Report - Kongsberg Gruppen 2007 - Kongsberg Maritime ...

Report - Kongsberg Gruppen 2007 - Kongsberg Maritime ...

Report - Kongsberg Gruppen 2007 - Kongsberg Maritime ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

60<br />

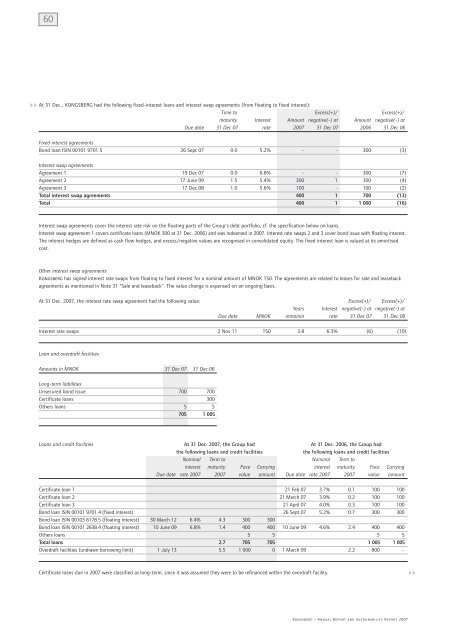

At 31 Dec., KONGSBERG had the following fixed-interest loans and interest swap agreements (from floating to fixed interest):<br />

Time to Excess(+)/ Excess(+)/<br />

maturity Interest Amount negative(-) at Amount negative(-) at<br />

Due date 31 Dec 07 rate <strong>2007</strong> 31 Dec 07 2006 31 Dec 06<br />

Fixed interest agreements<br />

Bond loan ISIN 00101 9701.5 26 Sept 07 0.0 5.2% - - 300 (3)<br />

Interest swap agreements<br />

Agreement 1 19 Dec 07 0.0 6.8% - - 300 (7)<br />

Agreement 2 17 June 09 1.5 5.4% 300 1 300 (4)<br />

Agreement 3 17 Dec 08 1.0 5.6% 100 - 100 (2)<br />

Total interest swap agreements 400 1 700 (13)<br />

Total 400 1 1 000 (16)<br />

Interest swap agreements cover the interest rate risk on the floating parts of the Group's debt portfolio, cf. the specification below on loans.<br />

Interest swap agreement 1 covers certificate loans (MNOK 300 at 31 Dec. 2006) and was redeemed in <strong>2007</strong>. Interest rate swaps 2 and 3 cover bond issue with floating interest.<br />

The interest hedges are defined as cash flow hedges, and excess/negative values are recognised in consolidated equity. The fixed interest loan is valued at its amortised<br />

cost.<br />

Other interest swap agreements<br />

<strong>Kongsberg</strong> has signed interest rate swaps from floating to fixed interest for a nominal amount of MNOK 150. The agreements are related to leases for sale and leaseback<br />

agreements as mentioned in Note 31 "Sale and leaseback". The value change is expensed on an ongoing basis.<br />

At 31 Dec. <strong>2007</strong>, the interest rate swap agreement had the following value: Excess(+)/ Excess(+)/<br />

Years Interest negative(-) at negative(-) at<br />

Due date MNOK remainin rate 31 Dec 07 31 Dec 06<br />

Interest rate swaps 2 Nov 11 150 3.8 6.3% (6) (10)<br />

Loan and overdraft facilities<br />

Amounts in MNOK 31 Dec 07 31 Dec 06<br />

Long-term liabilities<br />

Unsecured bond issue 700 700<br />

Certificate loans 300<br />

Others loans 5 5<br />

705 1 005<br />

Loans and credit facilities At 31 Dec. <strong>2007</strong>, the Group had At 31 Dec. 2006, the Group had<br />

the following loans and credit facilities<br />

the following loans and credit facilities<br />

Nominal Term to Nominal Term to<br />

interest maturity Face Carrying interest maturity Face Carrying<br />

Due date rate <strong>2007</strong> <strong>2007</strong> value amount Due date rate <strong>2007</strong> <strong>2007</strong> value amount<br />

Certificate loan 1 21 Feb 07 3.7% 0.1 100 100<br />

Certificate loan 2 21 March 07 3.9% 0.2 100 100<br />

Certificate loan 3 21 April 07 4.0% 0.3 100 100<br />

Bond loan ISIN 00101 9701.4 (fixed interest) 26 Sept 07 5.2% 0.7 300 300<br />

Bond loan ISIN 00103 6178.5 (floating interest) 30 March 12 6.4% 4.3 300 300<br />

Bond loan ISIN 00101 2638.4 (floating interest) 10 June 09 6.8% 1.4 400 400 10 June 09 4.6% 2.4 400 400<br />

Others loans 5 5 5 5<br />

Total loans 2.7 705 705 1 005 1 005<br />

Overdraft facilities (undrawn borrowing limit) 1 July 13 5.5 1 000 0 1 March 09 2.2 800 -<br />

Certificate loans due in <strong>2007</strong> were classified as long-term, since it was assumed they were to be refinanced within the overdraft facility.<br />

<strong>Kongsberg</strong> – Annual <strong>Report</strong> and Sustainability <strong>Report</strong> <strong>2007</strong>