GIF Select - Repsource - Manulife Financial

GIF Select - Repsource - Manulife Financial

GIF Select - Repsource - Manulife Financial

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

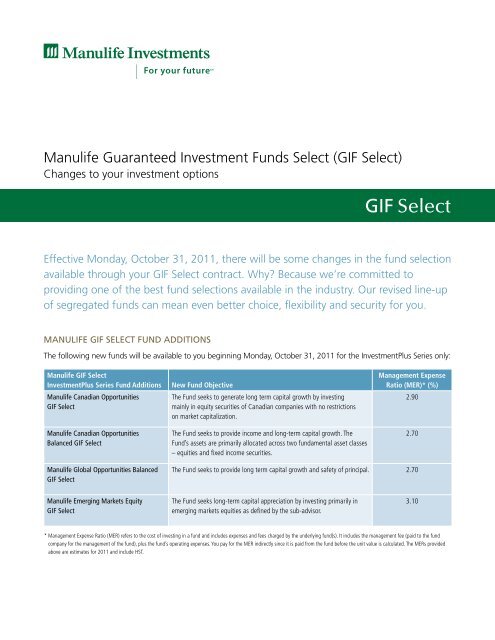

<strong>Manulife</strong> Guaranteed Investment Funds <strong>Select</strong> (<strong>GIF</strong> <strong>Select</strong>)<br />

Changes to your investment options<br />

Effective Monday, October 31, 2011, there will be some changes in the fund selection<br />

available through your <strong>GIF</strong> <strong>Select</strong> contract. Why? Because we’re committed to<br />

providing one of the best fund selections available in the industry. Our revised line-up<br />

of segregated funds can mean even better choice, flexibility and security for you.<br />

MANULIFE <strong>GIF</strong> SELECT FUND ADDITIONS<br />

The following new funds will be available to you beginning Monday, October 31, 2011 for the InvestmentPlus Series only:<br />

<strong>Manulife</strong> <strong>GIF</strong> <strong>Select</strong><br />

InvestmentPlus Series Fund Additions<br />

<strong>Manulife</strong> Canadian Opportunities<br />

<strong>GIF</strong> <strong>Select</strong><br />

<strong>Manulife</strong> Canadian Opportunities<br />

Balanced <strong>GIF</strong> <strong>Select</strong><br />

New Fund Objective<br />

The Fund seeks to generate long term capital growth by investing<br />

mainly in equity securities of Canadian companies with no restrictions<br />

on market capitalization.<br />

The Fund seeks to provide income and long-term capital growth. The<br />

Fund’s assets are primarily allocated across two fundamental asset classes<br />

– equities and fixed income securities.<br />

Management Expense<br />

Ratio (MER)* (%)<br />

2.90<br />

2.70<br />

<strong>Manulife</strong> Global Opportunities Balanced<br />

<strong>GIF</strong> <strong>Select</strong><br />

The Fund seeks to provide long term capital growth and safety of principal. 2.70<br />

<strong>Manulife</strong> Emerging Markets Equity<br />

<strong>GIF</strong> <strong>Select</strong><br />

The Fund seeks long-term capital appreciation by investing primarily in<br />

emerging markets equities as defined by the sub-advisor.<br />

3.10<br />

* Management Expense Ratio (MER) refers to the cost of investing in a fund and includes expenses and fees charged by the underlying fund(s). It includes the management fee (paid to the fund<br />

company for the management of the fund), plus the fund’s operating expenses. You pay for the MER indirectly since it is paid from the fund before the unit value is calculated. The MERs provided<br />

above are estimates for 2011 and include HST.

<strong>Manulife</strong> <strong>GIF</strong> <strong>Select</strong> Fund Closures<br />

Effective Friday, November 18, 2011, we will close the following funds and assets will be switched to the continuing funds.<br />

Closing Fund Continuing Fund MER of Continuing Fund (%) *<br />

<strong>Manulife</strong> Global Monthly Income <strong>GIF</strong> <strong>Select</strong> <strong>Manulife</strong> Simplicity Income Portfolio <strong>GIF</strong> <strong>Select</strong> 2.33<br />

<strong>Manulife</strong> U.S. Mid-Cap <strong>GIF</strong> <strong>Select</strong> <strong>Manulife</strong> U.S. Opportunities <strong>GIF</strong> <strong>Select</strong> 3.04<br />

