The Carbon Footprint of Capital Investments - adelphi

The Carbon Footprint of Capital Investments - adelphi

The Carbon Footprint of Capital Investments - adelphi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

014 <strong>adelphi</strong> • <strong>The</strong> <strong>Carbon</strong> <strong>Footprint</strong> <strong>of</strong> <strong>Capital</strong> <strong>Investments</strong> <strong>adelphi</strong> • <strong>The</strong> <strong>Carbon</strong> <strong>Footprint</strong> <strong>of</strong> <strong>Capital</strong> <strong>Investments</strong><br />

015<br />

<strong>The</strong> comparison <strong>of</strong> the two savings products<br />

demonstrates how much integrating renewable<br />

energy into loan allocations can reduce the<br />

greenhouse gas emissions financed by the savings<br />

products concerned. Compared to the conventional<br />

savings product, the renewable energy savings<br />

product <strong>of</strong>fers the potential to reduce financed<br />

greenhouse gas emissions by as much as 67 %.<br />

5.2<br />

Company shareholdings<br />

Greenhouse gas emissions are financed differently<br />

in the case <strong>of</strong> financial investments<br />

through investment products such as stocks,<br />

stock certificates or stock funds than in the<br />

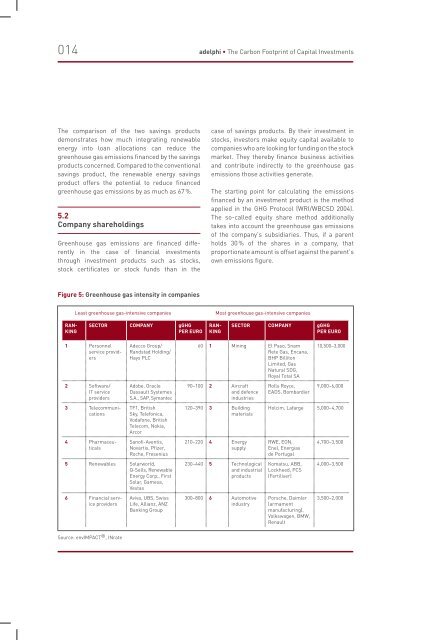

Figure 5: Greenhouse gas intensity in companies<br />

Least greenhouse gas-intensive companies<br />

Sector Company gGHG<br />

per Euro<br />

1 Personnel<br />

service providers<br />

2 S<strong>of</strong>tware/<br />

IT service<br />

providers<br />

3 Telecommunications<br />

4 Pharmaceuticals<br />

Adecco Group/<br />

Randstad Holding/<br />

Hays PLC<br />

Adobe, Oracle<br />

Dassault Systemes<br />

S. A., SAP, Symantec<br />

TF1, British<br />

Sky, Telefonica,<br />

Vodafone, British<br />

Telecom, Nokia,<br />

Arcor<br />

San<strong>of</strong>i-Aventis,<br />

Novartis, Pfizer,<br />

Roche, Fresenius<br />

5 Renewables Solarworld,<br />

Q-Sells, Renewable<br />

Energy Corp., First<br />

Solar, Gamesa,<br />

Vestas<br />

6 Financial service<br />

providers<br />

Source: envIMPACT ® , INrate<br />

Aviva, UBS, Swiss<br />

Life, Allianz, ANZ<br />

Banking Group<br />

case <strong>of</strong> savings products. By their investment in<br />

stocks, investors make equity capital available to<br />

companies who are looking for funding on the stock<br />

market. <strong>The</strong>y thereby finance business activities<br />

and contribute indirectly to the greenhouse gas<br />

emissions those activities generate.<br />

<strong>The</strong> starting point for calculating the emissions<br />

financed by an investment product is the method<br />

applied in the GHG Protocol (WRI/WBCSD 2004).<br />

<strong>The</strong> so-called equity share method additionally<br />

takes into account the greenhouse gas emissions<br />

<strong>of</strong> the company's subsidiaries. Thus, if a parent<br />

holds 30 % <strong>of</strong> the shares in a company, that<br />

proportionate amount is <strong>of</strong>fset against the parent's<br />

own emissions figure.<br />

Most greenhouse gas-intensive companies<br />

<strong>The</strong> viewed renewable energy index tracks 30<br />

<strong>of</strong> the world's leading stock market quoted<br />

companies operating in the field. Those sectors<br />

are not the lowest-emission ones in terms <strong>of</strong> their<br />

greenhouse gas balance, but by concentrating on<br />

this sector the index does remain well below the<br />

emissions figures <strong>of</strong> the comparative indices. <strong>The</strong><br />

greenhouse gas intensity in this case is 165 gGHG<br />

per euro. <strong>The</strong> comparison <strong>of</strong> stock indices shows<br />

a clear correlation between the greenhouse gas<br />

intensity <strong>of</strong> the products and the incorporation <strong>of</strong><br />

