The Carbon Footprint of Capital Investments - adelphi

The Carbon Footprint of Capital Investments - adelphi

The Carbon Footprint of Capital Investments - adelphi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

018 <strong>adelphi</strong> • <strong>The</strong> <strong>Carbon</strong> <strong>Footprint</strong> <strong>of</strong> <strong>Capital</strong> <strong>Investments</strong> <strong>adelphi</strong> • <strong>The</strong> <strong>Carbon</strong> <strong>Footprint</strong> <strong>of</strong> <strong>Capital</strong> <strong>Investments</strong><br />

019<br />

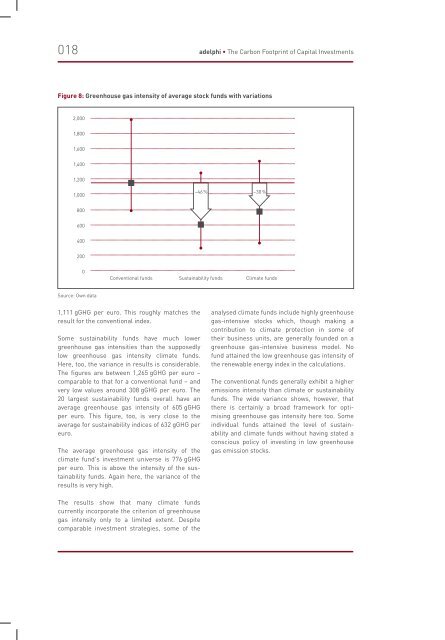

Figure 8: Greenhouse gas intensity <strong>of</strong> average stock funds with variations<br />

Figure 9: Comparison <strong>of</strong> pension funds<br />

2,000<br />

400<br />

gGHG per euro<br />

1,800<br />

350<br />

300<br />

369<br />

–43 %<br />

1,600<br />

250<br />

1,400<br />

200<br />

210<br />

1,200<br />

1,000<br />

–46 % –30 %<br />

150<br />

100<br />

50<br />

800<br />

0<br />

Pension funds<br />

Sustainability pension funds<br />

600<br />

Source: Own data<br />

400<br />

200<br />

0<br />

Source: Own data<br />

Conventional funds Sustainability funds Climate funds<br />

1,111 gGHG per euro. This roughly matches the<br />

result for the conventional index.<br />

Some sustainability funds have much lower<br />

greenhouse gas intensities than the supposedly<br />

low greenhouse gas intensity climate funds.<br />

Here, too, the variance in results is considerable.<br />

<strong>The</strong> figures are between 1,265 gGHG per euro –<br />

comparable to that for a conventional fund – and<br />

very low values around 308 gGHG per euro. <strong>The</strong><br />

20 largest sustainability funds overall have an<br />

average greenhouse gas intensity <strong>of</strong> 605 gGHG<br />

per euro. This figure, too, is very close to the<br />

average for sustainability indices <strong>of</strong> 632 gGHG per<br />

euro.<br />

<strong>The</strong> average greenhouse gas intensity <strong>of</strong> the<br />

climate fund's investment universe is 776 gGHG<br />

per euro. This is above the intensity <strong>of</strong> the sustainability<br />

funds. Again here, the variance <strong>of</strong> the<br />

results is very high.<br />

<strong>The</strong> results show that many climate funds<br />

currently incorporate the criterion <strong>of</strong> greenhouse<br />

gas intensity only to a limited extent. Despite<br />

comparable investment strategies, some <strong>of</strong> the<br />

analysed climate funds include highly greenhouse<br />

gas-intensive stocks which, though making a<br />

contribution to climate protection in some <strong>of</strong><br />

their business units, are generally founded on a<br />

greenhouse gas-intensive business model. No<br />

fund attained the low greenhouse gas intensity <strong>of</strong><br />

the renewable energy index in the calculations.<br />

<strong>The</strong> conventional funds generally exhibit a higher<br />

emissions intensity than climate or sustainability<br />

funds. <strong>The</strong> wide variance shows, however, that<br />

there is certainly a broad framework for optimising<br />

greenhouse gas intensity here too. Some<br />

individual funds attained the level <strong>of</strong> sustainability<br />

and climate funds without having stated a<br />

conscious policy <strong>of</strong> investing in low greenhouse<br />

gas emission stocks.<br />

5.3<br />

Bonds and pension funds<br />

<strong>The</strong> calculation <strong>of</strong> pension funds in respect <strong>of</strong><br />

enterprises and countries follows the same<br />

logic as already applied to savings deposits.<br />

Private investors acquire shares in the equity <strong>of</strong><br />

business enterprises and other institutions by<br />

purchasing bonds and pension funds. With regard<br />

to bonds and pension funds, the study only takes<br />

into account sustainability products. No capital<br />

investment product investing in fixed-interest<br />

securities oriented explicitly to climate protection<br />

could be found.<br />

To illustrate calculation <strong>of</strong> the average greenhouse<br />

gas intensities <strong>of</strong> investment products<br />

in fixed-interest securities, one conventional<br />

and one sustainable pension fund respectively<br />

were analysed, both funds being among the<br />

leading funds on the German market and as<br />

such permitting maximum comparability. Since<br />

companies frequently issue bonds through banks,<br />

a bond cannot always be allocated to a single<br />

company in the pension funds' annual reports.<br />

Consequently, funds investing most <strong>of</strong> their assets<br />

in corporate bonds could not be analysed. But<br />

government bonds play a much greater role than<br />

corporate bonds in the eurozone anyway. In view <strong>of</strong><br />

that, two funds primarily investing in government<br />

bonds were compared here. As the emissions<br />

intensity <strong>of</strong> the pension funds is to a great extent<br />

dependent on the scale <strong>of</strong> investment in corporate<br />

or government bonds, this analysis compared two<br />

funds, with a very similar mix <strong>of</strong> the two categories,<br />

which invest primarily in government bonds<br />

and which dominate the market in continental<br />

Europe.<br />

<strong>The</strong> results for the analysed pension funds show<br />

a widely differing greenhouse gas intensity. <strong>The</strong><br />

sustainability pension fund exhibits a much lower<br />

greenhouse gas intensity – 210 gGHG per euro –<br />

than its conventional counterpart, at 369 gGHG per<br />

euro. This evidently results from the interposed<br />

sustainability analysis <strong>of</strong> the issuing governments.<br />

<strong>The</strong> sustainability fund invests in countries with<br />

much lower greenhouse gas intensities than the<br />

conventional pension fund.