br />

m sq ft<br />

m sq ft<br />

Occupier Demand 12<br />

8<br />

14<br />

Demand remained broadly 10 stable in <strong>Q4</strong> at 6just over 9.8 million<br />

12<br />

sq ft, of which 5.3 million 8sq ft was active and 4 the balance<br />

10<br />

was potential demand. 6<br />

2<br />

Ogilvy and Mather<br />

8<br />

WPP’s 4 search for 250,0000<br />

sq ft extends<br />

to the City market 6 and is the 2 largest active search in this part<br />

of the market; 4 Cameron McKenna 0 and Bird & Bird are both<br />

in the market 2 for up to 200,000 sq ft and KPMG is seeking<br />

150,000 sq 0ft, as is, potentially, Mishcon de Reya.<br />

West End: Take-Up 5 2001-2011 6 Q1<br />

Source: <strong>Jones</strong> <strong>Lang</strong> <strong>LaSalle</strong><br />

Source: <strong>Jones</strong> <strong>Lang</strong> <strong>LaSalle</strong><br />

2010<br />

West End: Vacancy Rates 2002-2011 Q1<br />

Existing Supply and the Development Source: <strong>Jones</strong> <strong>Lang</strong> Pipeline <strong>LaSalle</strong><br />

West End: Vacancy Rates 2002-2011 Q1<br />

Overall supply was 8.2 million 9%<br />

Source: <strong>Jones</strong> <strong>Lang</strong> <strong>LaSalle</strong><br />

sq ft, at the end of <strong>Q4</strong> <strong>2012</strong>,<br />

which translates into a manageable 8%<br />

9%<br />

vacancy rate of 7.5%.<br />

Almost three quarters of<br />

7%<br />

8%<br />

the space available was of Grade A<br />

6%<br />

quality and 7% that equates to a Grade A vacancy rate of 5.7%.<br />

5%<br />

There was 6% just under 4.0 million sq ft speculatively under<br />

4%<br />

construction 5% at the end of <strong>Q4</strong>.<br />

availability (%) of overall stock<br />

m sq ft<br />

Source: <strong>Jones</strong> 16 <strong>Lang</strong> <strong>LaSalle</strong><br />

18<br />

14<br />

16<br />

4%<br />

3%<br />

2%<br />

1%<br />

0%<br />

June 02<br />

02<br />

m sq ft<br />

June 03<br />

availability (%) of overall stock<br />

03<br />

June 04<br />

3%<br />

2%<br />

1%<br />

0%<br />

04<br />

June 02<br />

Mar 02<br />

June 05<br />

05<br />

June 03<br />

Mar 03<br />

m sq ft<br />

June 06<br />

06<br />

June 04<br />

Mar 04<br />

m sq ft<br />

12<br />

10<br />

June 05<br />

June 07<br />

June 06<br />

June 08<br />

m sq ft<br />

June 07<br />

June 09<br />

4<br />

3<br />

2<br />

1<br />

0<br />

2004<br />

2008<br />

2005<br />

2009<br />

2011<br />

m sq ft<br />

2006<br />

8<br />

4<br />

2<br />

0<br />

2010 13<br />

City: Take-Up 2003-<strong>2012</strong><br />

Source: <strong>Jones</strong> <strong>Lang</strong> <strong>LaSalle</strong><br />

West End: Take-Up 2001-2011 Q1<br />

Source: <strong>Jones</strong> <strong>Lang</strong> <strong>LaSalle</strong><br />

June 10<br />

2002<br />

June 08<br />

June 11<br />

2003<br />

City: Demand 2002-2011 Q2<br />

June 02<br />

07<br />

Mar 05<br />

June 03<br />

08<br />

Mar 06<br />

June 04<br />

09<br />

Man 07<br />

June 05<br />

10<br />

Man 08<br />

June 06<br />

m sq ft<br />

June 09<br />

availability (%) of overall stock<br />

11<br />

Mar 09<br />

11<br />

2004<br />

9<br />

7<br />

5<br />

3<br />

1<br />

June 07<br />

2004<br />

2005<br />

Off Plan<br />

2006<br />

2007<br />

Under Construction Second hand<br />

City: 2008 Demand 2009 2003-<strong>2012</strong><br />

2010 2011<br />

Source: <strong>Jones</strong> <strong>Lang</strong> <strong>LaSalle</strong><br />

Second hand New<br />

2007<br />

Dec 03<br />

2011<br />

2005<br />

New<br />

Dec 04<br />

Active<br />

2006<br />

Dec 05<br />

2007<br />

Off Plan<br />

2008<br />

Under Construction<br />

Dec 06<br />

2008<br />

Dec 07<br />

2009<br />

Dec 08<br />

2009<br />

2010<br />

Dec 09<br />

Off Plan<br />

Off Plan<br />

Under C<br />

Off Plan<br />

Under Construction Second<br />

New<br />

Under Construction Second hand<br />

2010<br />

2011<br />

Second hand<br />

2011<br />

New<br />

Potential Rolling 12 Month Take-Up<br />

City: Vacancy Rates 2003-<strong>2012</strong><br />

Source: <strong>Jones</strong> <strong>Lang</strong> <strong>LaSalle</strong><br />

Rolling 12 Month Take-Up<br />

14%<br />

June 10<br />

12%<br />

10%<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

Mar 10<br />

Dec 03<br />

June 08<br />

June 11<br />

Dec 04<br />

June 09<br />

Overall<br />

Grade A<br />

Mar 11<br />

Dec 05<br />

June 10<br />

Active<br />

Potential<br />

Dec 06<br />

June 11<br />

Dec 07<br />

Overall<br />

Grade A<br />

Dec 08<br />

Active<br />

Potential<br />

Dec 10<br />

Dec 11<br />

<strong>2012</strong><br />

New<br />

Dec 12<br />

Rolling 12 Month Take-Up<br />

Dec 09<br />

Dec 10<br />

Dec 11<br />

Dec 12<br />

Potentia<br />

Active<br />

Rolling 1<br />

Gra<br />

Ove

![Presseinformation inklusive Charts [PDF] - Jones Lang LaSalle](https://img.yumpu.com/23689734/1/184x260/presseinformation-inklusive-charts-pdf-jones-lang-lasalle.jpg?quality=85)