climate protection aspects in their composition.<br />

While the greenhouse gas intensity <strong>of</strong> sustainabi-<br />

Ranking<br />

Ranking<br />

Sector Company gGHG<br />

per Euro<br />

60 1 Mining El Paso, Snam<br />

Rete Gas, Encana,<br />

BHP Billiton<br />

Limited, Gas<br />

Natural SDG,<br />

Royal Total SA<br />

90–100 2 Aircraft<br />

and defence<br />

industries<br />

120–390 3 Building<br />

materials<br />

210–220 4 Energy<br />

supply<br />

230–440 5 Technological<br />

and industrial<br />

products<br />

300–800 6 Automotive<br />

industry<br />

Rolls Royce,<br />

EADS, Bombardier<br />

10,500–3,000<br />

9,000–6,000<br />

Holcim, Lafarge 5,000– 4,700<br />

RWE, EON,<br />

Enel, Energias<br />

de Portugal<br />

Komatsu, ABB,<br />

Lockheed, PCS<br />

(Fertiliser)<br />

Porsche, Daimler<br />

(armament<br />

manufacturing),<br />

Volkswagen, BMW,<br />

Renault<br />

4,700–3,500<br />

4,000–3,500<br />

3,500–2,000<br />

INrate expanded this method to incorporate a<br />

financing component. Accordingly, the greenhouse<br />

gases financed by capital investments are not<br />

calculated proportionately to their percentage <strong>of</strong><br />

the total shares held in a company, but only to the<br />

extent to which shares contribute to the financing<br />

<strong>of</strong> the company by way <strong>of</strong> equity capital. This takes<br />

account <strong>of</strong> the fact that, by purchasing shares,<br />

investors increase the equity <strong>of</strong> the company<br />

the first time a dividend is paid on them. <strong>The</strong><br />

commercial activity <strong>of</strong> the company may, however,<br />

also be financed by borrowings. Based on this<br />

approach, therefore, only the proportion <strong>of</strong> the<br />

emissions <strong>of</strong> a company corresponding to the<br />

respective equity share is included in calculating<br />

the emissions financed by investors.<br />

<strong>The</strong> decisive factor in determining the greenhouse<br />

gas intensity <strong>of</strong> capital investment products, apart<br />

from the equity share, is the greenhouse gas<br />

intensity <strong>of</strong> the enterprises concerned. This varies<br />

very widely between different sectors (figure 5).<br />

Greenhouse gas-intensive companies emit up to<br />

175 times more greenhouse gases per euro earned<br />

than low-emission companies. Low greenhouse<br />

gas emission companies are mainly in the service<br />

sector. Renewable energy companies are "only" in<br />

fifth place, as no negative Scope 3 emissions are<br />

taken into account.<br />

5.2.1<br />

Stocks and stock certificates<br />

As there is no data relating to the overall portfolio<br />

composition <strong>of</strong> stock investments held by German<br />

private investors, the study instead utilised the<br />

composition <strong>of</strong> stock indices to calculate the<br />

emissions financed by capital investments in<br />

stocks and stock certificates. <strong>The</strong> indices mostly<br />

weight the companies according to the value <strong>of</strong><br />

their stock in circulation and their performance. 15<br />

<strong>The</strong>y thus provide a guide value – if a rough<br />

one – for the average investment behaviour on<br />

the stock market. <strong>The</strong> emissions financed by a<br />

capital investment in stocks or stock certificates<br />

are produced from the different weighting <strong>of</strong><br />

the companies in the respective index and their<br />

equity-financed greenhouse gas intensity. In this,<br />

a standard index is compared against a renewable<br />

energy index and two sustainability indices.<br />

<strong>The</strong> emissions financed by conventional investors<br />

are calculated by way <strong>of</strong> example based on a<br />

European standard index 16 . It maps the performance<br />

<strong>of</strong> the largest European blue-chips,<br />

representing a major portion <strong>of</strong> the total market<br />

capitalisation <strong>of</strong> all stock market quoted European<br />

companies. <strong>The</strong> calculations produce an emissions<br />

intensity for the index overall <strong>of</strong> 1,243 gGHG per<br />

euro.<br />

With regard to sustainability indices, two particularly<br />

market-relevant indices were applied<br />

as the calculation base. Both indices select only<br />

companies which have attained a certain minimum<br />

score in the underlying non-financial ratings. 17<br />

Climate aspects are covered by both ratings<br />

systems, but are weighted very differently. That is<br />

also reflected in the greenhouse gas intensities.<br />

<strong>The</strong> much less greenhouse gas-intensive index, at<br />

464 gGHG per euro, also imposes more stringent<br />

climate criteria than the much poorer-performing<br />

index, with emissions <strong>of</strong> 976 gGHG per euro. In<br />

this case, stricter criteria for non-financial ratings<br />

result in a lower greenhouse gas intensity <strong>of</strong> the<br />

indices. Both indices are, however, well below the<br />

greenhouse gas intensity <strong>of</strong> the standard index by<br />

comparison. <strong>The</strong>ir average weighted by investment<br />

volume is 632 gGHG per euro.<br />

15 <strong>The</strong><br />

composition <strong>of</strong> the individual indices is mostly based on different criteria. <strong>The</strong> two criteria cited are the ones most frequently used<br />

however.<br />

16 This index represents around 50 % <strong>of</strong> the free-float shares <strong>of</strong> European stock market listed companies.<br />

17 Sustainability<br />

indices in some cases pursue very different approaches with regard to the composition <strong>of</strong> their funds (see also Fowler,<br />

Stephen J. and Chris Hope 2007).