Report - Kongsberg Gruppen 2007 - Kongsberg Maritime ...

Report - Kongsberg Gruppen 2007 - Kongsberg Maritime ...

Report - Kongsberg Gruppen 2007 - Kongsberg Maritime ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

48<br />

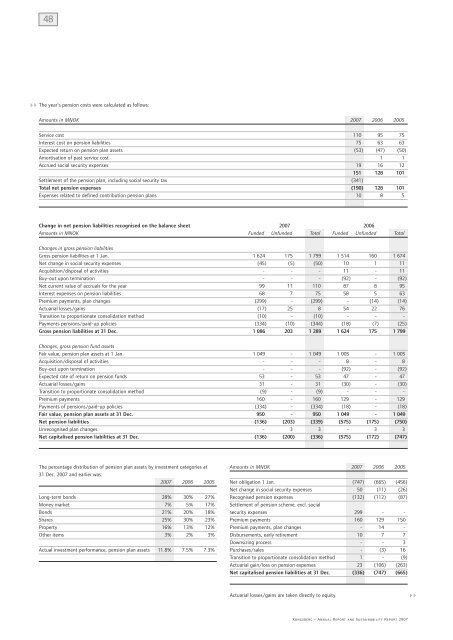

The year's pension costs were calculated as follows:<br />

Amounts in MNOK <strong>2007</strong> 2006 2005<br />

Service cost 110 95 75<br />

Interest cost on pension liabilities 75 63 63<br />

Expected return on pension plan assets (53) (47) (50)<br />

Amortisation of past service cost 1 1<br />

Accrued social security expenses 19 16 12<br />

151 128 101<br />

Settlement of the pension plan, including social security tax (341)<br />

Total net pension expenses (190) 128 101<br />

Expenses related to defined contribution pension plans 10 8 5<br />

Change in net pension liabilities recognised on the balance sheet <strong>2007</strong> 2006<br />

Amounts in MNOK Funded Unfunded Total Funded Unfunded Total<br />

Changes in gross pension liabilities<br />

Gross pension liabilities at 1 Jan. 1 624 175 1 799 1 514 160 1 674<br />

Net change in social security expenses (45) (5) (50) 10 1 11<br />

Acquisition/disposal of activities - - - 11 - 11<br />

Buy-out upon termination - - - (92) - (92)<br />

Net current value of accruals for the year 99 11 110 87 8 95<br />

Interest expenses on pension liabilities 68 7 75 58 5 63<br />

Premium payments, plan changes (299) - (299) - (14) (14)<br />

Actuarial losses/gains (17) 25 8 54 22 76<br />

Transition to proportionate consolidation method (10) - (10) - - -<br />

Payments pensions/paid-up policies (334) (10) (344) (18) (7) (25)<br />

Gross pension liabilities at 31 Dec. 1 086 203 1 289 1 624 175 1 799<br />

Changes, gross pension fund assets<br />

Fair value, pension plan assets at 1 Jan. 1 049 - 1 049 1 005 - 1 005<br />

Acquisition/disposal of activities - - - 8 - 8<br />

Buy-out upon termination - - - (92) - (92)<br />

Expected rate of return on pension funds 53 - 53 47 - 47<br />

Actuarial losses/gains 31 - 31 (30) - (30)<br />

Transition to proportionate consolidation method (9) - (9) - - -<br />

Premium payments 160 - 160 129 - 129<br />

Payments of pensions/paid-up policies (334) - (334) (18) - (18)<br />

Fair value, pension plan assets at 31 Dec. 950 - 950 1 049 - 1 049<br />

Net pension liabilities (136) (203) (339) (575) (175) (750)<br />

Unrecognised plan changes - 3 3 - 3 3<br />

Net capitalised pension liabilities at 31 Dec. (136) (200) (336) (575) (172) (747)<br />

The percentage distribution of pension plan assets by investment categories at<br />

31 Dec. <strong>2007</strong> and earlier was:<br />

<strong>2007</strong> 2006 2005<br />

Long-term bonds 28% 30% 27%<br />

Money market 7% 5% 17%<br />

Bonds 21% 20% 18%<br />

Shares 25% 30% 23%<br />

Property 16% 13% 12%<br />

Other items 3% 2% 3%<br />

Actual investment performance, pension plan assets 11.8% 7.5% 7.3%<br />

Amounts in MNOK <strong>2007</strong> 2006 2005<br />

Net obligation 1 Jan. (747) (665) (456)<br />

Net change in social security expenses 50 (11) (26)<br />

Recognised pension expenses (132) (112) (87)<br />

Settlement of pension scheme, excl. social<br />

security expenses 299 - -<br />

Premium payments 160 129 150<br />

Premium payments, plan changes - 14 -<br />

Disbursements, early retirement 10 7 7<br />

Downsizing process - - 3<br />

Purchases/sales - (3) 16<br />

Transition to proportionate consolidation method 1 - (9)<br />

Actuarial gain/loss on pension expenses 23 (106) (263)<br />

Net capitalised pension liabilities at 31 Dec. (336) (747) (665)<br />

Actuarial losses/gains are taken directly to equity.<br />

<strong>Kongsberg</strong> – Annual <strong>Report</strong> and Sustainability <strong>Report</strong> <strong>2007</strong>