STATEMENT OF REVENUES, EXPENDITURES, CITY OF OKLAHOMA CITY, OKLAHOMA AND CHANGES IN FUND BALANCES GOVERNMENTAL FUNDS For the Year Ended June 30, <strong>2012</strong> (dollars are in thousands) General Other Total Debt Grants MAPS3 Obligation Governmental Governmental General Service Management Sales Tax Bonds Funds Funds REVENUES Sales taxes-------------------------------------------- $197,864 $ - $ - $100,157 $ - $91,848 $389,869 Use taxes---------------------------------------------- 38,388 - - - - 14,081 52,469 Hotel/Motel taxes------------------------------------ - - - - - 12,342 12,342 Property taxes---------------------------------------- - 75,106 - - - 35 75,141 Emergency telephone taxes------------------------ - - - - - 4,597 4,597 Other taxes------------------------------------------- 6,401 - - - - - 6,401 Franchise taxes--------------------------------------- 42,433 - - - - - 42,433 Licenses and permits-------------------------------- 12,741 - - - - 9,153 21,894 Oil and gas royalties-------------------------------- 161 - - - - 912 1,073 Fines and forfeitures-------------------------------- 22,912 - - - - 1,123 24,035 Investment income---------------------------------- 730 429 15 1,200 656 1,964 4,994 Charges for services--------------------------------- 17,614 - - - - 18,330 35,944 Rental income---------------------------------------- 9 - - 12 - 1,252 1,273 Payments from component units------------------ - - 3 - 311 - 314 Intergovernmental programs----------------------- 30,045 - 29,421 - - 3,578 63,044 Other-------------------------------------------------- 5,380 28 2 - 586 3,672 9,668 Total revenues------------------------------- 374,678 75,563 29,441 101,369 1,553 162,887 745,491 EXPENDITURES CURRENT General government--------------------------------- 44,954 735 - - - 878 46,567 Public safety: Police----------------------------------------------- 107,386 - - - - 35,866 143,252 Fire------------------------------------------------- 90,381 - - - - 35,557 125,938 Other----------------------------------------------- 8,716 - - - - 17,851 26,567 Public services--------------------------------------- 52,942 - 25,020 - 6,601 6,571 91,134 Culture and recreation------------------------------ 24,080 - - 23 - 39,669 63,772 Education--------------------------------------------- - - - - - 1,519 1,519 Economic development----------------------------- - - - - - 7,198 7,198 Capital outlay---------------------------------------- 422 - 5,781 8,915 64,997 43,121 123,236 DEBT SERVICE Principal---------------------------------------------- 112 44,410 2,050 - - 128 46,700 Interest------------------------------------------------ 289 22,473 - - - 89 22,851 Bond issuance costs--------------------------------- - 581 - - - - 581 Other debt service----------------------------------- 3 13,562 - - - - 13,565 Total expenditures--------------------------- 329,285 81,761 32,851 8,938 71,598 188,447 712,880 Excess (deficiency) <strong>of</strong> revenues over (under) expenditures------------------------ 45,393 (6,198) (3,410) 92,431 (70,045) (25,560) 32,611 OTHER FINANCING SOURCES (USES) Transfers from other funds------------------------- 6,112 - 3,592 - 50,038 38,141 97,883 Transfers to other funds---------------------------- (35,159) (51,703) (826) - - (11,323) (99,011) Capital financing------------------------------------ 405 - - - - - 405 Sale <strong>of</strong> assets----------------------------------------- 23 - - - - 435 458 Premium on bonds---------------------------------- - 19,407 - - - - 19,407 Long-term debt issued------------------------------ - 130,110 - - - - 130,110 Payment to bond escrow agent-------------------- - (91,315) - - - - (91,315) Net other financing sources (uses)------- (28,619) 6,499 2,766 - 50,038 27,253 57,937 1 1 1 1 - - 1 1 SPECIAL ITEM Special item------------------------------------------ - - - - - 7,497 7,497 Net change in fund balances--------------------- 16,774 301 (644) 92,431 (20,007) 9,190 98,045 FUND BALANCES Fund balances, beginning-------------------------- 99,313 56,433 5,058 112,855 148,604 191,522 613,785 Fund balances, ending---------------------------- $116,087 $56,734 $4,414 $205,286 $128,597 $200,712 $711,830 0ck fig ck fig ck fig ck fig 0ck fig See accompanying notes to financial statements. 32

