Untitled

Untitled

Untitled

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes on<br />

the Accounts<br />

<br />

<br />

I Associated Compan-es<br />

The group accounts for the year to gO June 1921 include the<br />

group's share ofthe results ofall associated companies (i.e- those<br />

ia yhic! the group owns between 20% and 50./o of tire equity<br />

voting rights) with the exception of:-<br />

(a) Companies which are not considered to be material oD the<br />

baeis olaesets or results; and<br />

(b) Companies in which the group's interest is not for the longterm,<br />

or, having regard to the disposition of the other shar;_<br />

holdings, the group is not in a position to exetcise a significant<br />

influence over the companies.<br />

Details of the companies which are treated as associated companies<br />

are given on page 37-<br />

Although the group owns 25yo of tbLe eqvtty of British Domestic<br />

Appliances Limited, it has not been treaied ae an associated company<br />

since it was not considered a long-term investment at BO June<br />

1971. The group has an option to sell it€ investment to the General<br />

Electric Company Limited at a guaranteed price. The option can<br />

be exercised on 31 December 1972, or within five years after that<br />

date, and the guarantee erceeds the present book value of the<br />

investment.<br />

It is the Board's present intention to exercise this option,<br />

T?re group's share of the losses of British Domeetic Appliances<br />

Limited amounted to €541,000 before taxation for the yei ended<br />

2 Sales<br />

Tlrese are sales to third parties including income from oatentscopyrights<br />

and trademarks, aft€r deducting all discounie, coml<br />

qrissions and taxes levied on salee, atrd excludes the group's sh;e<br />

31 March 1971. No provision is necessar5z, however, because the<br />

losses do uot reduce the value ofthe guaranteed selling price.<br />

Itr the previous year the group accounta included only the dividentls<br />

distributed by associated companies, togethe; with the<br />

group'e share of undistributed profits ofthose companies in which<br />

the group,owned 5O% of the equity capital. Of thJincome arising<br />

tbLis year from all associated companies, a sun of €128,000 relatei<br />

to undistributed income from those companiea where the group<br />

holils between 20'/. and 49./o ofthe equity capital.<br />

Wherever possible, the group's share of trading results has been<br />

obtained from audited accounts of aesociated companiee covering<br />

the period to 3O June 1971. Where theee are noi available, the<br />

results have been taken from unaudited management accounts for<br />

the period from the date of the most recent audited accounts to<br />

30 June 1971. The amounts so included are, however, not material<br />

in relation to the total income from this source. Furtherrnore, the<br />

directors are of the opirfon that the results disclosed bv the unaufited<br />

accounte are reliable.<br />

On 1 April 79'11 a 5Ol" interest $'as acquired in the equity of<br />

Vorson SpA- In view of the particular pattern of trade in ihie<br />

company, it is impractical to prepare accounts to B0 June, and it<br />

has been decided that the group will consolidate its share of<br />

Vorson's audited results on the basis of their accounts for the<br />

twelve montha to 31 March each year, and accordingly, no<br />

amounts are included from this source in the gToup accounta to<br />

30 June 1971.<br />

ofthe sales by associated companies. Sales in 1969/?0 included the<br />

gtoup's share of sales by associated companies of i9,6O8,000. The<br />

comparative figures are after deducting this amount.<br />

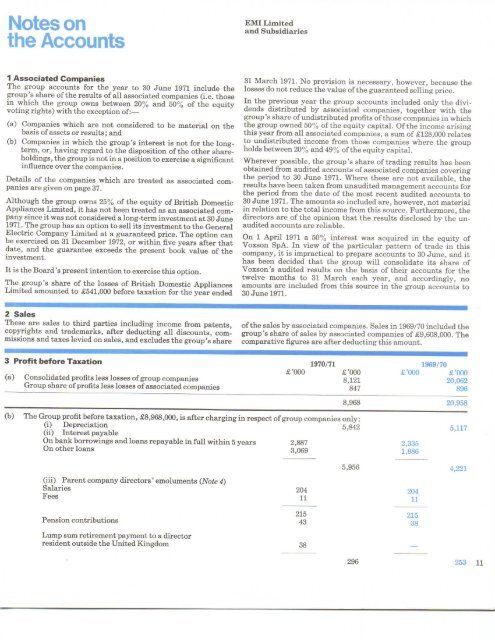

3 Profit beforo Taxation<br />

(a) Consolidated profits less losses ofgroup companies<br />

Group share ofprofits less lossee ofassociated companies<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

(b) The Group proft before taxation, €8,968,000, is after charging in respect of group companies only:<br />

(i) Depreciation<br />

5 ,U2<br />

(ii) Interest payable<br />

On bank borrowings and loans repayable in full within b years<br />

Z,g7<br />

Onotherloans g,069<br />

<br />

<br />

<br />

<br />

<br />

(iii) Parent company directors' emoluments (Not€ 4)<br />

Salariee<br />

Fees<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Pension contributions<br />

<br />

<br />

<br />

<br />

Lump sum retirenent payment to a director<br />

resident outside the United Kingdom