The Carbon Footprint of Capital Investments - adelphi

The Carbon Footprint of Capital Investments - adelphi

The Carbon Footprint of Capital Investments - adelphi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

010 <strong>adelphi</strong> • <strong>The</strong> <strong>Carbon</strong> <strong>Footprint</strong> <strong>of</strong> <strong>Capital</strong> <strong>Investments</strong> <strong>adelphi</strong> • <strong>The</strong> <strong>Carbon</strong> <strong>Footprint</strong> <strong>of</strong> <strong>Capital</strong> <strong>Investments</strong><br />

011<br />

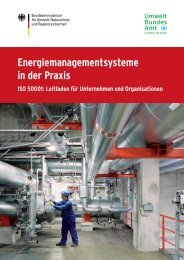

Figure 2: Average breakdown <strong>of</strong> the greenhouse gas intensities <strong>of</strong> various industrial sectors<br />

For some product categories, such as pension<br />

schemes, corporate bonds and closed funds, it is<br />

not possible to calculate the emissions intensity<br />

as no reliable data could be collected in relation<br />

to them.<br />

Calculation <strong>of</strong> the emissions financed by private<br />

investors is based on the assumption that<br />

investors finance businesses and projects through<br />

the capital they provide by way <strong>of</strong> the financial<br />

market. <strong>The</strong> greenhouse gas intensity <strong>of</strong> capital<br />

investment products is a measure <strong>of</strong> the financed<br />

emissions <strong>of</strong> a capital investment product in the<br />

course <strong>of</strong> a year (in CO 2 equivalents) relative to<br />

the investment volume. <strong>The</strong> greenhouse gas<br />

intensity, calculated in grams <strong>of</strong> greenhouse gas<br />

emissions (gGHG) per euro, can thus be applied as<br />

a comparative between various capital investment<br />

products. This takes into account the fact that<br />

investors only provide the portion <strong>of</strong> the finance<br />

for which their capital serves as a source <strong>of</strong><br />

financing to the capital recipients. Consequently,<br />

depending on the form <strong>of</strong> financial investment,<br />

either the share <strong>of</strong> the capital in financing <strong>of</strong> the<br />