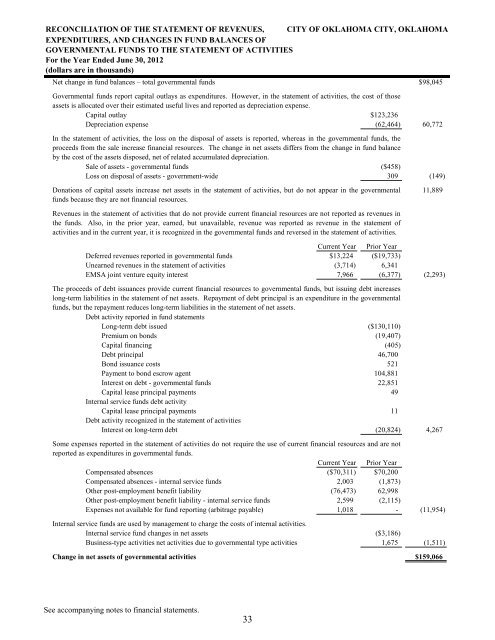

RECONCILIATION OF THE STATEMENT OF REVENUES, CITY OF OKLAHOMA CITY, OKLAHOMA EXPENDITURES, AND CHANGES IN FUND BALANCES OF GOVERNMENTAL FUNDS TO THE STATEMENT OF ACTIVITIES For the Year Ended June 30, <strong>2012</strong> (dollars are in thousands) Net change in fund balances – total governmental funds $98,045 Governmental funds report capital outlays as expenditures. However, in the statement <strong>of</strong> activities, the cost <strong>of</strong> those assets is allocated over their estimated useful lives and reported as depreciation expense. $0 Capital outlay $123,236 $0 Depreciation expense (62,464) 60,772 In the statement <strong>of</strong> activities, the loss on the disposal <strong>of</strong> assets is reported, whereas in the governmental funds, the proceeds from the sale increase financial resources. The change in net assets differs from the change in fund balance by the cost <strong>of</strong> the assets disposed, net <strong>of</strong> related accumulated depreciation. Sale <strong>of</strong> assets - governmental funds Loss on disposal <strong>of</strong> assets - government-wide Donations <strong>of</strong> capital assets increase net assets in the statement <strong>of</strong> activities, but do not appear in the governmental funds because they are not financial resources. Revenues in the statement <strong>of</strong> activities that do not provide current financial resources are not reported as revenues in the funds. Also, in the prior year, earned, but unavailable, revenue was reported as revenue in the statement <strong>of</strong> activities and in the current year, it is recognized in the governmental funds and reversed in the statement <strong>of</strong> activities. $0 - ($458) 309 (149) 11,889 Current Year Prior Year Deferred revenues reported in governmental funds $13,224 ($19,733) Unearned revenues in the statement <strong>of</strong> activities (3,714) 6,341 EMSA joint venture equity interest 7,966 (6,377) (2,293) The proceeds <strong>of</strong> debt issuances provide current financial resources to governmental funds, but issuing debt increases long-term liabilities in the statement <strong>of</strong> net assets. Repayment <strong>of</strong> debt principal is an expenditure in the governmental funds, but the repayment reduces long-term liabilities in the statement <strong>of</strong> net assets. Debt activity reported in fund statements Long-term debt issued Premium on bonds Capital financing Debt principal Bond issuance costs Payment to bond escrow agent Interest on debt - governmental funds ($130,110) (19,407) (405) 46,700 521 104,881 22,851 Capital lease principal payments $0 $0 49 Internal service funds debt activity Capital lease principal payments $0 $0 11 Debt activity recognized in the statement <strong>of</strong> activities Interest on long-term debt (20,824) 4,267 Some expenses reported in the statement <strong>of</strong> activities do not require the use <strong>of</strong> current financial resources and are not reported as expenditures in governmental funds. Current Year Prior Year Compensated absences ($70,311) $70,200 Compensated absences - internal service funds 2,003 (1,873) Other post-employment benefit liability (76,473) 62,998 Other post-employment benefit liability - internal service funds 2,599 (2,115) Expenses not available for fund reporting (arbitrage payable) 1,018 - (11,954) Internal service funds are used by management to charge the costs <strong>of</strong> internal activities. Internal service fund changes in net assets Business-type activities net activities due to governmental type activities ($3,186) 1,675 (1,511) Change in net assets <strong>of</strong> governmental activities CK TO GOV WIDE $159,066 $0 See accompanying notes to financial statements. 33

- Page 1: Comprehensive Annual Financial Repo

- Page 5 and 6: TABLE OF CONTENTS June 30, 2012 I.

