Annual Report.CDR - Colombo Stock Exchange

Annual Report.CDR - Colombo Stock Exchange

Annual Report.CDR - Colombo Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

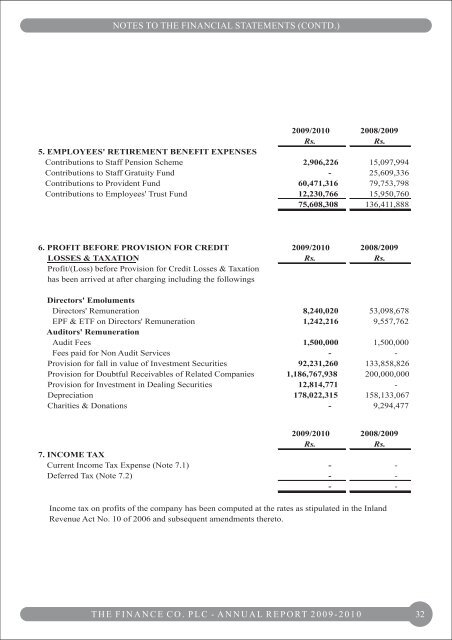

NOTES TO THE FINANCIAL STATEMENTS (CONTD.)<br />

2009/2010 2008/2009<br />

Rs.<br />

Rs.<br />

5. EMPLOYEES' RETIREMENT BENEFIT EXPENSES<br />

Contributions to Staff Pension Scheme 2,906,226 15,097,994<br />

Contributions to Staff Gratuity Fund - 25,609,336<br />

Contributions to Provident Fund 60,471,316 79,753,798<br />

Contributions to Employees' Trust Fund 12,230,766 15,950,760<br />

75,608,308 136,411,888<br />

6. PROFIT BEFORE PROVISION FOR CREDIT 2009/2010 2008/2009<br />

LOSSES & TAXATION Rs. Rs.<br />

Profit/(Loss) before Provision for Credit Losses & Taxation<br />

has been arrived at after charging including the followings<br />

Directors' Emoluments<br />

Directors' Remuneration 8,240,020 53,098,678<br />

EPF & ETF on Directors' Remuneration 1,242,216 9,557,762<br />

Auditors' Remuneration<br />

Audit Fees 1,500,000 1,500,000<br />

Fees paid for Non Audit Services - -<br />

Provision for fall in value of Investment Securities 92,231,260 133,858,826<br />

Provision for Doubtful Receivables of Related Companies 1,186,767,938 200,000,000<br />

Provision for Investment in Dealing Securities 12,814,771 -<br />

Depreciation 178,022,315 158,133,067<br />

Charities & Donations - 9,294,477<br />

2009/2010 2008/2009<br />

Rs.<br />

Rs.<br />

7. INCOME TAX<br />

Current Income Tax Expense (Note 7.1) - -<br />

Deferred Tax (Note 7.2) - -<br />

- -<br />

Income tax on profits of the company has been computed at the rates as stipulated in the Inland<br />

Revenue Act No. 10 of 2006 and subsequent amendments thereto.<br />

T H E F I N A N C E C O . P L C - A N N U A L R E P O RT 2 0 0 9 - 2 0 1 0<br />

32