2008 Annual Report - Kenford Group Holdings Limited

2008 Annual Report - Kenford Group Holdings Limited

2008 Annual Report - Kenford Group Holdings Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Financial Statements<br />

For the year ended 31 March <strong>2008</strong><br />

4. PRINCIPAL ACCOUNTING POLICIES (Continued)<br />

(s)<br />

Impairment of other assets<br />

At each balance sheet date, the <strong>Group</strong> reviews the carrying amounts of the following assets to determine whether<br />

there is any indication that those assets have suffered an impairment loss or an impairment loss previously<br />

recognised no longer exists or may have decreased:<br />

• property, plant and equipment;<br />

• payments for leasehold land held for own use under operating leases; and<br />

• investments in subsidiaries.<br />

If the recoverable amount (i.e. the greater of the fair value less costs to sell and value in use) of an asset is estimated<br />

to be less than its carrying amount, the carrying amount of the asset is reduced to its recoverable amount. An<br />

impairment loss is recognised as an expense immediately, unless the relevant asset is carried at a revalued amount<br />

under another HKFRS, in which case the impairment loss is treated as a revaluation decrease under that HKFRS.<br />

Where an impairment loss subsequently reverses, the carrying amount of the asset is increased to the revised<br />

estimate of its recoverable amount, but so that the increased carrying amount does not exceed the carrying amount<br />

that would have been determined had no impairment loss been recognised for the asset in prior years. A reversal of<br />

an impairment loss is recognised as income immediately, unless the relevant asset is carried at a revalued amount<br />

under another HKFRS, in which case the reversal of impairment loss is treated as a revaluation increase under that<br />

HKFRS.<br />

5. TURNOVER<br />

The <strong>Group</strong> is principally engaged in the design, manufacture and sale of electrical hair care products, electrical health<br />

care products and other small household electrical appliances. Turnover represents the net invoiced value of goods sold<br />

which is the most signifi cant category of revenue during the year.<br />

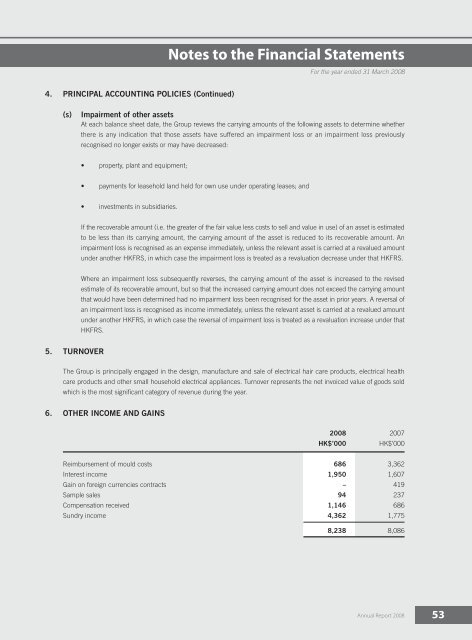

6. OTHER INCOME AND GAINS<br />

<strong>2008</strong> 2007<br />

HK$’000<br />

HK$’000<br />

Reimbursement of mould costs 686 3,362<br />

Interest income 1,950 1,607<br />

Gain on foreign currencies contracts – 419<br />

Sample sales 94 237<br />

Compensation received 1,146 686<br />

Sundry income 4,362 1,775<br />

8,238 8,086<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong><br />

53