2008 Annual Report - Kenford Group Holdings Limited

2008 Annual Report - Kenford Group Holdings Limited

2008 Annual Report - Kenford Group Holdings Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Financial Statements<br />

For the year ended 31 March <strong>2008</strong><br />

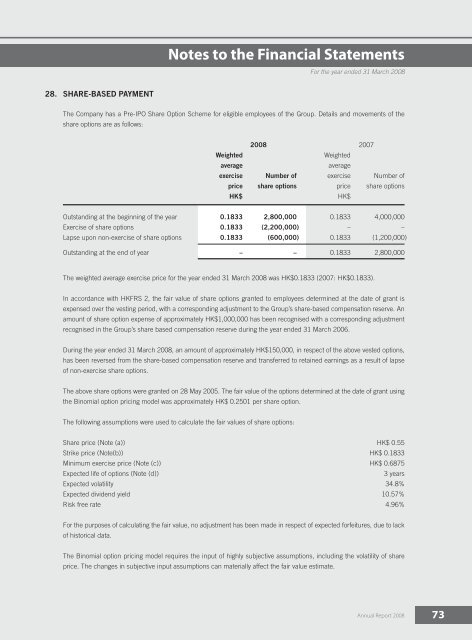

28. SHARE-BASED PAYMENT<br />

The Company has a Pre-IPO Share Option Scheme for eligible employees of the <strong>Group</strong>. Details and movements of the<br />

share options are as follows:<br />

<strong>2008</strong> 2007<br />

Weighted<br />

Weighted<br />

average<br />

average<br />

exercise Number of exercise Number of<br />

price share options price share options<br />

HK$<br />

HK$<br />

Outstanding at the beginning of the year 0.1833 2,800,000 0.1833 4,000,000<br />

Exercise of share options 0.1833 (2,200,000) – –<br />

Lapse upon non-exercise of share options 0.1833 (600,000) 0.1833 (1,200,000)<br />

Outstanding at the end of year – – 0.1833 2,800,000<br />

The weighted average exercise price for the year ended 31 March <strong>2008</strong> was HK$0.1833 (2007: HK$0.1833).<br />

In accordance with HKFRS 2, the fair value of share options granted to employees determined at the date of grant is<br />

expensed over the vesting period, with a corresponding adjustment to the <strong>Group</strong>’s share-based compensation reserve. An<br />

amount of share option expense of approximately HK$1,000,000 has been recognised with a corresponding adjustment<br />

recognised in the <strong>Group</strong>’s share based compensation reserve during the year ended 31 March 2006.<br />

During the year ended 31 March <strong>2008</strong>, an amount of approximately HK$150,000, in respect of the above vested options,<br />

has been reversed from the share-based compensation reserve and transferred to retained earnings as a result of lapse<br />

of non-exercise share options.<br />

The above share options were granted on 28 May 2005. The fair value of the options determined at the date of grant using<br />

the Binomial option pricing model was approximately HK$ 0.2501 per share option.<br />

The following assumptions were used to calculate the fair values of share options:<br />

Share price (Note (a)) HK$ 0.55<br />

Strike price (Note(b)) HK$ 0.1833<br />

Minimum exercise price (Note (c)) HK$ 0.6875<br />

Expected life of options (Note (d))<br />

3 years<br />

Expected volatility 34.8%<br />

Expected dividend yield 10.57%<br />

Risk free rate 4.96%<br />

For the purposes of calculating the fair value, no adjustment has been made in respect of expected forfeitures, due to lack<br />

of historical data.<br />

The Binomial option pricing model requires the input of highly subjective assumptions, including the volatility of share<br />

price. The changes in subjective input assumptions can materially affect the fair value estimate.<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong><br />

73