Annual Report.CDR - Colombo Stock Exchange

Annual Report.CDR - Colombo Stock Exchange

Annual Report.CDR - Colombo Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

R E V I E W O F O P E R AT I O N S<br />

The Company Performances<br />

As a result of decline in demand for new credit facilities and<br />

current depression in real estate market, the net revenue of the<br />

Company decreased to Rs. 5.2 billion in 2009/10 from Rs.<br />

10.6 billion in 2008/09.<br />

The interest income of the Company declined by 43 percent<br />

during the year under review mainly due to decline in new<br />

credit facilities to compensate the depletion of current<br />

facilities.<br />

The interest expense for the same period decreased by 27<br />

percent mainly due to the reduction of deposit rate in line with<br />

reduction in Treasury Bill rates and decrease in borrowings<br />

rates.<br />

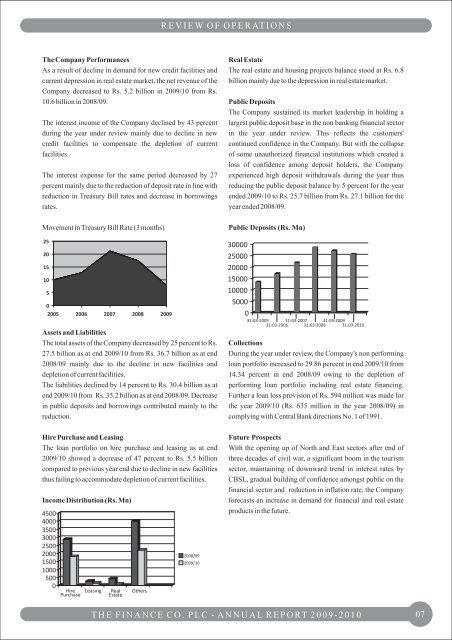

Movement in Treasury Bill Rate (3 months)<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

2005 2006 2007 2008 2009<br />

Real Estate<br />

The real estate and housing projects balance stood at Rs. 6.8<br />

billion mainly due to the depression in real estate market.<br />

Public Deposits<br />

The Company sustained its market leadership in holding a<br />

largest public deposit base in the non banking financial sector<br />

in the year under review. This reflects the customers'<br />

continued confidence in the Company. But with the collapse<br />

of some unauthorized financial institutions which created a<br />

loss of confidence among deposit holders, the Company<br />

experienced high deposit withdrawals during the year thus<br />

reducing the public deposit balance by 5 percent for the year<br />

ended 2009/10 to Rs. 25.7 billion from Rs. 27.1 billion for the<br />

year ended 2008/09.<br />

Public Deposits (Rs. Mn)<br />

30000<br />

25000<br />

20000<br />

15000<br />

10000<br />

5000<br />

0<br />

31-03-2005<br />

31-03-2006<br />

31-03-2007<br />

31-03-2008<br />

31-03-2009<br />

31-03-2010<br />

Assets and Liabilities<br />

The total assets of the Company decreased by 25 percent to Rs.<br />

27.5 billion as at end 2009/10 from Rs. 36.7 billion as at end<br />

2008/09 mainly due to the decline in new facilities and<br />

depletion of current facilities.<br />

The liabilities declined by 14 percent to Rs. 30.4 billion as at<br />

end 2009/10 from Rs. 35.2 billion as at end 2008/09. Decrease<br />

in public deposits and borrowings contributed mainly to the<br />

reduction.<br />

Hire Purchase and Leasing<br />

The loan portfolio on hire purchase and leasing as at end<br />

2009/10 showed a decrease of 47 percent to Rs. 5.5 billion<br />

compared to previous year end due to decline in new facilities<br />

thus failing to accommodate depletion of current facilities.<br />

Income Distribution (Rs. Mn)<br />

4500<br />

4000<br />

3500<br />

3000<br />

2500<br />

2000<br />

1500<br />

1000<br />

500<br />

0<br />

Hire<br />

Purchase<br />

Leasing Real<br />

Estate<br />

Others<br />

2008/09<br />

2009/10<br />

Collections<br />

During the year under review, the Company's non performing<br />

loan portfolio increased to 29.86 percent in end 2009/10 from<br />

14.34 percent in end 2008/09 owing to the depletion of<br />

performing loan portfolio including real estate financing.<br />

Further a loan loss provision of Rs. 594 million was made for<br />

the year 2009/10 (Rs. 635 million in the year 2008/09) in<br />

complying with Central Bank directions No. 1 of 1991.<br />

Future Prospects<br />

With the opening up of North and East sectors after end of<br />

three decades of civil war, a significant boom in the tourism<br />

sector, maintaining of downward trend in interest rates by<br />

CBSL, gradual building of confidence amongst public on the<br />

financial sector and reduction in inflation rate, the Company<br />

forecasts an increase in demand for financial and real estate<br />

products in the future.<br />

T H E F I N A N C E C O . P L C - A N N U A L R E P O RT 2 0 0 9 - 2 0 1 0<br />

07