Customs Declaration Processing System Detailed User and ...

Customs Declaration Processing System Detailed User and ...

Customs Declaration Processing System Detailed User and ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

DETAILED USER & TECHNICAL REQUIREMENTS FOR CDPS<br />

AND USE-CASE MODELS<br />

Ref: PHASE V<br />

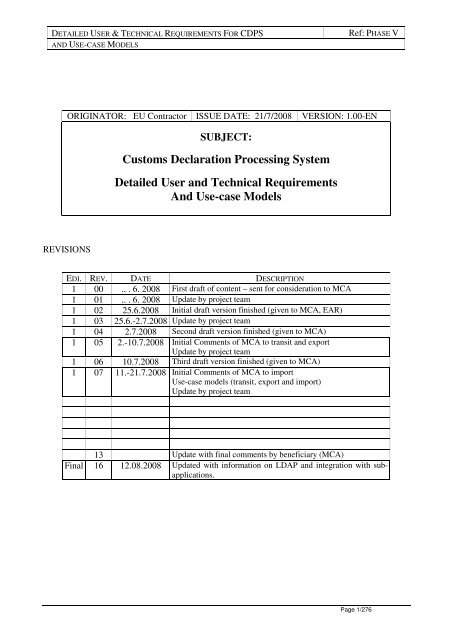

ORIGINATOR: EU Contractor ISSUE DATE: 21/7/2008 VERSION: 1.00-EN<br />

SUBJECT:<br />

<strong>Customs</strong> <strong>Declaration</strong> <strong>Processing</strong> <strong>System</strong><br />

<strong>Detailed</strong> <strong>User</strong> <strong>and</strong> Technical Requirements<br />

And Use-case Models<br />

REVISIONS<br />

EDI. REV. DATE DESCRIPTION<br />

1 00 .. . 6. 2008 First draft of content – sent for consideration to MCA<br />

1 01 .. . 6. 2008 Update by project team<br />

1 02 25.6.2008 Initial draft version finished (given to MCA, EAR)<br />

1 03 25.6.-2.7.2008 Update by project team<br />

1 04 2.7.2008 Second draft version finished (given to MCA)<br />

1 05 2.-10.7.2008 Initial Comments of MCA to transit <strong>and</strong> export<br />

Update by project team<br />

1 06 10.7.2008 Third draft version finished (given to MCA)<br />

1 07 11.-21.7.2008 Initial Comments of MCA to import<br />

Use-case models (transit, export <strong>and</strong> import)<br />

Update by project team<br />

13 Update with final comments by beneficiary (MCA)<br />

Final 16 12.08.2008 Updated with information on LDAP <strong>and</strong> integration with subapplications.<br />

Page 1/276

DETAILED USER & TECHNICAL REQUIREMENTS FOR CDPS<br />

AND USE-CASE MODELS<br />

Ref: PHASE V<br />

Table of Contents<br />

REVISIONS ........................................................................................................................................................... 1<br />

TABLE OF CONTENTS ..................................................................................................................................... 2<br />

1 INTRODUCTION - EXECUTIVE SUMMARY .................................................................................... 12<br />

1.1 Purpose of CDPS............................................................................................................................. 12<br />

1.2 Objectives of CDPS......................................................................................................................... 12<br />

1.3 Scope of CDPS................................................................................................................................. 13<br />

1.4 Intended audience ........................................................................................................................... 13<br />

1.5 Structure of this document............................................................................................................. 14<br />

1.6 Terminology..................................................................................................................................... 14<br />

THERE ARE DIFFERENT LEVELS OF REQUIREMENTS:........................................................................... 14<br />

A) USER REQUIREMENTS ............................................................................................................................ 14<br />

B) FUNCTIONAL SPECIFICATIONS ........................................................................................................... 14<br />

C) TECHNICAL SPECIFICATIONS (SOFTWARE SPECIFICATION)................................................... 14<br />

MUST .................................................................................................................................................................. 15<br />

MUST NOT......................................................................................................................................................... 15<br />

SHOULD ............................................................................................................................................................. 15<br />

SHOULD NOT.................................................................................................................................................... 15<br />

MAY .................................................................................................................................................................... 15<br />

THIS WORD, OR THE ADJECTIVE "OPTIONAL", MEANS THAT AN ITEM IS TRULY<br />

OPTIONAL. ................................................................................................................................................ 15<br />

1.7 Abbreviations used in this document ............................................................................................ 15<br />

1.8 Related documents.......................................................................................................................... 16<br />

2 DOMAINS OF THE CDPS.................................................................................................................... 18<br />

2.1 National Domain ............................................................................................................................. 19<br />

2.2 External Domain ............................................................................................................................. 19<br />

2.3 Domains of the government agencies ............................................................................................ 20<br />

2.4 Common Domain (only for EU-EFTA communication) ............................................................. 21<br />

3 CDPS – MAIN APPLICATION............................................................................................................... 22<br />

3.1 Transit regime (NCTS)................................................................................................................... 22<br />

3.1.1 Trade <strong>Customs</strong> office of departure....................................................................... 22<br />

3.1.1.1 Electronic transit declaration...................................................................................... 22<br />

3.1.1.2 Paper transit declarations ........................................................................................... 23<br />

3.1.1.3 Documents to accompany the transit declaration....................................................... 24<br />

3.1.1.4 Acceptance, customs controls, modifications, rectifications <strong>and</strong> cancellation of<br />

transit declaration....................................................................................................... 24<br />

3.1.1.5 Cancellation of transit declaration or transit regime .................................................. 25<br />

3.1.1.6 Consultation of the status of transit declaration......................................................... 26<br />

3.1.2 Release of goods for transit regime ................................................................................ 26<br />

