Central London Market Report Q4 2012 - Jones Lang LaSalle

Central London Market Report Q4 2012 - Jones Lang LaSalle

Central London Market Report Q4 2012 - Jones Lang LaSalle

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

6 On Point • <strong>Central</strong> <strong>London</strong> <strong>Market</strong> • Fourth Quarter <strong>2012</strong><br />

The <strong>Central</strong> <strong>London</strong> <strong>Market</strong><br />

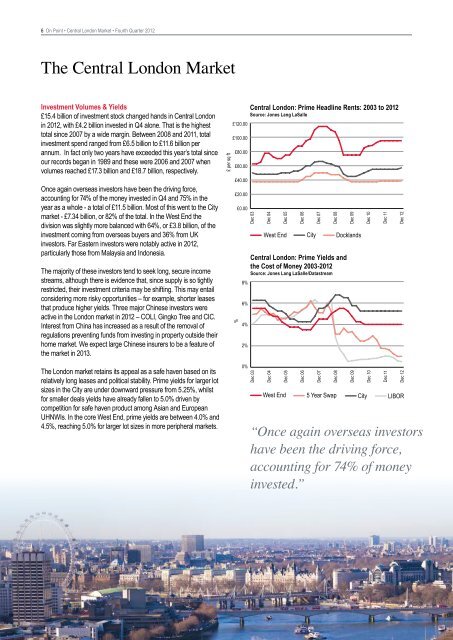

Investment Volumes & Yields<br />

£15.4 billion of investment stock changed hands in <strong>Central</strong> <strong>London</strong><br />

in <strong>2012</strong>, with £4.2 billion invested in <strong>Q4</strong> alone. That is the highest<br />

£120.00<br />

total since 2007 by a wide margin. Between <strong>Central</strong> 2008 and <strong>London</strong>: 2011, Prime total Headline Rents: 2002 to 2011 Q2<br />

£100.00<br />

Source: <strong>Jones</strong> <strong>Lang</strong> <strong>LaSalle</strong><br />

investment spend ranged from<br />

<strong>Central</strong><br />

£6.5 billion<br />

<strong>London</strong>:<br />

to £11.6<br />

Prime<br />

billion<br />

Headline<br />

per<br />

Rents: 2002 to 2011 Q2<br />

annum. In fact only two years<br />

£120.00<br />

Source: have exceeded <strong>Jones</strong> <strong>Lang</strong> this <strong>LaSalle</strong> year’s total since £80.00<br />

our records began <strong>Central</strong> in 1989 <strong>London</strong>: £120.00 and these Prime were Headline 2006 and Rents: 20072002 when to 2011 Q2<br />

£100.00<br />

Source: <strong>Jones</strong> <strong>Lang</strong> <strong>LaSalle</strong><br />

£60.00<br />

volumes reached £17.3 billion and £18.7 billion, respectively.<br />

£ per sq ft<br />

June 02<br />

June 03<br />

June 04<br />

June 05<br />

June 06<br />

June 07<br />

June 08<br />

June 09<br />

June 10<br />

£ per sq ft<br />

June 11<br />

<strong>Central</strong> <strong>London</strong>: Prime Headline Rents: 2003 to <strong>2012</strong><br />

Source: <strong>Jones</strong> <strong>Lang</strong> <strong>LaSalle</strong><br />

£120.00<br />

£100.00 £80.00<br />

£40.00<br />

West En<br />

Once again £100.00 overseas investors £80.00 have been the driving force,<br />

£60.00<br />

accounting for 74% of the money invested in <strong>Q4</strong> and 75% in the<br />

£80.00<br />

£60.00<br />

year as a whole - a total of £11.5 billion. £40.00 Most of this went to the City<br />

£20.00<br />

£0.00 West End<br />

City<br />

Docklan<br />

market -<br />

£60.00<br />

£7.34 billion, or 82%<br />

£40.00of the total. In the West End the<br />

£20.00<br />

division was slightly more balanced with 64%, or £3.8 billion, of the<br />

West End City<br />

investment £40.00 coming from overseas £20.00 buyers £0.00 and 36% from UK<br />

West End City Docklands<br />

investors. Far Eastern investors were notably active in <strong>2012</strong>,<br />

