2008 Annual Report - Kenford Group Holdings Limited

2008 Annual Report - Kenford Group Holdings Limited

2008 Annual Report - Kenford Group Holdings Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Financial Statements<br />

For the year ended 31 March <strong>2008</strong><br />

30. FINANCIAL INSTRUMENTS – RISK MANAGEMENT (Continued)<br />

(b)<br />

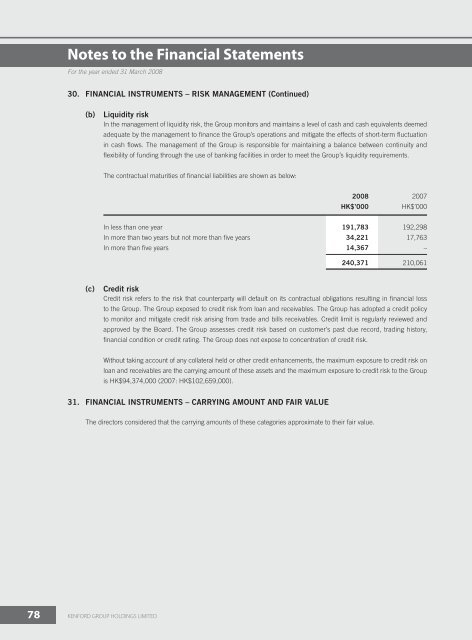

Liquidity risk<br />

In the management of liquidity risk, the <strong>Group</strong> monitors and maintains a level of cash and cash equivalents deemed<br />

adequate by the management to fi nance the <strong>Group</strong>’s operations and mitigate the effects of short-term fl uctuation<br />

in cash fl ows. The management of the <strong>Group</strong> is responsible for maintaining a balance between continuity and<br />

fl exibility of funding through the use of banking facilities in order to meet the <strong>Group</strong>’s liquidity requirements.<br />

The contractual maturities of fi nancial liabilities are shown as below:<br />

<strong>2008</strong> 2007<br />

HK$’000<br />

HK$’000<br />

In less than one year 191,783 192,298<br />

In more than two years but not more than fi ve years 34,221 17,763<br />

In more than fi ve years 14,367 –<br />

240,371 210,061<br />

(c)<br />

Credit risk<br />

Credit risk refers to the risk that counterparty will default on its contractual obligations resulting in fi nancial loss<br />

to the <strong>Group</strong>. The <strong>Group</strong> exposed to credit risk from loan and receivables. The <strong>Group</strong> has adopted a credit policy<br />

to monitor and mitigate credit risk arising from trade and bills receivables. Credit limit is regularly reviewed and<br />

approved by the Board. The <strong>Group</strong> assesses credit risk based on customer’s past due record, trading history,<br />

fi nancial condition or credit rating. The <strong>Group</strong> does not expose to concentration of credit risk.<br />

Without taking account of any collateral held or other credit enhancements, the maximum exposure to credit risk on<br />

loan and receivables are the carrying amount of these assets and the maximum exposure to credit risk to the <strong>Group</strong><br />

is HK$94,374,000 (2007: HK$102,659,000).<br />

31. FINANCIAL INSTRUMENTS – CARRYING AMOUNT AND FAIR VALUE<br />

The directors considered that the carrying amounts of these categories approximate to their fair value.<br />

78 KENFORD GROUP HOLDINGS LIMITED