3.1.2.1 Use of st<strong>and</strong>ard procedure.......................................................................................... 26<br />

Page 2/276

DETAILED USER & TECHNICAL REQUIREMENTS FOR CDPS<br />

AND USE-CASE MODELS<br />

Ref: PHASE V<br />

3.1.2.2 Use of simplified procedure of authorised consignor ................................................ 27<br />

3.1.3 <strong>Customs</strong> office of departure <strong>Customs</strong> office of guarantee.................................. 28<br />

3.1.3.1 Check of the guarantee............................................................................................... 28<br />

3.1.3.2 Register of guarantee usage ....................................................................................... 30<br />

3.1.3.3 Writing off the guarantee ........................................................................................... 30<br />

3.1.4 <strong>Customs</strong> office of departure <strong>Customs</strong> office of transit........................................ 30<br />

3.1.4.1 Anticipated Transit Record ........................................................................................ 30<br />

3.1.4.2 Transit Accompanying Document ............................................................................. 31<br />

3.1.4.3 Incidents during the transport..................................................................................... 31<br />

3.1.5 <strong>Customs</strong> office of departure <strong>Customs</strong> office of destination................................ 32<br />

3.1.5.1 Anticipated Arrival Record........................................................................................ 32<br />

3.1.5.2 Transit Accompanying Document ............................................................................. 33<br />

3.1.5.3 Cancellation of transit regime .................................................................................... 33<br />

3.1.6 Trade <strong>Customs</strong> office of transit (Common/Community transit)........................ 33<br />

3.1.6.1 Notification of arrival <strong>and</strong> presentation of goods....................................................... 33<br />

3.1.6.2 Control of goods......................................................................................................... 34<br />

3.1.7 Trade <strong>Customs</strong> office of entry or exit................................................................... 34<br />

3.1.7.1 Entry or exit summary declaration............................................................................. 34<br />

3.1.7.2 Risk analysis .............................................................................................................. 35<br />

3.1.7.3 Presentation of goods <strong>and</strong> notification of arrival ....................................................... 35<br />

3.1.7.4 Control of goods......................................................................................................... 35<br />

3.1.7.5 Registration ................................................................................................................ 35<br />

3.1.7.6 Diversion.................................................................................................................... 35<br />

3.1.8 Trade <strong>Customs</strong> office of destination ..................................................................... 36<br />

3.1.8.1 Notification of arrival................................................................................................. 36<br />

3.1.8.2 Risk analysis .............................................................................................................. 36<br />

3.1.8.3 Presentation of goods <strong>and</strong> controls with st<strong>and</strong>ard procedure..................................... 36<br />

3.1.8.4 Diversion.................................................................................................................... 37<br />

3.1.8.5 Use of simplified procedure of authorised consignee ................................................ 37<br />

3.1.9 <strong>Customs</strong> office of destination <strong>Customs</strong> office of departure................................ 39<br />

3.1.9.1 Presentation of goods at destination (Arrival Advice)............................................... 39<br />

3.1.9.2 Control of goods (Control results) <strong>and</strong> ending of transit regime ............................... 39<br />

3.1.9.3 Discrepancies ............................................................................................................. 39<br />

3.1.10 Write-off by <strong>Customs</strong> office of departure...................................................................... 40<br />

3.1.10.1 End of transit procedure confirmed............................................................................ 40<br />

3.1.10.2 Release of guarantee .................................................................................................. 40<br />

3.1.10.3 Principal notification on discharge of transit regime ................................................. 40<br />

3.1.11 Enquiry procedure........................................................................................................... 40<br />

3.1.11.1 Notification towards Principal ................................................................................... 41<br />

3.1.11.2 Enquiry procedure towards declared/actual <strong>Customs</strong> office of destination............... 41<br />

3.1.11.3 Enquiry procedure towards declared/actual customs office of transit ....................... 41<br />

3.1.11.4 Recovery procedure towards a debtor (a principal) ................................................... 42<br />

3.1.12 NCTS/TIR procedure...................................................................................................... 42<br />

3.1.12.1 NCTS/TIR procedure at <strong>Customs</strong> office of departure ............................................... 42<br />

3.1.12.2 NCTS/TIR procedure at <strong>Customs</strong> office of destination............................................. 43<br />

3.1.12.3 Write-off by <strong>Customs</strong> office of departure (NCTS/TIR)............................................. 44<br />

3.1.13 Railway procedure........................................................................................................... 44<br />

3.1.13.1 Railway procedure at <strong>Customs</strong> office of departure (national transit) ........................ 45<br />

3.1.13.2 Railway procedure at <strong>Customs</strong> office of destination (national transit)...................... 45<br />

Page 3/276

DETAILED USER & TECHNICAL REQUIREMENTS FOR CDPS<br />

AND USE-CASE MODELS<br />

Ref: PHASE V<br />

3.1.13.3 Write-off by <strong>Customs</strong> office of departure (Railway)................................................. 46<br />

3.2 Export regimes ................................................................................................................................ 47<br />

3.2.1 Trade <strong>Customs</strong> office of export............................................................................. 47<br />

3.2.1.1 Electronic export declaration ..................................................................................... 47<br />

3.2.1.2 Paper export declarations ........................................................................................... 48<br />

3.2.1.3 Oral export declaration............................................................................................... 48<br />

3.2.1.4 Documents to accompany the export declaration ...................................................... 49<br />

3.2.1.5 Control of accompanied documents........................................................................... 49<br />

3.2.1.6 Acceptance, modifications, rectifications <strong>and</strong> deletions of export declarations ........ 50<br />

3.2.1.7 Cancellation of export declaration ............................................................................. 51<br />

