Central London Market Report Q4 2012 - Jones Lang LaSalle

Central London Market Report Q4 2012 - Jones Lang LaSalle

Central London Market Report Q4 2012 - Jones Lang LaSalle

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

4 On Point • <strong>Central</strong> <strong>London</strong> <strong>Market</strong> • Fourth Quarter <strong>2012</strong><br />

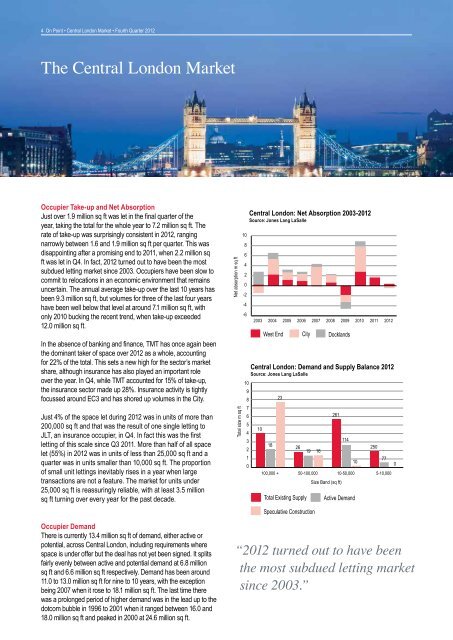

The <strong>Central</strong> <strong>London</strong> <strong>Market</strong><br />

Occupier Take-up and Net Absorption<br />

Just over 1.9 million sq ft was let in the final quarter of the<br />

year, taking the total for the whole year to 7.2 million sq ft. The<br />

rate of take-up was surprisingly consistent in <strong>2012</strong>, ranging<br />

Source: <strong>Jones</strong> <strong>Lang</strong> <strong>LaSalle</strong><br />

narrowly between 1.6 and 1.9 million sq ft per quarter. This was<br />

disappointing after a promising end to 2011, when 2.2 million sq<br />

Source: <strong>Jones</strong> 10 <strong>Lang</strong> <strong>LaSalle</strong><br />

ft was let in <strong>Q4</strong>. In fact, <strong>2012</strong> turned out to have been the most<br />

subdued letting market<br />

<strong>Central</strong><br />

since<br />

<strong>London</strong>:<br />

2003. Occupiers<br />

Net Absorption<br />

8<br />

have been<br />

2002-2011<br />

slow to<br />

Q2<br />

Source: <strong>Jones</strong> <strong>Lang</strong> 10 <strong>LaSalle</strong> 6<br />

commit to relocations in an economic<br />

8<br />

environment that remains<br />

4<br />

uncertain. The annual 10 average take-up over the last 10 years has<br />

6<br />

2<br />

been 9.3 million sq 8 ft, but volumes for three of the last four years<br />

4<br />

have been well below 6 that level at around 7.1<br />

0<br />

million sq ft, with<br />

2<br />

only 2010 bucking<br />

4the recent trend, when take-up -2 exceeded<br />

0<br />

12.0 million sq ft.<br />

-4<br />

Net absorption m sq ft<br />

2<br />

0<br />

In the absence of banking and finance,<br />

-4<br />

2002 2003 2004 2005<br />

TMT has once again been<br />

-2<br />

the dominant taker of space over -6<strong>2012</strong> as a whole, accounting<br />

-4<br />

2002 2003 2004 2005 2006<br />

for 22% of the total. This sets a new high for the sector’s market<br />

-6<br />

share, although insurance has also played an important role<br />

2002 2003 2004 2005 2006 2007 2008 2009<br />

over the year. In <strong>Q4</strong>, while TMT accounted for 15% of take-up,<br />

the insurance sector made up 28%. Insurance activity is tightly<br />

focussed around EC3 and has shored up volumes in the City.<br />

Just 4% of the <strong>Central</strong> space let <strong>London</strong>: during Demand <strong>2012</strong> was and in units Supply of more Balance than 2011 Q2 6<br />

Source: <strong>Jones</strong> <strong>Lang</strong> <strong>LaSalle</strong><br />

<strong>Central</strong> <strong>London</strong>: Demand and Supply Balance 2011 Q2<br />

200,000 sq ft and that was the result Source: of one <strong>Jones</strong> single <strong>Lang</strong> <strong>LaSalle</strong> letting to<br />

5<br />

10<br />

10<br />

4<br />

JLT, an insurance <strong>Central</strong> occupier, <strong>London</strong>: in <strong>Q4</strong>. Demand 10In fact this was the first<br />

