Report - Kongsberg Gruppen 2007 - Kongsberg Maritime ...

Report - Kongsberg Gruppen 2007 - Kongsberg Maritime ...

Report - Kongsberg Gruppen 2007 - Kongsberg Maritime ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

64<br />

Non-current provisions<br />

In the period from 1999 to <strong>2007</strong>, <strong>Kongsberg</strong> sold properties in the <strong>Kongsberg</strong><br />

Industrial Park. The properties have subsequently been leased back on long-term<br />

contracts that expire between 2014 and 2025. In connection with sale and leaseback,<br />

subleases were signed at lower rents than the sum of the rent, maintenance<br />

and renovation costs for the subleased buildings. In addition, the Group has under -<br />

taken operational and maintenance responsibility for subleased buildings. This net<br />

loss is considered a loss contract according to IAS 37 and the net current value of<br />

future losses is provided for in the accounts. A provision has also been set aside<br />

attached to the cessation of rent. The remaining need for provisions is considered<br />

each year. The discounting effect has been recognised as operating costs.<br />

Other provisions<br />

Provisions are recognised when the Group has a commitment as a result of<br />

a past event, it is probable that there will be a financial settlement as a result of<br />

this commitment, and the size of that amount can be measured reliably. Provisions<br />

are made when there is disagreement with contracting parties, agents, or as an<br />

estimated settlement related to product liability.<br />

Provisions for guarantees<br />

Provisions for guarantees refer to guarantee liabilities on completed deliveries.<br />

Unused provisions for guarantees are dissolved upon expiry of the guarantee<br />

period. Provisions for guarantees are estimated on the basis of a combination of<br />

historical figures, specific calculations and best estimate. Guarantee periods vary<br />

from 1 to 2 years for <strong>Kongsberg</strong> <strong>Maritime</strong>. For <strong>Kongsberg</strong> Defence & Aerospace,<br />

they normally extend from one to five years, but can last for 30 years under<br />

certain circumstances.<br />

The increase in guarantees is distributed equally between the business areas.<br />

The increase within <strong>Kongsberg</strong> <strong>Maritime</strong>. has arisen as a result of general growth<br />

in deliveries. The increase within <strong>Kongsberg</strong> Defence & Aerospace has aris en as a<br />

result of strong growth in the number of remote weapons systems delivered.<br />

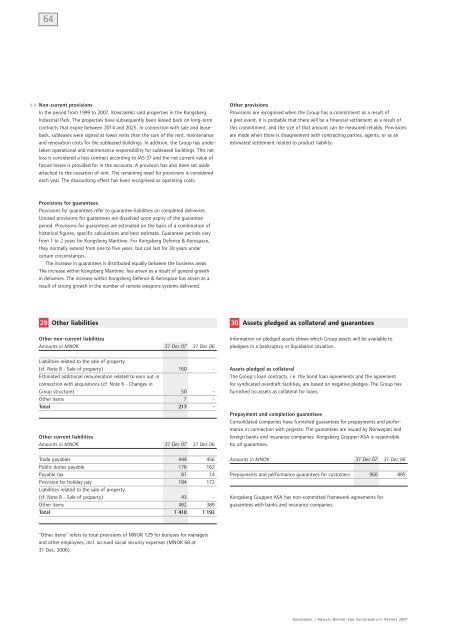

29 Other liabilities<br />

Other non-current liabilities<br />

Amounts in MNOK 31 Dec 07 31 Dec 06<br />

Liabilities related to the sale of property<br />

(cf. Note 8 - Sale of property) 160 -<br />

Estimated additional remuneration related to earn out in<br />

connection with acquisitions (cf. Note 6 - Changes in<br />

Group structure) 50 -<br />

Other items 7 -<br />

Total 217 -<br />

Other current liabilities<br />

Amounts in MNOK 31 Dec 07 31 Dec 06<br />

Trade payables 444 456<br />

Public duties payable 176 162<br />

Payable tax 81 14<br />

Provision for holiday pay 184 172<br />

Liabilities related to the sale of property<br />

(cf. Note 8 - Sale of property) 43 -<br />

Other items 482 389<br />

Total 1 410 1 193<br />

30 Assets pledged as collateral and guarantees<br />

Information on pledged assets shows which Group assets will be available to<br />

pledgees in a bankruptcy or liquidation situation.<br />

Assets pledged as collateral<br />

The Group's loan contracts, i.e. the bond loan agreements and the agreement<br />

for syndicated overdraft facilities, are based on negative pledges. The Group has<br />

furnished no assets as collateral for loans.<br />

Prepayment and completion guarantees<br />

Consolidated companies have furnished guarantees for prepayments and performance<br />

in connection with projects. The guarantees are issued by Norwegian and<br />

foreign banks and insurance companies. <strong>Kongsberg</strong> <strong>Gruppen</strong> ASA is responsible<br />

for all guarantees.<br />

Amounts in MNOK 31 Dec 07 31 Dec 06<br />

Prepayments and performance guarantees for customers 960 885<br />

<strong>Kongsberg</strong> <strong>Gruppen</strong> ASA has non-committed framework agreements for<br />

guarantees with banks and insurance companies.<br />

"Other items" refers to total provisions of MNOK 129 for bonuses for managers<br />

and other employees, incl. accrued social security expenses (MNOK 68 at<br />

31 Dec. 2006).<br />

<strong>Kongsberg</strong> – Annual <strong>Report</strong> and Sustainability <strong>Report</strong> <strong>2007</strong>