3.2.2 Release of goods for export regime................................................................................. 51<br />

3.2.2.1 Use of st<strong>and</strong>ard procedure.......................................................................................... 51<br />

3.2.2.2 Use of simplified procedure of local clearance.......................................................... 52<br />

3.2.2.3 Use of simplified procedure of incomplete export declaration .................................. 53<br />

3.2.2.4 Use of simplified procedure of simplified export declaration.................................... 54<br />

3.2.2.5 Cancellation of export regime.................................................................................... 56<br />

3.2.2.6 Consultation of the status of export declaration......................................................... 57<br />

3.2.3 <strong>Customs</strong> office of export <strong>Customs</strong> office of exit................................................... 57<br />

3.2.3.1 Anticipated Export Record......................................................................................... 57<br />

3.2.3.2 Export Accompanying Document.............................................................................. 58<br />

3.2.3.3 Cancellation of export regime.................................................................................... 58<br />

3.2.4 Trade <strong>Customs</strong> office of exit.................................................................................. 58<br />

3.2.4.1 Notification of arrival................................................................................................. 58<br />

3.2.4.2 Risk analysis <strong>and</strong> pre-requisite controls of data......................................................... 58<br />

3.2.4.3 Presentation of goods <strong>and</strong> controls with st<strong>and</strong>ard procedure..................................... 58<br />

3.2.4.4 Diversion.................................................................................................................... 59<br />

3.2.5 Exit authority (airport h<strong>and</strong>ling company) <strong>Customs</strong> of exit.............................. 59<br />

3.2.5.1 Goods movement information.................................................................................... 60<br />

3.2.5.2 Risk analysis - pre-requisite controls of data ............................................................. 60<br />

3.2.5.3 Presentation of goods ................................................................................................. 60<br />

3.2.5.4 Control of goods......................................................................................................... 60<br />

3.2.5.5 Notification of exit..................................................................................................... 61<br />

3.2.6 <strong>Customs</strong> office of exit <strong>Customs</strong> office of export................................................... 61<br />

3.2.6.1 Presentation of goods at exit ...................................................................................... 61<br />

3.2.6.2 Confirmation of Exit <strong>and</strong> Control results................................................................... 62<br />

3.2.6.3 Discrepancies ............................................................................................................. 62<br />

3.2.6.4 Invalidation of export declaration acknowledgement ................................................ 62<br />

3.2.7 Write-off by <strong>Customs</strong> office of export............................................................................ 63<br />

3.2.7.1 Exit of exported goods confirmed.............................................................................. 63<br />

3.2.7.2 Goods not exported .................................................................................................... 63<br />

3.2.7.3 Exit not confirmed – invalidation of export declaration ............................................ 63<br />

3.2.7.4 Notification of exit to declarant <strong>and</strong>/or exporter........................................................ 64<br />

3.2.8 Diversion........................................................................................................................... 64<br />

3.2.8.1 Export declaration request.......................................................................................... 64<br />

3.2.8.2 Export Advice Response............................................................................................ 64<br />

3.2.8.3 Diversion Notification................................................................................................ 64<br />

3.2.9 Split Consignments .......................................................................................................... 65<br />

3.2.9.1 Exit of goods via one <strong>Customs</strong> office of exit............................................................. 65<br />

3.2.9.2 Exit of goods via more than one <strong>Customs</strong> office of exit (computerised solution)..... 65<br />

3.2.9.3 Exit of goods via more than one <strong>Customs</strong> office of exit (paper solution).................. 66<br />

Page 4/276

DETAILED USER & TECHNICAL REQUIREMENTS FOR CDPS<br />

AND USE-CASE MODELS<br />

Ref: PHASE V<br />

3.2.10 Consolidated Consignments............................................................................................ 66<br />

3.3 Export control system..................................................................................................................... 67<br />

3.3.1 Trade <strong>Customs</strong> office of lodgement of EXD......................................................... 67<br />

3.3.1.1 Electronic exit summary declaration.......................................................................... 67<br />

3.3.1.2 Paper-based exit summary declaration....................................................................... 68<br />

3.3.1.3 Acceptance, modifications, rectifications <strong>and</strong> deletions of EXD............................... 68<br />

3.3.2 Trade <strong>Customs</strong> office of exit.................................................................................. 69<br />

3.3.2.1 Risk analysis - pre-requisite controls of data ............................................................. 69<br />

3.3.2.2 Notification of arrival................................................................................................. 69<br />

3.3.2.3 Presentation of goods ................................................................................................. 69<br />

3.3.2.4 Control of goods......................................................................................................... 69<br />

3.3.2.5 Diversion.................................................................................................................... 70<br />

3.3.3 Exit authority (airport h<strong>and</strong>ling company) <strong>Customs</strong> of exit.............................. 70<br />

3.4 Import regimes................................................................................................................................ 70<br />

3.4.1 Trade <strong>Customs</strong> office of lodgement of summary declaration............................. 70<br />

3.4.1.1 Electronic or paper summary declaration................................................................... 70<br />

3.4.1.2 Acceptance, modifications, rectifications <strong>and</strong> deletions of SD.................................. 71<br />

3.4.1.3 Temporary storage ..................................................................................................... 72<br />

3.4.1.4 Release from temporary storage................................................................................. 72<br />

3.4.2 Trade <strong>Customs</strong> office of import ............................................................................ 72<br />

3.4.2.1 Electronic or paper-based import declaration ............................................................ 72<br />

3.4.2.2 Oral import declarations............................................................................................. 74<br />

3.4.2.3 Documents to accompany the import declaration...................................................... 75<br />

3.4.2.4 Control of accompanied documents........................................................................... 75<br />