9<br />

and Supply Balance 2011 Q2<br />

letting of this scale<br />

Source:<br />

since<br />

<strong>Jones</strong> <strong>Lang</strong><br />

Q3 2011.<br />

<strong>LaSalle</strong>9<br />

3<br />

8<br />

More than half of all space<br />

18<br />

2<br />

26<br />

let (55%) in<br />

10<br />

8<br />

<strong>2012</strong> 7 was in units of less than 25,000 sq ft and a<br />

9<br />

7<br />

296<br />

1<br />

quarter was 6in units smaller than 10,000 sq ft. The proportion 296<br />

8<br />

6<br />

0<br />

of small unit 5lettings inevitably rises in a year when large<br />

100,000 +<br />

7<br />

5<br />

296<br />

transactions 4<br />

16<br />

Total Existing Supply<br />

are not a feature. The market for units under<br />

6<br />

4<br />

16<br />

25,000 sq ft<br />

3 15<br />

is reassuringly reliable, with at least 3.5 million<br />

5<br />

3 15<br />

113 341<br />

11<br />

113 341<br />

2<br />

26<br />

Active Demand<br />

11<br />

sq ft turning over every 16 year for the 20 past decade. 26<br />

Total Existing Supply<br />

Total size m Total sq ft size m sq ft<br />

4<br />

1<br />

3<br />

0<br />

2<br />

15<br />

11<br />

100,000 +<br />

Net absorption m sq ft<br />

-2<br />

Total size m sq ft<br />

Occupier Demand 1<br />

9 100,000 + 50-100,000 92<br />

Size Band (sq ft) 10<br />

There is currently 0 13.4 million sq ft of demand, either active or<br />

100,000 + 50-100,000 10-50,000<br />

potential, across <strong>Central</strong> <strong>London</strong>, including requirements where<br />

Size Band (sq ft)<br />

space is under offer but the deal has not yet been signed. It splits<br />

fairly evenly between active and potential demand at 6.8 million<br />

sq ft and 6.6 million sq ft respectively. Demand has been around<br />

11.0 to 13.0 million sq ft for nine to 10 years, with the exception<br />

being 2007 when it rose to 18.1 million sq ft. The last time there<br />

was a prolonged period of higher demand was in the lead up to the<br />

dotcom bubble in 1996 to 2001 when it ranged between 16.0 and<br />

18.0 million sq ft and peaked in 2000 at 24.6 million sq ft.<br />

<strong>Central</strong> <strong>London</strong>: Net Absorption 10 2002-2011 Q2<br />

8<br />

6<br />

4<br />

2<br />

0<br />

-2<br />

-4<br />

-6<br />

2003 2004 2005<br />

<strong>Central</strong> <strong>London</strong>: Net Absorption 2002-2011 Q2<br />

Net absorption m sq ft<br />

-6<br />

2007<br />

2010<br />

2006<br />

2008<br />

Net absorption m sq ft<br />

2011<br />

yoy<br />

2007<br />

Total size m sq ft<br />

2009<br />

<strong>Central</strong> <strong>London</strong>: Net Absorption 2003-<strong>2012</strong><br />

Source: <strong>Jones</strong> <strong>Lang</strong> <strong>LaSalle</strong><br />

2008<br />

2010<br />

West End<br />

2009<br />

City<br />

2011<br />

yoy<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

<strong>2012</strong><br />

<strong>Central</strong> Docklands <strong>London</strong>: Demand and Supply Balance <strong>2012</strong><br />

Source: <strong>Jones</strong> <strong>Lang</strong> <strong>LaSalle</strong><br />

10<br />

9<br />

8<br />

23<br />

7<br />

2<br />

9 20 92<br />

1<br />

10<br />

113 3419 0<br />

92<br />

10<br />

26<br />

0<br />

0<br />

50-100,000 20<br />

10-50,000<br />

5-10,000<br />

10-50,000<br />

5-10,000<br />

Size Band (sq 0 ft)<br />

5-10,000<br />

2010<br />

2011<br />

yoy<br />

West End<br />

City<br />

Docklands<br />

19 16<br />

Speculative Construction<br />

Active Demand<br />

Speculative Construction<br />

West End<br />

City<br />

Docklands<br />

261<br />

114<br />

10<br />

50-100,000 10-50,000<br />

Size Band Total (sq Existing ft) Supply<br />

Active Demand<br />

250<br />

Speculative Construction<br />

77<br />

0<br />

5-10,000<br />

“<strong>2012</strong> turned out to have been<br />

the most subdued letting market<br />

since 2003.”<br />

Docklands<br />

City<br />

West End<br />

Total Exis<br />

Active De<br />

Speculat

![Presseinformation inklusive Charts [PDF] - Jones Lang LaSalle](https://img.yumpu.com/23689734/1/184x260/presseinformation-inklusive-charts-pdf-jones-lang-lasalle.jpg?quality=85)