Untitled

Untitled

Untitled

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

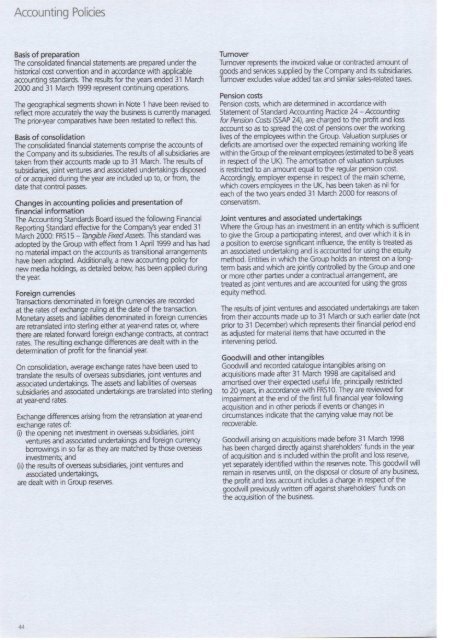

Accounting Policies<br />

Basis of preparation<br />

The consolidaed finanoal statements are prepared under the<br />

historical cost convention and in accordance with applicable<br />

accounting standards. The resufs for the years ended 31 March<br />

2000 and 31 March 1999 represent continuing operations.<br />

The geographical segmen6 shq,'rn in llote t ha\€ been re/ised to<br />

reflect rnore accurately the way the business is currently managed.<br />

The prior-par comparatrves hale been restated to reflect this.<br />

Basis of consolidation<br />

The consolidated financial statements comprise the accounts of<br />

the Company and its subsidiaries. the resuls of all subsidiaries are<br />

taken from therr accoun6 made up to 31 March. The resuls of<br />

subsidiaries, joint ventures and asociated undertakings disposed<br />

of or acquired during the year are included up to, or from, the<br />

date that control pass6.<br />

Changes in accounting policies and presentation of<br />

financial information<br />

The Accounting Standards Board isued the {ollowing Financial<br />

Reporting Standard effectrve for the CompanyS year ended 31<br />

Mirch 2000: FPSIS - Tangible Fixd Asse6. lhis standard was<br />

ad@ted by the Group Wth effect from 1 April 1999 and has had<br />

no material impact on the accounB as transitional anangements<br />

have been adopted. Addibonally, a naau accounting policy for<br />

na,v media holdings, as detailed below, has been applied during<br />

the year.<br />

Foreign currencies<br />

Transaictions denominated in foreign currencies are recorded<br />

at the rates of exchange ruling at the date of the transaction.<br />

Monetary asse6 and liabilities denominated in foreign cunencies<br />

are retranslated into sterling either at year+nd rates or, where<br />

there are related forward foreign exchange contracb. at contact<br />

rates. The resuhing o(hange differences are dealt with in the<br />

determination of profrt for the financial year.<br />

On consolidation, a\erage exchange rates hale been used to<br />

translate the resulB of overseas subsidiaries, joint ventures and<br />

associated undertakings. The assets and liabilities of cwerseas<br />

subsidiaries and associated undertakings are translated into sterling<br />

at year+nd rates.<br />

Exchange differencs arising from the retranslation at year€nd<br />

exchange rates of:<br />

(i) the opening net investment in o/erseas subsdiaries, joint<br />

lenttjres anid associated undertakings and foreign currency<br />

bonor,rurngs in so far as they are matched by those overseas<br />

investments; and<br />

(ii) the resulb of o/erseas subsidiaries, Joint venturcs and<br />

associated undertakings,<br />

are dealt with in Group reserves.<br />

Tumover<br />

Turnover represents the invoiced value or contracted amount of<br />

gmds and services supplied by the Company and is subsdiaries.<br />

Turnoer excludes value added tax and similar sales-related taxes.<br />

Pension cosE<br />

Pension cosb, which are determined in xcordance with<br />

Statement of Standard Accountrng Practice 24 - Accounting<br />

for ftnsrbn CosB (SSAP 24), are charged to the profit and loss<br />

account so as to spread the cost of pensions over the woking<br />

li\es of the employees within the Group. Valuation surpluses or<br />

deficlts are amortised wer the expected remaining working life<br />

within the Group of the relevant emplqpes (6tjmated to be 8 years<br />

in respect of the UK). The amortisation of valuation surpluses<br />

is rcstricted to an amount equal to the regular pension cost.<br />

Accordingly, emplqpr expense in respect of the main scheme,<br />

which covers employees in the UK. has been taken as nilfor<br />

each of the two yeam ended 31 March 2000 for reasons of<br />

conservatism.<br />

Joint ventures and associated undertakings<br />

Where the Group has an in€stment in an entrty which is sufflcient<br />

to give the Group a participating interest, and over vvhich it is in<br />

a posrtion to exercise significant influence, the entity is treated as<br />

an associated undertaking and is rcounted for using the equity<br />

method. Entities in vvhich the Group holds an interest on a longterm<br />

basis and which are jointly controlled by the Group and one<br />

or more other parties under a contractual anangement, are<br />

treated as joint ventum and are accounted for using the gros<br />

equity method.<br />

fhe resutts of joint \€ntures and associated undertakings are taken<br />

from their accounts made up to 31 March or such earlier date (not<br />

prior to 31 December)which represents their financial period end<br />

as adjusted for.material items that have occuned in the<br />

rntervenrng penod.<br />

Goodwill and other intangibles<br />

Goodwill and recorded catalogue intangibles arising on<br />

acquisitions made after 31 March 1998 are opitalised and<br />

amortised c €r their expected useful life, principally restricted<br />

to 20 vea6, in accordance wth FRS10. They are revis/'/ed for<br />

rmpairhent at the end of the finl {ull iinancial year follorrurng<br />

acquietion and in other penods if orens or changes in<br />

ciromstances indicate that the carrying value may not be<br />

recoverable.<br />

Goodwill arising on acquisitions made before 31 March 1998<br />

has been charged directly against shareholders' funds in the year<br />

of acquisitron and is included within the profit and loss reserve,<br />

yet sebarately identffied within the reserves note. This goodwill will<br />

iemaiir in reirves until, on the disposl or closure of any business,<br />

the profn and loss account includes a charge in respect of the<br />

good\,,/ill prs/iously witten off against shareholders' funds on<br />

the acquisition of the business.