3.4.2.5 Acceptance, modifications, rectifications <strong>and</strong> deletions of import declarations........ 75<br />

3.4.2.6 Cancellation of import declaration............................................................................. 76<br />

3.4.3 <strong>Customs</strong> office of import <strong>Customs</strong> office of guarantee ....................................... 77<br />

3.4.3.1 Check of the guarantee............................................................................................... 77<br />

3.4.3.2 Register of guarantee usage ....................................................................................... 77<br />

3.4.3.3 Writing off the guarantee ........................................................................................... 78<br />

3.4.4 Release of goods for import regime of free circulation................................................. 78<br />

3.4.4.1 Use of st<strong>and</strong>ard procedure.......................................................................................... 78<br />

3.4.4.2 Use of simplified procedure of local clearance.......................................................... 80<br />

3.4.4.3 Use of simplified procedure of incomplete declaration ............................................. 81<br />

3.4.4.4 Use of simplified procedure of simplified declaration............................................... 82<br />

3.4.4.5 Cancellation of regime ............................................................................................... 84<br />

3.4.5 Release of goods for import regimes with economic impact ........................................ 85<br />

3.4.5.1 Use of st<strong>and</strong>ard procedure.......................................................................................... 85<br />

3.4.5.2 Control of goods......................................................................................................... 86<br />

3.4.5.3 Use of simplified procedure of local clearance.......................................................... 87<br />

3.4.5.4 Use of simplified procedure of incomplete declaration ............................................. 88<br />

3.4.5.5 Use of simplified procedure of simplified declaration............................................... 90<br />

3.4.5.6 Cancellation of an import regime with economic impact .......................................... 92<br />

3.4.5.7 Discharge of import regime with economic impact................................................... 92<br />

3.5 Import control system..................................................................................................................... 93<br />

3.5.1 Trade <strong>Customs</strong> office of lodgement of END......................................................... 93<br />

3.5.1.1 Electronic entry summary declaration (END)............................................................ 93<br />

3.5.1.2 Paper-based entry summary declaration .................................................................... 94<br />

3.5.1.3 Acceptance, modifications, rectifications <strong>and</strong> deletions of END............................... 94<br />

Page 5/276

DETAILED USER & TECHNICAL REQUIREMENTS FOR CDPS<br />

AND USE-CASE MODELS<br />

Ref: PHASE V<br />

3.5.2 Trade <strong>Customs</strong> office of first entry....................................................................... 95<br />

3.5.2.1 Risk analysis - pre-requisite controls ......................................................................... 95<br />

3.5.2.2 Arrival notification..................................................................................................... 95<br />

3.5.2.3 Presentation of goods ................................................................................................. 95<br />

3.5.2.4 Control of goods......................................................................................................... 96<br />

3.5.2.5 Diversion.................................................................................................................... 96<br />

3.5.3 Trade <strong>Customs</strong> office of subsequent entry........................................................... 96<br />

3.5.3.1 Notification of arrival................................................................................................. 96<br />

3.5.3.2 Pre-requisite controls ................................................................................................. 97<br />

3.5.3.3 Presentation of goods ................................................................................................. 97<br />

3.5.3.4 Diversion.................................................................................................................... 97<br />

3.5.4 Process at entry ................................................................................................................ 98<br />

4 SUB-APPLICATIONS .............................................................................................................................. 98<br />

4.1 Authorisations sub-application...................................................................................................... 98<br />

4.1.1 Authorisations in Transit regime ................................................................................... 98<br />

4.1.1.1 Simplified procedure of authorised consignor ........................................................... 98<br />

4.1.1.2 Simplified procedure of authorised consignee........................................................... 99<br />

4.1.1.3 Simplified procedure of use of special seals ............................................................ 100<br />

4.1.1.4 Simplified procedure of exemption regarding prescribed itinerary ......................... 101<br />

4.1.1.5 Electronic communications in transit....................................................................... 101<br />

4.1.1.6 Authorisation for representation in transit ............................................................... 104<br />

4.1.2 Authorisations in Export regimes................................................................................. 104<br />

4.1.2.1 Simplified procedure of local clearance in export regimes...................................... 104<br />

4.1.2.2 Simplified procedure of incomplete declaration in export regimes ......................... 105<br />

4.1.2.3 Simplified procedure of simplified declaration in export regimes........................... 106<br />

4.1.2.4 Use of outward processing regime (authorisation for RwEI)................................... 106<br />

4.1.2.5 Electronic communications in export regimes......................................................... 107<br />

4.1.2.6 Authorisation for representation in export ............................................................... 109<br />

4.1.3 Authorisations in Import regimes ................................................................................ 109<br />

4.1.3.1 Simplified procedure of local clearance in free circulation ..................................... 109<br />

4.1.3.2 Simplified procedure of incomplete declaration in free circulation......................... 110<br />

4.1.3.3 Simplified procedure of simplified declaration in free circulation .......................... 111<br />

4.1.3.4 Authorisation of end-use.......................................................................................... 112<br />

4.1.3.5 Use of customs warehousing regime (authorisation for RwEI) ............................... 112<br />

4.1.3.6 Use of inward processing regime (authorisation for RwEI)..................................... 113<br />

4.1.3.7 Use of temporary importation regime (authorisation for RwEI).............................. 114<br />

4.1.3.8 Use of processing under customs control regime (authorisation for RwEI) ............ 115<br />

4.1.3.9 Electronic communications in import regimes......................................................... 116<br />

4.1.3.10 Authorisation for representation in import............................................................... 118<br />

4.1.4 Authorised economic operator (AEO)................................................................................... 119<br />

4.1.4.1 Simplifications................................................................................................................. 119<br />

4.1.4.2 Security <strong>and</strong> safety........................................................................................................... 119<br />