- Page 7 and 8: TABLE OF CONTENTS June 30, 2012 Oth

- Page 9: Introductory

- Page 12 and 13: TRANSMITTAL LETTER June 30, 2012 CI

- Page 15: SELECTED CITY OFFICIALS June 30, 20

- Page 19 and 20: Independent Accountants’ Report o

- Page 21 and 22: The Honorable Mayor and City Counci

- Page 23 and 24: MANAGEMENT'S DISCUSSION AND ANALYSI

- Page 25 and 26: MANAGEMENT'S DISCUSSION AND ANALYSI

- Page 27 and 28: MANAGEMENT'S DISCUSSION AND ANALYSI

- Page 29 and 30: MANAGEMENT'S DISCUSSION AND ANALYSI

- Page 31 and 32: MANAGEMENT'S DISCUSSION AND ANALYSI

- Page 33 and 34: MANAGEMENT'S DISCUSSION AND ANALYSI

- Page 35: Basic Financial Statements

- Page 38 and 39: STATEMENT OF NET ASSETS June 30, 20

- Page 40 and 41: BALANCE SHEET CITY OF OKLAHOMA CITY

- Page 44 and 45: STATEMENT OF REVENUES, EXPENDITURES

- Page 46 and 47: STATEMENT OF REVENUES, EXPENDITURES

- Page 48 and 49: STATEMENT OF FUND NET ASSETS PROPRI

- Page 50 and 51: STATEMENT OF CASH FLOWS CITY OF OKL

- Page 52 and 53: STATEMENT OF FIDUCIARY NET ASSETS J

- Page 54 and 55: COMBINING STATEMENT OF NET ASSETS C

- Page 56 and 57: This Page Intentionally Left Blank

- Page 59 and 60: TABLE OF CONTENTS INCOMPLETE. UPDAT

- Page 61 and 62: NOTES TO FINANCIAL STATEMENTS June

- Page 63 and 64: NOTES TO FINANCIAL STATEMENTS June

- Page 65 and 66: NOTES TO FINANCIAL STATEMENTS June

- Page 67 and 68: NOTES TO FINANCIAL STATEMENTS June

- Page 69 and 70: NOTES TO FINANCIAL STATEMENTS June

- Page 71 and 72: NOTES TO FINANCIAL STATEMENTS June

- Page 73 and 74: NOTES TO FINANCIAL STATEMENTS June

- Page 75 and 76: NOTES TO FINANCIAL STATEMENTS June

- Page 77 and 78: NOTES TO FINANCIAL STATEMENTS June

- Page 79 and 80: NOTES TO FINANCIAL STATEMENTS June

- Page 81 and 82: NOTES TO FINANCIAL STATEMENTS June

- Page 83 and 84: NOTES TO FINANCIAL STATEMENTS June

- Page 85 and 86: NOTES TO FINANCIAL STATEMENTS June

- Page 87 and 88: NOTES TO FINANCIAL STATEMENTS June

- Page 89 and 90: NOTES TO FINANCIAL STATEMENTS June

- Page 91 and 92: NOTES TO FINANCIAL STATEMENTS June

- Page 93 and 94:

NOTES TO FINANCIAL STATEMENTS June

- Page 95 and 96:

NOTES TO FINANCIAL STATEMENTS June

- Page 97 and 98:

NOTES TO FINANCIAL STATEMENTS June

- Page 99 and 100:

NOTES TO FINANCIAL STATEMENTS June

- Page 101 and 102:

NOTES TO FINANCIAL STATEMENTS June

- Page 103 and 104:

NOTES TO FINANCIAL STATEMENTS June

- Page 105 and 106:

NOTES TO FINANCIAL STATEMENTS June

- Page 107 and 108:

NOTES TO FINANCIAL STATEMENTS June

- Page 109 and 110:

NOTES TO FINANCIAL STATEMENTS June

- Page 111 and 112:

NOTES TO FINANCIAL STATEMENTS June

- Page 113 and 114:

NOTES TO FINANCIAL STATEMENTS June

- Page 115 and 116:

NOTES TO FINANCIAL STATEMENTS June

- Page 117 and 118:

NOTES TO FINANCIAL STATEMENTS June

- Page 119 and 120:

