Annual Report - KonÄar Distribution and Special Transformers Inc.

Annual Report - KonÄar Distribution and Special Transformers Inc.

Annual Report - KonÄar Distribution and Special Transformers Inc.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

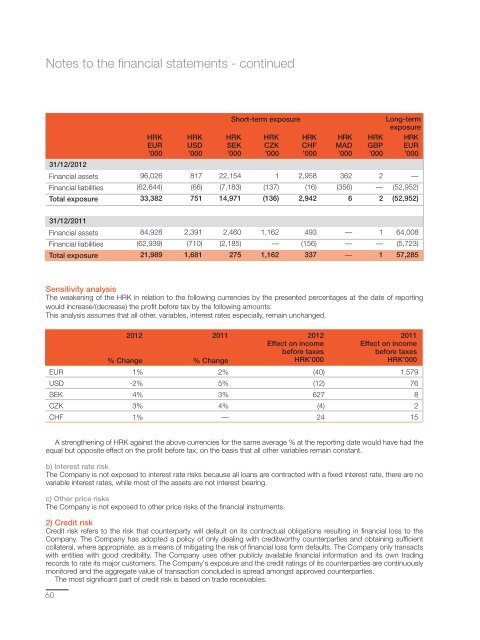

Notes to the financial statements - continued<br />

31/12/2012<br />

Financial assets<br />

Financial liabilities<br />

Total exposure<br />

Short-term exposure<br />

Long-term<br />

exposure<br />

HRK HRK HRK HRK HRK HRK HRK HRK<br />

EUR USD SEK CZK CHF MAD GBP EUR<br />

’000 ’000 ’000 ’000 ’000 ’000 ’000 ’000<br />

96,026 817 22,154 1 2,958 362 2 —<br />

(62,644) (66) (7,183) (137) (16) (356) — (52,952)<br />

33,382 751 14,971 (136) 2,942 6 2 (52,952)<br />

31/12/2011<br />

Financial assets<br />

Financial liabilities<br />

Total exposure<br />

84,928 2,391 2,460 1,162 493 — 1 64,008<br />

(62,939) (710) (2,185) — (156) — — (5,723)<br />

21,989 1,681 275 1,162 337 — 1 57,285<br />

Sensitivity analysis<br />

The weakening of the HRK in relation to the following currencies by the presented percentages at the date of reporting<br />

would increase/(decrease) the profit before tax by the following amounts:<br />

This analysis assumes that all other, variables, interest rates especially, remain unchanged.<br />

2012<br />

% Change<br />

2011<br />

% Change<br />

2012<br />

Effect on income<br />

before taxes<br />

HRK’000<br />

2011<br />

Effect on income<br />

before taxes<br />

HRK’000<br />

EUR 1% 2% (40) 1.579<br />

USD -2% 5% (12) 76<br />

SEK 4% 3% 627 8<br />

CZK 3% 4% (4) 2<br />

CHF 1% — 24 15<br />

A strengthening of HRK against the above currencies for the same average % at the reporting date would have had the<br />

equal but opposite effect on the profit before tax, on the basis that all other variables remain constant.<br />

b) Interest rate risk<br />

The Company is not exposed to interest rate risks because all loans are contracted with a fixed interest rate, there are no<br />

variable interest rates, while most of the assets are not interest bearing.<br />

c) Other price risks<br />

The Company is not exposed to other price risks of the financial instruments.<br />

2) Credit risk<br />

Credit risk refers to the risk that counterparty will default on its contractual obligations resulting in financial loss to the<br />

Company. The Company has adopted a policy of only dealing with creditworthy counterparties <strong>and</strong> obtaining sufficient<br />

collateral, where appropriate, as a means of mitigating the risk of financial loss form defaults. The Company only transacts<br />

with entities with good credibility. The Company uses other publicly available financial information <strong>and</strong> its own trading<br />

records to rate its major customers. The Company’s exposure <strong>and</strong> the credit ratings of its counterparties are continuously<br />

monitored <strong>and</strong> the aggregate value of transaction concluded is spread amongst approved counterparties.<br />

The most significant part of credit risk is based on trade receivables.<br />

60