4.1.4.3 Simplifications <strong>and</strong> Security <strong>and</strong> safety........................................................................... 120<br />

4.1.4.4 National <strong>and</strong> European AEO database............................................................................. 120<br />

4.2 Guarantee management system........................................................................................................ 121<br />

4.2.1 Guarantees in transit regime.................................................................................................. 121<br />

4.2.1.1 Guarantee in the form of cash deposit ............................................................................. 121<br />

4.2.1.2 Individual guarantee in the form of single guarantee undertaking .................................. 122<br />

4.2.1.3 Individual guarantee in the form of guarantee vouchers ................................................. 123<br />

4.2.1.4 Comprehensive guarantee................................................................................................ 123<br />

Page 6/276

DETAILED USER & TECHNICAL REQUIREMENTS FOR CDPS<br />

AND USE-CASE MODELS<br />

Ref: PHASE V<br />

4.2.1.5 Comprehensive guarantee waiver.................................................................................... 124<br />

4.2.2 Guarantees in other regimes than transit regime................................................................. 125<br />

4.2.2.1 Guarantee in the form of cash deposit ............................................................................. 125<br />

4.2.2.2 Individual guarantee in the form of single guarantee undertaking .................................. 126<br />

4.2.2.3 Comprehensive guarantee................................................................................................ 126<br />

4.2.3 Electronic communication with Office of Guarantee........................................................... 127<br />

4.3 Risk analysis <strong>and</strong> risk management system..................................................................................... 128<br />

4.3.1 Risk management.................................................................................................................... 128<br />

4.3.2 Risk management within the customs authorities................................................................ 129<br />

4.3.2.1 The context ...................................................................................................................... 129<br />

4.3.2.2 Selectivity, Profiling <strong>and</strong> Targeting................................................................................. 129<br />

4.3.2.3 Evaluation <strong>and</strong> review ..................................................................................................... 130<br />

4.3.2.4 Compliance Measurement Areas..................................................................................... 130<br />

4.3.2.5 Use of information technology for effective implementation of Risk Management ....... 131<br />

4.4 Tarim (TARIC).................................................................................................................................. 131<br />

4.4.1 General conditions of Tarim (TARIC)...................................................................................... 131<br />

4.4.2 Content of Tarim (TARIC) ....................................................................................................... 132<br />

4.4.3 Information flows...................................................................................................................... 132<br />

4.4.4 Business Process <strong>and</strong> Security Requirements ........................................................................... 133<br />

4.5 Accounting management system sub-application........................................................................... 133<br />

4.5.1 General conditions of Accounting management system sub-application.................................. 133<br />

5. TECHNICAL REQUIREMENTS .............................................................................................................. 134<br />

5.1 Introduction of concept <strong>and</strong> architecture........................................................................................ 134<br />

5.2 General Technical Requirements..................................................................................................... 134<br />

5.2.1 Networking Requirements......................................................................................................... 134<br />

5.2.1.1 Common Domain............................................................................................................. 135<br />

5.2.2 Modes of operation.................................................................................................................... 135<br />

5.2.3 Globalisation <strong>and</strong> Localisation.................................................................................................. 136<br />

5.2.3.1 Common Domain............................................................................................................. 136<br />

5.2.4 Fallback <strong>and</strong> availability ........................................................................................................... 136<br />

5.2.4.1 Overview.......................................................................................................................... 136<br />

5.2.4.2 Requirements ................................................................................................................... 137<br />

5.2.4.2.1 Common Domain Specific Requirements .................................................................... 138<br />

5.2.5 Security ..................................................................................................................................... 139<br />

5.2.5.1 Overview.......................................................................................................................... 139<br />

5.2.5.1.1 <strong>User</strong>s ............................................................................................................................. 139<br />

5.2.5.1.2 Access Rights, Roles <strong>and</strong> Security ............................................................................... 139<br />

5.2.5.1.3 Authentication <strong>and</strong> Digital Certificates ........................................................................ 140<br />

5.2.5.2 Requirements ................................................................................................................... 140<br />

5.2.5.2.1 Common Domain Specific Requirements .................................................................... 143<br />

5.2.6 Other – Supporting Services ..................................................................................................... 144<br />

5.2.7 Data Warehouse <strong>and</strong> Reporting................................................................................................. 144<br />

5.2.8 Technical Architecture .............................................................................................................. 145<br />

5.2.9 Operating Environment............................................................................................................. 146<br />

5.2.10 Version management <strong>and</strong> work packages ............................................................................... 148<br />

5.2.11 <strong>User</strong> Interface.......................................................................................................................... 149<br />

Page 7/276

DETAILED USER & TECHNICAL REQUIREMENTS FOR CDPS<br />

AND USE-CASE MODELS<br />

Ref: PHASE V<br />

5.3 CDPS Requirements.......................................................................................................................... 150<br />

5.3.1 Introduction............................................................................................................................... 150<br />

5.3.2 Integration Architecture ............................................................................................................ 151<br />

5.3.3 CDPS modules .......................................................................................................................... 152<br />

5.3.3.1 Transit Control <strong>System</strong> (TCS)......................................................................................... 152<br />

5.3.3.1.1 Availability Requirements............................................................................................ 153<br />

5.3.3.1.2 Requirements ................................................................................................................ 153<br />

5.3.3.2 Export regimes/Export Control <strong>System</strong> (ECS)................................................................ 153<br />

5.3.3.2.1 Availability Requirements............................................................................................ 153<br />

5.3.3.2.2 Requirements ................................................................................................................ 153<br />

5.3.3.3 Import Regime/Import Control <strong>System</strong> (ICS) ................................................................. 153<br />

