Untitled

Untitled

Untitled

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

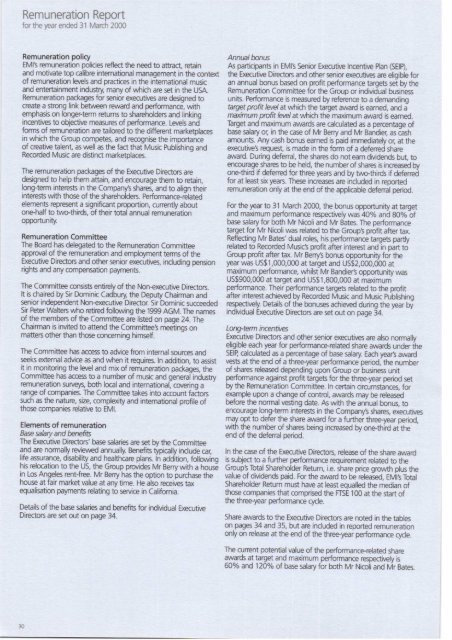

Remuneration Report<br />

for the year ended 31 March 2000<br />

Remuneration poliqy<br />

EM|S remuneration policies reflect the need to attract, retain<br />

and motivate top calibre international management in the context<br />

of remunera{on leyels and practices in the international music<br />

and entertainment industry many of vvhich are set in the USA.<br />

Remuneration packages for senior executiues are designed to<br />

create a strong link bet\eeen reward and performance, with<br />

emphasis on longeFterm returns to strareholders and linkinq<br />

incentiles to objectrre measum of perfornrance. Leds and=<br />

forms of remuneration are tailorcd to the different marketplaces<br />

in which the Group compet6, and recognise the importance<br />

of creatrve talenL as \ €ll as the fact that Music fublishing and<br />

Recorded Music are distlnct marketplaces.<br />

The remuneration packages of the Executive Directors are<br />

designed to help them attain, and encourage them to retain,<br />

long-term interests in the Companys shares, and to align their<br />

interes6 with those of the shareholden. Performanc+related<br />

ehmenB represent a significant proportion, currently about<br />

one-half to twqthirds, of their total annual remuneiatron<br />

opportunity<br />

Remuneration Committee<br />

the Board has delegated to the Remuneration Committee<br />

apprwal of the remuneration and emplqment terms of the<br />

Executile Directors and other senior executi!€s, induding pension<br />

righ$ and any compensation paymen6.<br />

'lhe Committee consists entrely of the Non€xecutive Directors.<br />

tt is chaied by Sir Dominic Cadbury the Deputy Chairman and<br />

senior independent Non-executirc Director. Sir Dominic succeeded<br />

Sir Peter Walters who retired follorving the 1999 AGM. The nam6<br />

of the memben of the Committee are listed on page 24. 'lhe<br />

Chairman is inMted to attend the Committees meetinos on<br />

matteG other than those concerning himself.<br />

The Committee has access to advice from internal souKes and<br />

seeks external advlce as and when it requires. ln addition, to assist<br />

it in monitoring the leyel and mix of remuneration packages, the<br />

Committee has access to a number of music and general industry<br />

remuneration surv€J,s, both lo(al and international, co€rinq a<br />

range of companies. lhe Committee takes into account faitors<br />

such as the nature, size, complexity and international profile of<br />

those companies relative to EMl.<br />

Elements of rem uneration<br />

Bae sahry and funefis<br />

the Executte Directors' base salanes are set by the Committee<br />

and are normally revio,raed annually. Benefits typically include car.<br />

life asurance, disability and heahha"re plans. iri addition, follouuing<br />

his relocation to the US, the Group provides Mr Berry with a hous6<br />

in Los Angeles rent-free. Mr Berry has the optron to purchase the<br />

house at fair market value at ani trrne. He dbo receives tax<br />

equalisation payments relating to seMce in California.<br />

Details of the base elaries and benefis for individual Executive<br />

Directo6 are set out on page 34.<br />

Annual fuius<br />

As participans in EM|S Senior Executive lncentive Plan (SEIP),<br />

the Executive Directors and other senior execr.rtnes are eligible for<br />

an annual bonus based on profit performance targets set by the<br />

Remuneration Committee for the Group or indivrdual busines<br />

units. Performance is measured by reference to a demanding<br />

F,ryet Fofit level alvvhich the target award is earned, and a<br />

maximum profit l*elat which the maximum award is earned.<br />

Target and maximum awards are calculated as a percenbge of<br />

base salary or, in the case of Mr Berry and Mr Bandier, as cash<br />

amounts. Any cash bonus earned is paid immediatet oi at the<br />

executves request, is made in the form of a defened share<br />

award. During defenal, the shares do not earn dividends but, to<br />

encourage_shares to be held, the number of shares is increased by<br />

one-third if defened for three years and by twethirds if deferred<br />

for at least six yea6. These increases are iricluded in reported<br />

remuneration only at the end of the applicable defenal period.<br />

For the year to 31 March 2000, the bonus opportunity at target<br />

and maximum performance respectively was 40% and 8oo/o-of<br />

base salary for both Mr Nrcoli and Mr Bates. The performance<br />

targ€t for Mr Nicoll was related to the Groupb profit after tax.<br />

Re{lectrng Mr Bates' dual oles, his performance targets partly<br />

related to Recorded Musicb profit after interest and in pan to<br />

Group profit after tax. Mr BerryS bonus opportunity for the<br />

year was US$1,000,000 at target and US$2,000,000 at<br />

mglrmgm performance, whilst Mr Bandie6 opportunity was<br />

US$900,000 at target and US$1,800,000 at maximum<br />

performance. Their performance targets related to the profit<br />

atter interest achieved by Recorded Music and Music publishinq<br />

respectvely. Details of the bonuses achieved during the year by<br />

indMdual Executile Directo6 are set out on page :+.<br />

Long-Hm incffitives<br />

Executive Directors and other senior executtv6 are also normallv<br />

eligible each year for performancerelated share awards under ihe<br />

SEIB calculated a< a percentage of base salary Each year,s award<br />

vesb at the end of a three-year performance period. the number<br />

of sham released depending upon Group or business unit<br />

performance against profit targeb for the three-year peiod set<br />

by the Remuneration Committee. In certain circumstances, for<br />

example upon a change of control, awards may be released<br />

before the normal vesting date. As with the anhual bonus, to<br />

encourage long-term interests in the Companys shares, executives<br />

may opt to defer the share award for a further threeyear period,<br />

with the number of shares being increased by onethird ai the<br />

end of the deferral period.<br />

ln the case of the Executile Directors, relede of the share award<br />

is subject to a further performance requirem€nt related to the<br />

Groups_Total Shareholder Return, i.e. share price growth plus the<br />

value of dividends paid. For the award to be released, EMIS Total<br />

Shareholder Return must have at least equalled the median of<br />

those companig that comprised the ffSE 100 at the start of<br />

the threeyear performance cycle.<br />

Share awards to the Executive Directo6 are noted in the tables<br />

on pages 34 and 35, but are included in reported remuneration<br />

only on release at the end of the three.year performance cycle.<br />

The cunent potential value of the performance-related share<br />

awards at target and maximum performance respectively is<br />

600/o and 120o/o of base salary for both Mr Nicoii and Mr Bates.