Annual Report.CDR - Colombo Stock Exchange

Annual Report.CDR - Colombo Stock Exchange

Annual Report.CDR - Colombo Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS (CONTD.)<br />

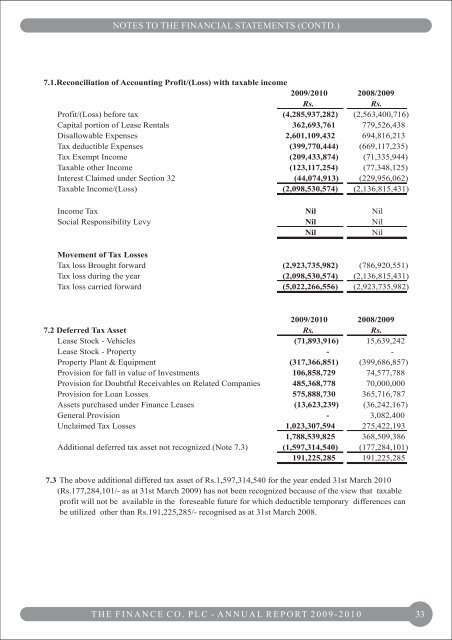

7.1.Reconciliation of Accounting Profit/(Loss) with taxable income<br />

2009/2010 2008/2009<br />

Rs.<br />

Rs.<br />

Profit/(Loss) before tax (4,285,937,282) (2,563,400,716)<br />

Capital portion of Lease Rentals 362,693,761 779,526,438<br />

Disallowable Expenses 2,601,109,432 694,816,213<br />

Tax deductible Expenses (399,770,444) (669,117,235)<br />

Tax Exempt Income (209,433,874) (71,335,944)<br />

Taxable other Income (123,117,254) (77,348,125)<br />

Interest Claimed under Section 32 (44,074,913) (229,956,062)<br />

Taxable Income/(Loss) (2,098,530,574) (2,136,815,431)<br />

Income Tax Nil Nil<br />

Social Responsibility Levy Nil Nil<br />

Nil<br />

Nil<br />

Movement of Tax Losses<br />

Tax loss Brought forward (2,923,735,982) (786,920,551)<br />

Tax loss during the year (2,098,530,574) (2,136,815,431)<br />

Tax loss carried forward (5,022,266,556) (2,923,735,982)<br />

2009/2010 2008/2009<br />

7.2 Deferred Tax Asset Rs. Rs.<br />

Lease <strong>Stock</strong> - Vehicles (71,893,916) 15,639,242<br />

Lease <strong>Stock</strong> - Property - -<br />

Property Plant & Equipment (317,366,851) (399,686,857)<br />

Provision for fall in value of Investments 106,858,729 74,577,788<br />

Provision for Doubtful Receivables on Related Companies 485,368,778 70,000,000<br />

Provision for Loan Losses 575,888,730 365,716,787<br />

Assets purchased under Finance Leases (13,623,239) (36,242,167)<br />

General Provision - 3,082,400<br />

Unclaimed Tax Losses 1,023,307,594 275,422,193<br />

1,788,539,825 368,509,386<br />

Additional deferred tax asset not recognized (Note 7.3) (1,597,314,540) (177,284,101)<br />

191,225,285 191,225,285<br />

7.3 The above additional differed tax asset of Rs.1,597,314,540 for the year ended 31st March 2010<br />

(Rs.177,284,101/- as at 31st March 2009) has not been recognized because of the view that taxable<br />

profit will not be available in the foreseable future for which deductible temporary differences can<br />

be utilized other than Rs.191,225,285/- recognised as at 31st March 2008.<br />

T H E F I N A N C E C O . P L C - A N N U A L R E P O RT 2 0 0 9 - 2 0 1 0<br />

33