5.3.3.3.1 Availability Requirements............................................................................................ 153<br />

5.3.3.3.2 Requirements ................................................................................................................ 153<br />

5.3.3.4 Reference Data Application............................................................................................. 153<br />

5.3.3.4.1 Requirements ................................................................................................................ 154<br />

5.3.3.4.1.1 Common Domain....................................................................................................... 154<br />

5.3.3.4.2 Availability requirements ............................................................................................. 154<br />

5.3.4 Integration with Common Domain ........................................................................................... 155<br />

5.3.4.1 Transit Control <strong>System</strong> (TCS)......................................................................................... 155<br />

5.3.4.2 Automated Export <strong>System</strong>/Export Control <strong>System</strong> (ECS) .............................................. 156<br />

5.3.4.3 Automated Import <strong>System</strong>/Import Control <strong>System</strong> (ICS) ............................................... 157<br />

5.3.4.4 Common Domain Conformance Testing Environment ................................................... 158<br />

5.3.4.4.1 Conformance Testing of CDPS .................................................................................... 158<br />

5.3.4.4.2 Conformance Testing Requirements ............................................................................ 159<br />

5.3.4.5 Connection to Common Domain ..................................................................................... 159<br />

5.3.5 Integration with National Domain............................................................................................. 160<br />

5.3.5.1 Connection to National Domain ...................................................................................... 160<br />

5.3.6 Integration with External Domain............................................................................................. 161<br />

5.3.6.1 Economic Operators ........................................................................................................ 161<br />

5.3.6.2 Other Government Agencies ........................................................................................... 161<br />

5.3.6.3 Connection to External Domain ...................................................................................... 161<br />

5.3.7 Conformance testing ................................................................................................................. 162<br />

5.3.8 Outsplication hosting................................................................................................................. 163<br />

6. PHASING/MILESTONES FOR THE CDPS PROOURCING OF APJECT ......................................... 164<br />

6.2 Introduction of the stages.................................................................................................................. 164<br />

6.2.1 Phase plan ................................................................................................................................ 164<br />

6.2.2 Phase objectives....................................................................................................................... 164<br />

7. USE-CASE MODELS.................................................................................................................................. 166<br />

7.1 Transit use-case model (national transit) ........................................................................................ 166<br />

7.1.1 Overview of Transit Core Business .......................................................................................... 167<br />

7.1.2 CO1A - Process Departure - Acceptance/Controls ................................................................... 168<br />

7.1.3 CO1B - Process Departure – Release........................................................................................ 169<br />

7.1.4 CO02 - Process Arrival at Office of destination ....................................................................... 170<br />

A) PROCESS ARRIVAL – PART I .................................................................................................................. 170<br />

B) PROCESS ARRIVAL - PART II.................................................................................................................. 171<br />

C) PROCESS ARRIVAL - PART III................................................................................................................. 172<br />

Page 8/276

DETAILED USER & TECHNICAL REQUIREMENTS FOR CDPS<br />

AND USE-CASE MODELS<br />

Ref: PHASE V<br />

7.1.5 CO04 - HANDLE ENQUIRY................................................................................................................... 173<br />

A) HANDLE ENQUIRY - PART 1................................................................................................................... 173<br />

B) HANDLE ENQUIRY - PART 2 ................................................................................................................... 174<br />

7.1.6 CO06 - Process Cancellation..................................................................................................... 175<br />

7.1.7 CO08 - Confirm Authorised Consignee.................................................................................... 176<br />

7.2 Transit use-case model (common/Community transit) .................................................................. 177<br />

7.2.1 Overview of common/Community Transit Core Business ....................................................... 177<br />

7.2.2 CO1A - Process Departure - Acceptance/Controls ................................................................... 178<br />

7.2.3 CO1B - Process Departure – Release........................................................................................ 179<br />

7.2.4 CO02 - Process Arrival at Office of destination ....................................................................... 180<br />

A) PROCESS ARRIVAL PART I ..................................................................................................................... 180<br />

B) PROCESS ARRIVAL PART II .................................................................................................................... 181<br />

C) PROCESS ARRIVAL PART III................................................................................................................... 182<br />

7.2.5 CO03 - Process movement at Office of Transit ........................................................................ 183<br />

7.2.6 CO04 - H<strong>and</strong>le enquiry ............................................................................................................. 184<br />

A) HANDLE ENQUIRY - PART 1................................................................................................................... 184<br />

B) HANDLE ENQUIRY - PART 2 ................................................................................................................... 185<br />

7.2.7 CO06 - Process Cancellation..................................................................................................... 186<br />

7.2.8 CO07 - Query Movement Information...................................................................................... 187<br />

7.2.9 CO08 - Confirm Authorised Consignee.................................................................................... 188<br />

7.3 National export use-case model ........................................................................................................ 189<br />

7.3.1 Overview of Export Core Business........................................................................................... 189<br />

7.3.2 CO1A - Process Export - Acceptance/Controls at Office of Export......................................... 190<br />

7.3.3 CO1B - Process Export – Release at Office of Export.............................................................. 191<br />

7.3.4 CO02 - Process Arrival at Actual Office of Exit....................................................................... 192<br />

A) PROCESS ARRIVAL AT ACTUAL OFFICE OF EXIT - PART I............................................................. 192<br />

B) PROCESS ARRIVAL AT OFFICE OF EXIT - PART II............................................................................. 193<br />

7.3.5 CO03 - Process Exit at Actual Office of Exit ........................................................................... 194<br />

A) PROCESS EXIT AT ACTUAL OFFICE OF EXIT - PART I ..................................................................... 194<br />

B) PROCESS EXIT AT ACTUAL OFFICE OF EXIT - PART II .................................................................... 195<br />

