Untitled

Untitled

Untitled

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Directors' Report<br />

for the year ended 3l March 2000<br />

The Chairmans Statement, the Business Revtews and the<br />

Financial Revisr in this Annual Report together contain details<br />

of the principal operations of the Group and their resulb during<br />

the year as well as likev future de€lopmenb.<br />

Wamer EMI Music<br />

On 24 January 2000, the Company and Time Warner lnc.<br />

announced their intentron, subject to shareholder approval,<br />

regulatory clearance and the satisfaction of certain other<br />

conditions, to combine their respectile music busineses to form<br />

Warner EMI Musrc. The apprwal of the Companyb sirareholders<br />

to the propo6al will be sought at an E;rtraordinary General<br />

Meeting which is expected to be held on 26 June 2000,<br />

Regulatory clearances and certain other conditions remain<br />

outsanding as at the date of this Report.<br />

Share capital<br />

changes in the Companys st''are capital during the year are set<br />

out in Note 25 on page 53.<br />

Employment policies<br />

The Group3 decentralised organietion empo\ €rs local<br />

manag€ment, encouraging them to make the best decisions on a<br />

timely, but informed, basis. Responsibility for employnrent matters<br />

therefore rests primarily with each business operation under the<br />

general umbrella of EMI Group5 policy and procedure guidelines.<br />

EMI Group companies are committed to the maintenance of<br />

a \ lork environment free of discrimination on the grounds of<br />

gender nationality, ethnic or racial ongin, non-job-related disability<br />

or marital status.<br />

Detailed information on the proposed combination will be<br />

set out in the Listing Partrculars which are expected to be posted<br />

to slEreholde6 on 2 June 2000. tf the combinaron is comdeted,<br />

the Company intends to change its financial period end to<br />

31 December with effect from 31 December 2000.<br />

Dividends<br />

An intedm dMdend of 4.25p per Ordinary Share was paid on<br />

3 March 2000. The Board is recommending a final dividend of<br />

'11.75p per Ordinary Share, making a total of 16.0p (1999: 16.0p).<br />

The final dMdend will be paid on Monday, 2 kober 2000 to<br />

Ordinary Shareholders on the register as at the close of business<br />

on Monday, 4 September 2000, with the shares going exdMdend<br />

on Tuesday, 29 Augun 2000.<br />

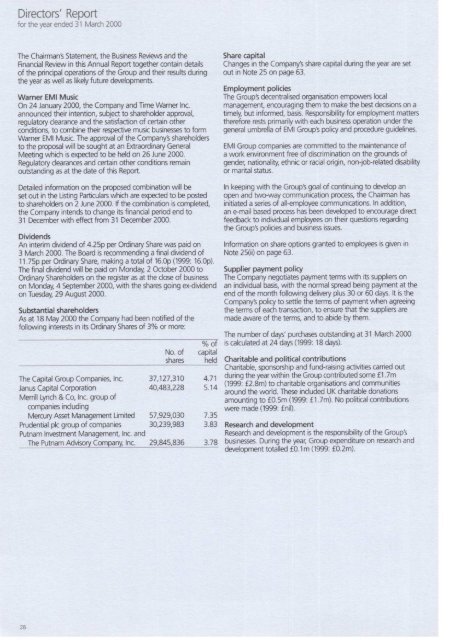

sub6tantial shareholders<br />

As at 18 May 2000 the Cornpany had been notified of the<br />

follo,ving interess in iE Ordinary Shares of 30lo or more:<br />

The Capital Grdp Companies, lnc. 37,127 ,310<br />

&,4€3228<br />

Janus Capital Corporation<br />

Merill Lynch & Co, lnc. group of<br />

companies including<br />

Mercury Asset Managernent Limited 57 ,929,030<br />

Prudential plc Aroup of companies 30,239,983<br />

Putnam lm€stment Management, lnc. and<br />

__nrelutnam<br />

Advisory company, Inc.<br />

3:il1ffi;.?,,:H,:l"rf.?';"13!8<br />

<br />

<br />

<br />

<br />

V" oI<br />

capital<br />

held<br />

4.71<br />

5.14<br />

ln keeping with the Groups goal of continuing to develop an<br />

open and two-way communication process, the Chairman has<br />

initiated a series of all+mplqpe communications. ln additron,<br />

an +mail baed process has been deeloped to encourage dircct<br />

feedback to indMdual employees on their questions regarding<br />

the Groups policies and busines isues.<br />

lnformation on share options granted to emplqlees is gtwn in<br />

Note 25(ii) on page 63.<br />

Supplier payment poliqy<br />

The Company negotiates payment terms with ib suppliers on<br />

an indMdual bais, with the normal spread being payment at the<br />

end of the month folloruing delirery plus 30 or 60 day5. lt is the<br />

Companys policy to settle the terms of payment wtren agreeinq<br />

the terms of each transaction, to ensure that the suppliers are<br />

made aware of the terms, and to abide by them.<br />

The number of days' purchases outstanding at 31 March 2000<br />

is calculated at 24 days (1999: 18 days).<br />

Charitable and politi@l contributions<br />

charitable, sponsorship and fund-raising activities canied out<br />

during the year within the Group contribr"rted some f 1.7m<br />

(1999: f2.8m) to charitable organisations and communities<br />

aound the uorld. These included UK charitable donations<br />

amounting to f0.5m (1999: fl.7m). No political contributions<br />

were made (1999: fnil).<br />

7 .35<br />

3.83 Research and development<br />

Research and darelopment is the responsibility of the Groups<br />

on research and<br />

?8:#iture