The Carbon Footprint of Capital Investments - adelphi

The Carbon Footprint of Capital Investments - adelphi

The Carbon Footprint of Capital Investments - adelphi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

002<br />

<strong>adelphi</strong> • <strong>The</strong> <strong>Carbon</strong> <strong>Footprint</strong> <strong>of</strong> <strong>Capital</strong> <strong>Investments</strong> <strong>adelphi</strong> • <strong>The</strong> <strong>Carbon</strong> <strong>Footprint</strong> <strong>of</strong> <strong>Capital</strong> <strong>Investments</strong><br />

003<br />

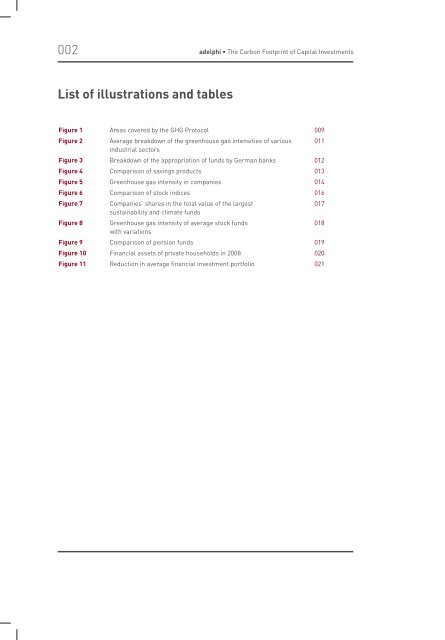

List <strong>of</strong> illustrations and tables<br />

1 Introduction<br />

Figure 1 Areas covered by the GHG Protocol 009<br />

Figure 2 Average breakdown <strong>of</strong> the greenhouse gas intensities <strong>of</strong> various 011<br />

industrial sectors<br />

Figure 3 Breakdown <strong>of</strong> the appropriation <strong>of</strong> funds by German banks 012<br />

Figure 4 Comparison <strong>of</strong> savings products 013<br />

Figure 5 Greenhouse gas intensity in companies 014<br />

Figure 6 Comparison <strong>of</strong> stock indices 016<br />

Figure 7 Companies' shares in the total value <strong>of</strong> the largest<br />

017<br />

sustainability and climate funds<br />

Figure 8 Greenhouse gas intensity <strong>of</strong> average stock funds<br />

018<br />

with variations<br />

Figure 9 Comparison <strong>of</strong> pension funds 019<br />

Figure 10 Financial assets <strong>of</strong> private households in 2008 020<br />

Figure 11 Reduction in average financial investment portfolio 021<br />

<strong>The</strong> capital <strong>of</strong> private investors worldwide finances<br />

industrial and commercial activities which<br />

contribute substantially to global greenhouse gas<br />

emissions. <strong>The</strong> results <strong>of</strong> this study show how, for<br />

example, the five largest stock funds in Germany<br />

alone – representing managed assets <strong>of</strong> 20.7<br />

billion euros – contribute to the financing <strong>of</strong> over<br />

23 million tonnes <strong>of</strong> greenhouse gas emissions<br />

a year. Extrapolated to the totality <strong>of</strong> all German<br />

stock funds 1 , that means some 200 million tonnes<br />

<strong>of</strong> greenhouse gases to which private investors<br />

are substantially contributing, either directly or<br />

indirectly through institutional investors. That<br />

corresponds to 20 % <strong>of</strong> all Germany's greenhouse<br />

gas emissions (UBA 2010).<br />

Private households in Germany held financial<br />

assets totalling 4.64 trillion euros in 2009<br />

(Deutsche Bundesbank 2010). <strong>The</strong>se enormous<br />

investment sums can perform a key controlling<br />

function in financing climate protection and<br />

in the transition to a low-carbon economy. By<br />

their choice <strong>of</strong> where to commit their money,<br />

investors determine the capital investments <strong>of</strong><br />

tomorrow. <strong>The</strong> study shows how private investors,<br />

by choosing climate-friendly and sustainable<br />

financial investment products, can reduce their<br />

personal carbon footprint and thus fulfill their<br />

role as capital providers in a climate-conscious<br />

manner.<br />

Climate-friendly and sustainable capital investment<br />

products have major potential for further<br />

growth. Despite growing consumer awareness and<br />

rising demand for climate-friendly products, the<br />

market potential for financial investment products<br />

giving due consideration to climate protection<br />

issues remains largely untapped. Demand for<br />

these products is restricted by inadequate<br />

consumer education, a lack <strong>of</strong> market transparency<br />

and a shortage <strong>of</strong> awareness among financial<br />

advisors as to available forms <strong>of</strong> investment.<br />

On the consumer goods market, the "product<br />

carbon footprint" provides a guide for climateconscious<br />

consumers to assess the impact <strong>of</strong><br />

consumed products on the climate. However, no<br />

method has yet been established to indicate the<br />

product carbon footprint <strong>of</strong> financial investments.<br />

Investors in Germany are therefore unable to judge<br />

the emissions generated by the capital they invest.<br />

In view <strong>of</strong> that fact, this scoping study by <strong>adelphi</strong>,<br />

in cooperation with INrate, represents an initial<br />

attempt to determine the average carbon<br />

footprint <strong>of</strong> the German investment portfolio.<br />

With the greenhouse gas emissions <strong>of</strong> selected<br />

capital investment products calculated by INrate,<br />

<strong>adelphi</strong> reveals the emissions financed by private<br />

investors' capital investments and indicates<br />

the savings potential in German investment<br />

portfolios. <strong>The</strong> study also demonstrates to private<br />

investors and financial services providers how<br />

the carbon footprint is applied with regard to<br />

capital investments. This enables them to utilise<br />

the opportunities <strong>of</strong>fered by climate change, to<br />

minimise its risks and at the same time to make a<br />

key contribution to climate protection efforts.<br />

1<br />

German stock funds manage assets with a total value <strong>of</strong> 192,205 billion euros (BVI 2010).