7.3.6 CO04 - HANDLE FOLLOW-UP.............................................................................................................. 196<br />

7.3.7 CO06 - Process Cancellation..................................................................................................... 197<br />

7.3.8 CO07 - Query Export Operation Information ........................................................................... 198<br />

7.4 ECS - AES use-case model ................................................................................................................ 199<br />

7.4.1 Overview of Export Core Business........................................................................................... 199<br />

7.4.2 CO1A - Process Export - Acceptance/Controls at Office of Export......................................... 200<br />

7.4.3 CO1B - Process Export – Release at Office of Export.............................................................. 201<br />

7.4.4 CO02 - Process Arrival at Actual Office of Exit....................................................................... 202<br />

A) PROCESS ARRIVAL AT ACTUAL OFFICE OF EXIT - PART I............................................................. 202<br />

B) PROCESS ARRIVAL AT OFFICE OF EXIT - PART II............................................................................. 203<br />

Page 9/276

DETAILED USER & TECHNICAL REQUIREMENTS FOR CDPS<br />

AND USE-CASE MODELS<br />

Ref: PHASE V<br />

7.4.5 CO03 - PROCESS EXIT AT ACTUAL OFFICE OF EXIT .................................................................... 204<br />

A) PROCESS EXIT AT ACTUAL OFFICE OF EXIT - PART I ..................................................................... 204<br />

B) PROCESS EXIT AT ACTUAL OFFICE OF EXIT - PART II .................................................................... 205<br />

7.4.6 CO04 - HANDLE FOLLOW-UP.............................................................................................................. 206<br />

7.4.7 CO06 - Process Cancellation..................................................................................................... 207<br />

7.4.8 CO07 - Query Export Operation Information ........................................................................... 208<br />

7.4.9 CO01A (SUM) – Process Exit summary declaration at Office of Lodgement ......................... 209<br />

7.4.10 CO02 (SUM) – Process Arrival at Actual Office of Exit........................................................ 210<br />

A) CO02 (SUM) – PROCESS ARRIVAL AT ACTUAL OFFICE OF EXIT PART I ..................................... 210<br />

B) CO02 (SUM) – PROCESS ARRIVAL AT ACTUAL OFFICE OF EXIT PART II.................................... 211<br />

7.4.11 CO03 (SUM) – Process Exit at Actual Office of Exit ............................................................ 212<br />

7.5 National import use-case model........................................................................................................ 214<br />

7.5.1 Overview of Import Core Business........................................................................................... 214<br />

7.5.2 CO1A - Process Import - Acceptance/Controls at Office of Import......................................... 215<br />

7.5.3 CO1B - Process Import – Release at Office of Import.............................................................. 216<br />

7.5.4 CO2 - Process Import – Discharge of Import Regime .............................................................. 217<br />

7.5.5 CO03 - H<strong>and</strong>le Follow-Up........................................................................................................ 218<br />

7.5.6 CO04 - Process Cancellation..................................................................................................... 219<br />

7.6 ICS - AIS use-case model .................................................................................................................. 220<br />

7.6.1 Overview of ICS-Core Business – ENS lodged at an Office of Lodgement............................. 220<br />

7.6.2 Overview of ICS-Core Business – ENS lodged at an Office of first Entry .............................. 221<br />

7.6.3 CO1A (SUM) – Process Entry Summary <strong>Declaration</strong> at Office of Lodgement ....................... 222<br />

7.6.4 CO1B (SUM) – Process Entry Summary <strong>Declaration</strong> at Office of first Entry.......................... 223<br />

7.6.5 CO1C (SUM) – Process Entry Summary <strong>Declaration</strong> at Office of subsequent Entry .............. 224<br />

7.6.6 C01D – Process international diversion at Office of first Entry ............................................... 225<br />

7.6.7 CO3A – Presentation at Actual Office of first Entry ................................................................ 226<br />

7.6.8 CO3B – Presentation at Actual Office of subsequent Entry ..................................................... 227<br />

7.6.9 CO3C– Release for Entry at Actual Office of (first or subsequent) Entry................................ 228<br />

7.6.10 Overview of Import Core Business......................................................................................... 229<br />

7.6.11 CO1A - Process Import - Acceptance/Controls at Office of Import....................................... 230<br />

7.6.12 CO1B - Process Import – Release at Office of Import............................................................ 231<br />

7.6.13 CO2 - Process Import – Discharge of Import Regime ............................................................ 232<br />

7.6.14 CO03 - H<strong>and</strong>le Follow-Up...................................................................................................... 233<br />

7.6.15 CO04 - Process Cancellation................................................................................................... 234<br />

8. ANNEXES..................................................................................................................................................... 235<br />

ANNEX 1 - DOMAINS FOR COMMUNICATION ..................................................................................... 235<br />

NATIONAL TRANSIT REGIME: .................................................................................................................... 235<br />

COMMON/COMMUNITY TRANSIT REGIME: ............................................................................................ 235<br />

NATIONAL EXPORT REGIME:...................................................................................................................... 236<br />

ECS - AES:......................................................................................................................................................... 236<br />

NATIONAL IMPORT REGIME:...................................................................................................................... 237<br />

Page 10/276

DETAILED USER & TECHNICAL REQUIREMENTS FOR CDPS<br />

AND USE-CASE MODELS<br />

Ref: PHASE V<br />

ICS - AIS:........................................................................................................................................................... 237<br />

ANNEX 2 - STAGES AND MILESTONES FOR CDPS.............................................................................. 238<br />

ANNEX 3 – LOCAL SELECTIVITY PROCESS......................................................................................... 239<br />

ANNEX 4 – SELECTIVITY PROFILE FILTER SYSTEM........................................................................ 240<br />