NOTES TO FINANCIAL STATEMENTS June

- Page 121 and 122:

NOTES TO FINANCIAL STATEMENTS June

- Page 123 and 124:

NOTES TO FINANCIAL STATEMENTS June

- Page 125 and 126:

NOTES TO FINANCIAL STATEMENTS June

- Page 127 and 128:

NOTES TO FINANCIAL STATEMENTS June

- Page 129 and 130:

NOTES TO FINANCIAL STATEMENTS June

- Page 131 and 132:

NOTES TO FINANCIAL STATEMENTS June

- Page 133 and 134:

NOTES TO FINANCIAL STATEMENTS June

- Page 135 and 136:

NOTES TO FINANCIAL STATEMENTS June

- Page 137 and 138:

NOTES TO FINANCIAL STATEMENTS June

- Page 139 and 140:

NOTES TO FINANCIAL STATEMENTS June

- Page 141:

Required Supplementary Information

- Page 144 and 145:

REQUIRED SUPPLEMENTARY INFORMATION

- Page 147:

Non-Major Governmental Funds

- Page 150 and 151:

Special Revenue Funds (continued) *

- Page 152 and 153:

COMBINING BALANCE SHEET NON-MAJOR G

- Page 154 and 155:

COMBINING STATEMENT OF REVENUES, EX

- Page 156 and 157:

SCHEDULE OF REVENUES, EXPENDITURES,

- Page 158 and 159:

SCHEDULE OF REVENUES, EXPENDITURES,

- Page 160 and 161:

SCHEDULE OF REVENUES, EXPENDITURES,

- Page 162 and 163:

SCHEDULE OF REVENUES, EXPENDITURES

- Page 164 and 165:

SCHEDULE OF REVENUES, EXPENDITURES

- Page 166 and 167:

SCHEDULE OF REVENUES, EXPENDITURES

- Page 168 and 169:

This Page Intentionally Left Blank

- Page 171 and 172:

Non-Major Enterprise Funds Enterpri

- Page 173 and 174:

COMBINING STATEMENT OF REVENUES, EX

- Page 175:

Internal Service Funds

- Page 178 and 179:

COMBINING STATEMENT OF FUND NET ASS

- Page 180 and 181:

COMBINING STATEMENT OF CASH FLOWS C

- Page 183 and 184:

Fiduciary Funds Fiduciary funds are

- Page 185 and 186:

COMBINING STATEMENT OF CHANGES CITY

- Page 187:

Component Unit

- Page 190 and 191:

STATEMENT OF CASH FLOWS CITY OF OKL

- Page 193 and 194:

CAPITAL ASSETS CITY OF OKLAHOMA CIT

- Page 195 and 196:

LONG-TERM DEBT SUPPORTING GENERAL G

- Page 197 and 198:

CITY OF OKLAHOMA CITY, OKLAHOMA Due

- Page 199 and 200:

CITY OF OKLAHOMA CITY, OKLAHOMA Tra

- Page 201:

Statistical

- Page 204 and 205:

This Page Intentionally Left Blank

- Page 206 and 207:

PRIMARY GOVERNMENT CITY OF OKLAHOMA

- Page 208 and 209:

This Page Intentionally Left Blank

- Page 210 and 211:

GOVERNMENTAL FUNDS CITY OF OKLAHOMA

- Page 212 and 213:

TAX REVENUES BY SOURCE (1) June 30,

- Page 214 and 215:

TAXABLE ASSESSED VALUE AND ESTIMATE

- Page 216 and 217:

PROPERTY TAX RATES OF DIRECT AND CI

- Page 218 and 219:

PRINCIPAL PROPERTY TAXPAYERS CITY O

- Page 220 and 221:

RATIOS OF GENERAL BONDED DEBT TO TA

- Page 222 and 223:

PLEDGED-REVENUE BOND COVERAGE CITY

- Page 224 and 225:

PLEDGED-REVENUE BOND COVERAGE CITY

- Page 226 and 227:

PLEDGED-REVENUE BOND COVERAGE CITY

- Page 228 and 229:

PLEDGED-REVENUE BOND COVERAGE CITY

- Page 230 and 231:

DEMOGRAPHIC STATISTICS CITY OF OKLA

- Page 232 and 233:

PRIMARY GOVERNMENT CITY OF OKLAHOMA

- Page 234 and 235:

OPERATING INDICATORS BY FUNCTION (1

- Page 236:

This Page Intentionally Left Blank