<strong>Manulife</strong> Japan Class <strong>GIF</strong> <strong>Select</strong> (MFC Global) <strong>Manulife</strong> World Investment <strong>GIF</strong> <strong>Select</strong> 2.98<br />

* The MERs shown here were those charged in 2010. They included GST only until June 30, 2010 and a blended HST rate was applied from July 1, 2010 onward. In 2011, MERs will include a<br />

blended HST for the full year.<br />

Closing funds will not accept new deposits or<br />

switches-in on or after Monday, October 31, 2011.<br />

Any deposits to the closing funds prior to this date will<br />

switch to the continuing fund. Regularly scheduled<br />

investments in place [pre-authorized chequing plans<br />

(PACs), monthly switches-in and scheduled withdrawal<br />

payments (SWPs)] for any of the closing funds listed,<br />

will automatically move to the continuing fund, unless<br />

you notify us otherwise.<br />

If you have investments allocated to these funds<br />

as of Friday, July 8, 2011, you could be entitled to<br />

fundamental change rights. This means that we will not<br />

apply a deferred sales charge should you decide<br />

to withdraw your investment from the contract<br />

between Monday, September 19, 2011 and no later<br />

than Monday, November 14, 2011.<br />

At any time you may switch to another eligible<br />

fund within your contract. Any switch, either to the<br />

continuing fund(s) listed or another eligible fund is a<br />

taxable disposition and may result in a capital gain or<br />

loss to you.<br />

Please speak to your Advisor to determine the<br />

most appropriate course of action, given your<br />

individual investment and tax circumstances.<br />

MANULIFE <strong>GIF</strong> SELECT FUND NAME CHANGES<br />

Some of our Segregated Funds will be changing names effective Monday, October 31, 2011.<br />

Segregated Fund Name<br />

<strong>Manulife</strong> American Focused <strong>GIF</strong> <strong>Select</strong><br />

<strong>Manulife</strong> Canadian Growth Equity <strong>GIF</strong> <strong>Select</strong><br />

<strong>Manulife</strong> Trimark <strong>Select</strong> Growth <strong>GIF</strong> <strong>Select</strong><br />

New Segregated Fund Name<br />

<strong>Manulife</strong> U.S. Opportunities <strong>GIF</strong> <strong>Select</strong><br />

<strong>Manulife</strong> Canadian Equity <strong>GIF</strong> <strong>Select</strong><br />

<strong>Manulife</strong> Trimark Global Fundamental Equity <strong>GIF</strong> <strong>Select</strong><br />

We had previously communicated that the <strong>Manulife</strong> U.S. Equity <strong>GIF</strong> <strong>Select</strong> name would be changed to the<br />

<strong>Manulife</strong> U.S. Opportunities <strong>GIF</strong> <strong>Select</strong>. Please note that this change did not occur and the fund will remain named<br />

the <strong>Manulife</strong> U.S. Equity <strong>GIF</strong> <strong>Select</strong>.<br />

IF YOU HAVE ANY QUESTIONS, PLEASE CONTACT<br />

YOUR ADVISOR OR MANULIFE INVESTMENTS AT MANULIFE.CA/INVESTMENTS<br />

Customer Service Centre: 1 888 790 4387 Quebec Residents: 1 800 355 6776<br />

The Manufacturers Life Insurance Company (<strong>Manulife</strong> <strong>Financial</strong>) is the issuer of the <strong>Manulife</strong> <strong>GIF</strong> <strong>Select</strong> insurance contract which offers the IncomePlus, EstatePlus and<br />

InvestmentPlus Series and the guarantor of any guarantee provisions therein. <strong>Manulife</strong> Investments is the brand name identifying the personal wealth management lines of<br />

business offered by <strong>Manulife</strong> <strong>Financial</strong> and its subsidiaries in Canada. <strong>Manulife</strong>, <strong>Manulife</strong> Investments, the <strong>Manulife</strong> Investments For Your Future logo, <strong>GIF</strong> <strong>Select</strong> IncomePlus,<br />

EstatePlus, InvestmentPlus, the Block Design, and Strong Reliable Trustworthy Forward-thinking are trademarks of The Manufacturers Life Insurance Company and are used<br />

by it, and by its affiliates under license.<br />

MCC895935 06/11 TMK918E<br />

strong reliable trustworthy forward-thinking