Annual Report - KonÄar Distribution and Special Transformers Inc.

Annual Report - KonÄar Distribution and Special Transformers Inc.

Annual Report - KonÄar Distribution and Special Transformers Inc.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the financial statements - continued<br />

Trade <strong>and</strong> other receivables<br />

The Company’s exposure to credit risk is influenced mainly by the individual characteristics of each customer. The demographics<br />

of the Company’s customer base, including the default risk of the industry <strong>and</strong> country, in which customers<br />

operate, has less of an influence on credit risk. The Company has established a credit policy under which each new<br />

customer is analysed individually for creditworthiness before st<strong>and</strong>ard payment <strong>and</strong> delivery terms <strong>and</strong> conditions are<br />

offered. From customers with low creditworthiness the Company requires common payment collateral, such as letters of<br />

credit, bank collateral, mortgages, debentures, etc. The Company establishes an allowance for impairment that represents<br />

its estimate of incurred losses in respect of trade <strong>and</strong> other receivables <strong>and</strong> investments.<br />

The Company has not used derivative financial instruments to protect itself against those risks.<br />

3) Liquidity risk<br />

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they fall due. Risk management<br />

is the responsibility of the Management Board which has built quality frame for the monitoring of current, middle <strong>and</strong> longterm<br />

financing <strong>and</strong> all depends related to liquidity risk. The Company manages this risk by constant monitoring of estimated<br />

<strong>and</strong> actual cash flow with the maturity of financial assets <strong>and</strong> liabilities.<br />

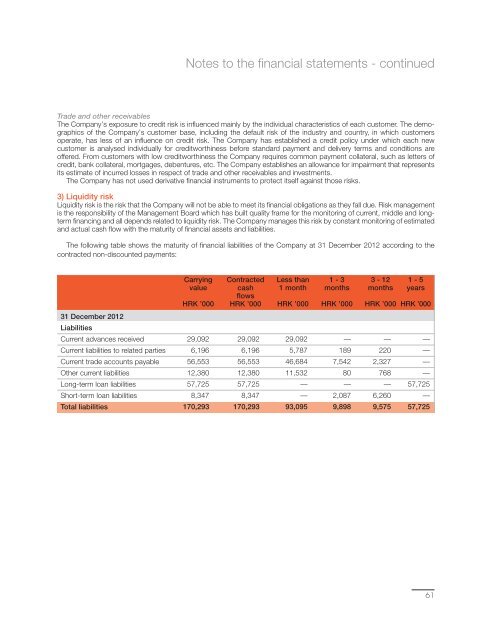

The following table shows the maturity of financial liabilities of the Company at 31 December 2012 according to the<br />

contracted non-discounted payments:<br />

31 December 2012<br />

Liabilities<br />

Current advances received<br />

Current liabilities to related parties<br />

Current trade accounts payable<br />

Other current liabilities<br />

Long-term loan liabilities<br />

Short-term loan liabilities<br />

Total liabilities<br />

Carrying<br />

value<br />

HRK ’000<br />

Contracted<br />

cash<br />

flows<br />

HRK ’000<br />

Less than<br />

1 month<br />

HRK ’000<br />

1 - 3<br />

months<br />

HRK ’000<br />

3 - 12<br />

months<br />

1 - 5<br />

years<br />

HRK ’000 HRK ’000<br />

29,092 29,092 29,092 — — —<br />

6,196 6,196 5,787 189 220 —<br />

56,553 56,553 46,684 7,542 2,327 —<br />

12,380 12,380 11,532 80 768 —<br />

57,725 57,725 — — — 57,725<br />

8,347 8,347 — 2,087 6,260 —<br />

170,293 170,293 93,095 9,898 9,575 57,725<br />

61