£20.00<br />

£0.00 City<br />

Docklands<br />

particularly those from Malaysia and Indonesia.<br />

<strong>Central</strong> <strong>London</strong>: Prime Yields and<br />

£0.00 Docklands<br />

£ per sq ft<br />

June 02<br />

£ per sq ft<br />

June 03<br />

June 02<br />

June 04<br />

June 03<br />

June 05<br />

June 04<br />

June 06<br />

June 05<br />

June 07<br />

June 06<br />

June 08<br />

June 07<br />

June 09<br />

%<br />

Dec 03<br />

June 08<br />

June 10<br />

Dec 04<br />

June 09<br />

June 11<br />

Dec 05<br />

June 10<br />

Dec 06<br />

June 11<br />

Dec 07<br />

the Cost of Money 2003-<strong>2012</strong><br />

Source: <strong>Jones</strong> <strong>Lang</strong> <strong>LaSalle</strong>/Datastream<br />

The majority of these investors tend to seek long, secure income<br />

streams, although there is evidence that, since supply is so tightly<br />

8%<br />

restricted, their investment criteria may be shifting. This may entail <strong>Central</strong> <strong>London</strong>: Prime Yields and<br />

considering more risky opportunities – for example, <strong>Central</strong> shorter <strong>London</strong>: leases<br />

the Cost of Money 2002-2011 Q2<br />

Prime Yields and<br />

Source: <strong>Jones</strong> <strong>Lang</strong> 6% <strong>LaSalle</strong>/Datastream<br />

that produce higher yields. Three major Chinese investors the Cost were of Money 2002-2011 Q2<br />

<strong>Central</strong> <strong>London</strong>: Prime<br />

Source:<br />

Yields 8%<br />

<strong>Jones</strong> <strong>Lang</strong><br />

and<br />

<strong>LaSalle</strong>/Datastream<br />

active in the <strong>London</strong> market in <strong>2012</strong> – COLI, Gingko Tree and CIC.<br />

the Cost of Money 2002-2011 Q2<br />

Interest from China <strong>Central</strong> has <strong>London</strong>: increased Prime Yields and 8%<br />

4%<br />

Source: as <strong>Jones</strong> a result <strong>Lang</strong> of <strong>LaSalle</strong>/Datastream<br />

the removal of<br />

the Cost of Money 2002-2011 Q2<br />

6%<br />

regulations preventing funds 8% from investing in property outside their<br />

Source: <strong>Jones</strong> <strong>Lang</strong> <strong>LaSalle</strong>/Datastream<br />

home market. We expect large Chinese insurers 6% to be a feature of<br />

2%<br />

8%<br />

the market in 2013.<br />

4%<br />

4%<br />

0% LIBOR<br />

The <strong>London</strong> 6% market retains its appeal as a safe haven based West End<br />

2%<br />

on its<br />

5 Year Swap<br />

relatively long leases and political<br />

4%<br />

stability. Prime yields for larger lot<br />

West End 5 Year SwapCity<br />

2%<br />

sizes in the 4% City are under downward pressure from 5.25%, whilst<br />

0% West End 5 Year Swap City<br />

for smaller deals yields have<br />

LIBOR<br />

2% already fallen to 5.0% driven by<br />

competition for safe haven product among Asian 0% and European<br />

5 Year Swap City<br />

LIBOR<br />

2%<br />

UHNWIs. In the core West End, prime yields are between 4.0% and<br />

0% City<br />

LIBOR<br />

4.5%, reaching 5.0% for larger lot sizes in more peripheral markets.<br />

0% LIBOR<br />

%<br />

June 02<br />

June 03<br />

%<br />

June 04<br />

6%<br />

June 02<br />

June 05<br />

June 03<br />

June 06<br />

%<br />

June 04<br />

June 07<br />

June 02<br />

June 05<br />

June 08<br />

%<br />

June 03<br />

June 06<br />

June 09<br />

June 02<br />

June 04<br />

June 07<br />

June 10<br />

June 03<br />

June 05<br />

June 08<br />

June 11<br />

June 04<br />

June 06<br />

June 09<br />

Dec 03<br />

June 05<br />

June 07<br />

June 10<br />

Dec 04<br />

June 06<br />

June 08<br />

June 11<br />

Dec 05<br />

June 07<br />

June 09<br />

Dec 06<br />

June 08<br />

June 10<br />

Dec 07<br />

June 09<br />

June 11<br />

Dec 08<br />

Dec 08<br />

June 10<br />

Dec 09<br />

Dec 09<br />

June 11<br />

Dec 10<br />

Dec 10<br />

Dec 11<br />

Dec 11<br />

Dec 12<br />

West End<br />

“Once again overseas investors<br />

have been the driving force,<br />

accounting for 74% of money<br />

invested.”<br />

Dec 12<br />

West E<br />

5 Year S<br />

City

![Presseinformation inklusive Charts [PDF] - Jones Lang LaSalle](https://img.yumpu.com/23689734/1/184x260/presseinformation-inklusive-charts-pdf-jones-lang-lasalle.jpg?quality=85)