equity through company shareholdings or <strong>of</strong> the<br />

borrowings by way <strong>of</strong> bank loans or bonds is taken<br />

into account. For the various financial investment<br />

products there also exist different means by which<br />

private investors finance emissions with their<br />

capital. This financing logic is stringently pursued<br />

across all calculation methods, which is why the<br />

term "financed emissions" is repeatedly used. 10<br />

To calculate the product carbon footprint <strong>of</strong> stock<br />

funds, a method was devised by Trucost which<br />

is already in use by a number <strong>of</strong> investment<br />

companies and banks (Trucost 2009a/2009b).<br />

Utopies and Centre Info 11 – in cooperation with<br />

Groupe Caisse D’Epargne, a French savings bank –<br />

devised a method applicable to other capital<br />

investment products (Utopies/Groupe Caisse<br />

D‘Epargne 2008) and together produced a report<br />

on their experience in calculating emissions<br />

intensity (Centre Info/Utopies /Groupe Caisse<br />

D’Epargne 2008). <strong>The</strong>ir method permits Scope<br />

3 emissions to be integrated into the calculation<br />

alongside Scope 1 and 2, thereby mapping the<br />

complete value creation chain <strong>of</strong> the enterprises<br />

and projects financed by the various financial<br />

products.<br />

<strong>The</strong> greenhouse gas emissions data for this<br />

study is taken from the INrate envIMPACT®<br />

database, which comprises all three emissions<br />

categories <strong>of</strong> the GHG Protocol 12 . This for the<br />

first time applies a differentiated methodology<br />

which also incorporates Scope 3 emissions <strong>of</strong><br />

financed enterprises and projects to calculate the<br />

greenhouse gas intensity <strong>of</strong> capital investments.<br />

Only 33 % <strong>of</strong> the German companies participating<br />

in the <strong>Carbon</strong> Disclosure Project (CDP) currently<br />

report their Scope 3 emissions (CDP 2009, p. 37).<br />

Consequently, the INrate envIMPACT® database<br />

utilises material input/output analyses <strong>of</strong> various<br />

industrial sectors along the value creation chain. 13<br />

This means envIMPACT® differentiates between<br />

active and passive products, indicating the extent<br />

to which a product does or does not have a<br />

significant impact on the environment when in use.<br />

For many products, the influence <strong>of</strong> their usage<br />

phase is much greater than that <strong>of</strong> their production<br />

and supply chain (Utopies/Group Caisse D’Epargne<br />

2008). Figure 2 shows that in industrial sectors<br />

such as oil and gas, and in car manufacturing,<br />

Scope 3 emissions represent a particularly high<br />

percentage <strong>of</strong> the emitted greenhouse gases.<br />

If Scope 3 emissions were not included in their<br />

analysis, those sectors would be classed as<br />

very low-intensity greenhouse gas emitters.<br />

At present, envIMPACT® holds emissions data<br />

from 1,800 companies and has calculated averages<br />

for 500 industrial sectors. It should nevertheless<br />

be considered that the recording and reporting <strong>of</strong><br />

corporate greenhouse gas emissions, in particular<br />

with regard to Scope 3 data, is still in need <strong>of</strong><br />

some improvement. <strong>The</strong> same is true <strong>of</strong> national<br />

greenhouse gas inventories. <strong>The</strong> inaccuracies<br />

in calculating the greenhouse gas intensity <strong>of</strong><br />

capital investment products are also heightened<br />

by the aggregation <strong>of</strong> emissions data for individual<br />

sectors. <strong>The</strong> study therefore makes no claim to<br />

3,500<br />

3,000<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

0<br />

2,849<br />

Oil and gas<br />

331<br />

Electricity companies<br />

Source: envIMPACT ® , INrate<br />

566<br />

1,965<br />

291<br />

be able to deliver entirely precise figures. <strong>The</strong><br />

basic message provided by the calculations is not<br />

decisively influenced by the inaccuracies however.<br />

Most especially, the comparison <strong>of</strong> investment<br />

products within the individual product categories<br />

set out in the following remains valid.<br />

Double counting <strong>of</strong> emissions within individual<br />

products is avoided. This happens where, for<br />

example, car manufacturers and oil producers<br />

are listed in the same fund. <strong>The</strong> emissions <strong>of</strong><br />

the fuels produced by the oil companies would<br />

then be counted double when calculating the<br />

emissions arising in use <strong>of</strong> the vehicles. To avoid<br />

this, the duplicate emissions within an investment<br />

product are cancelled out. As a result, the Scope 3<br />

emissions financed by financial investments can be<br />

collated without producing an unrealistically high<br />

figure due to multiple counting. However, based<br />

on the current methodology applied when creating<br />

average capital investment portfolios, double<br />

counts between different product categories<br />

cannot be entirely avoided. Consequently, with<br />

regard to the overall portfolio it is a fact that<br />

the absolute carbon footprint figures for capital<br />

investment portfolios include double counts which<br />

cannot be precisely stated.<br />

Airlines<br />

Car manufacturers<br />

Building materials<br />

manufacturers<br />

634 400 50<br />

Semiconductor<br />

manufacturers<br />

Food producers<br />

IT service providers<br />

Scope 1<br />

Scope 2<br />

Scope 3<br />

In calculating the carbon footprint, the study<br />

records the emissions financed by the investor<br />

or lender pro rata along the entire value creation<br />

chain. For the sake <strong>of</strong> transparency, an industrywide<br />

consensus should be found with regard to<br />

system limits in determining the carbon footprint<br />

<strong>of</strong> capital investment products.<br />

10 In<br />

addition to the financing logic, other approaches may also be pursued. It may, for example, be argued that investors in stocks bear a greater<br />

responsibility than investors in bank deposits because the former actual become co-owners. For the sake <strong>of</strong> comparability <strong>of</strong> the product<br />

forms, however, strict application <strong>of</strong> the financing logic is the most useful approach.<br />

11 Centre Info recently merged with INrate.<br />

12 <strong>The</strong><br />

GHG Protocol emerged from an initiative <strong>of</strong> the World Business Council for Sustainable Development (WBCSD) and the World Resources<br />

Institute (WRI). It is regularly updated in cooperation with companies in various industrial and business sectors.<br />

13 envIMPACT ® utilises input/output analysis data from the Green Design Institute at Carnegie Mellon University in Pittsburgh (comprising<br />

426 business sectors and recording the emissions data <strong>of</strong> 50 greenhouse gases) as well as the life cycle inventory (LCI) <strong>of</strong> industrial systems<br />

from the ecoinvent database and the life cycle assessment (LCA) data <strong>of</strong> specific products (e.g. <strong>The</strong> International Journal <strong>of</strong> Life Cycle Assessment).