ANNEX 5 – NCTS REFERENCE DATA ...................................................................................................... 241<br />

ANNEX 6 – AES REFERENCE DATA ........................................................................................................ 253<br />

ANNEX 7 – AIS REFERENCE DATA .......................................................................................................... 268<br />

Page 11/276

DETAILED USER & TECHNICAL REQUIREMENTS FOR CDPS<br />

AND USE-CASE MODELS<br />

Ref: PHASE V<br />

1 INTRODUCTION - EXECUTIVE SUMMARY<br />

1.1 Purpose of CDPS<br />

The purpose of this document is to provide the user <strong>and</strong> technical requirement for the “<strong>Customs</strong> <strong>Declaration</strong><br />

<strong>Processing</strong> <strong>System</strong>” (CDPS).<br />

The purpose of the CDPS project is to provide a solution that will allow the customs offices involved in all<br />

customs regimes to:<br />

- h<strong>and</strong>le (receive, register, validate, accept, store <strong>and</strong> transmit) the customs declarations,<br />

- release the goods for declared customs regime,<br />

- exchange electronic messages in order automate the administrative flow of the operation,<br />

- elevate the effectiveness of controls against customs duties, taxes <strong>and</strong> other charges <strong>and</strong> other fraud,<br />

- expedite the flow of goods, <strong>and</strong><br />

- contribute to better supply chain security within WCO initiative <strong>and</strong> later within EU membership.<br />

The purpose of the CDPS project is to provide a solution to exchange data not only between <strong>Customs</strong><br />

authorities but also with other governmental organisations <strong>and</strong> economic operators.<br />

All efforts <strong>and</strong> attempts to lay down the groundwork for the implementation of the CDPS are part of a<br />

complete strategy from an electronic customs perspective. Similar strategy has been set up by European<br />

Commission, European Council <strong>and</strong> European Parliament <strong>and</strong> it is under development in all EU member<br />

states as well as in European Commission, DG TAXUD.<br />

1.2 Objectives of CDPS<br />

The overall long term objective of the CDPS project is to provide a system that will allow seamless flow of<br />

electronic information between all actors involved in the import, export or transit process, linking together<br />

the External-, National- <strong>and</strong> Common Domains (for EU-EFTA communications) as well as the Domain of<br />

other government agencies. To simplify <strong>and</strong> automate the administrative flow of the import, export or transit<br />

process will elevate the effectiveness of controls <strong>and</strong> expedite the flow of goods. All parties, traders,<br />

Macedonian customs authorities, other agencies <strong>and</strong> society will benefit from this development.<br />

From a legal/procedural, as well as from an IT point of view, there are similarities between the export<br />

regimes, transit regime (national transit, as well as common/Community transit system) <strong>and</strong> import regimes.<br />

Basing the export <strong>and</strong> import modules of CDPS on the technological achievements of transit module,<br />

especially NCTS, <strong>and</strong> the experience gained during the Single window, transit module, project will also<br />

allow Macedonian customs administration (MCA) to implement a defined <strong>and</strong> specified CDPS which takes<br />

into account both the national requirements, insofar as interface between the declarant <strong>and</strong> the office of<br />

export or import is concerned, <strong>and</strong> international requirements.<br />

The key element of the CDPS is to set the necessary conditions for an import, export <strong>and</strong> transit regimes on<br />

the basis of specifications (functional <strong>and</strong> technical level) which are compatible <strong>and</strong> in line with EU<br />

commonly agreed specifications for transit regime (NCTS), export regimes (ECS-AES) <strong>and</strong> import regimes<br />

(ICS-AIS) where:<br />

• the use of advanced computer systems <strong>and</strong> the electronic processing of data should, amongst other<br />

things, ensure a more efficient management of the export import, export <strong>and</strong> transit regimes than the<br />

paper-based system <strong>and</strong> should improve the efficiency of customs controls, particularly those relating to<br />

export, import <strong>and</strong> transit restrictions <strong>and</strong> to the entry or exit of goods, <strong>and</strong> their effectiveness in the fight<br />

against fraud in these areas;<br />

• new computerized procedures based on the use of modern information technology <strong>and</strong> electronic data<br />

interchange (EDI) are covered by adapted legal provisions to provide procedural, technical, legal<br />

certainty <strong>and</strong> for possible security-linked needs, if found necessary. With regard to the common <strong>and</strong><br />

comprehensive use of such a system in Macedonian customs administration (MCA), all system related<br />

procedures not directly impacting upon the trading community should be governed by guidelines.<br />

Page 12/276

DETAILED USER & TECHNICAL REQUIREMENTS FOR CDPS<br />

AND USE-CASE MODELS<br />

Ref: PHASE V<br />

• most of the products delivered <strong>and</strong>/or produced in context of transit regime (NCTS) for the exchange of<br />

messages via the Common Domain (within EU-EFTA common transit procedure) will be re-used after<br />

the accession of the Republic of Macedonia into the EU in order to limit the resources <strong>and</strong> the timescale<br />

acceptable for all participants involved; <strong>and</strong><br />

• in the first stage the Republic of Macedonia will be linked with EU <strong>and</strong> EFTA countries via a common<br />

network in order to exchange NCTS st<strong>and</strong>ard messages, wherever possible in real time, <strong>and</strong> in the<br />

second stage with EU member states in order to exchange ECS-AES or ICS-AIS st<strong>and</strong>ard messages.<br />

1.3 Scope of CDPS<br />

The CDPS will apply to the movement of goods released for import, export or transit regime, either covered<br />

by declarations made under the normal procedure, i.e. where a full declaration is submitted to the office of<br />

import/export/departure, or under the simplified procedure when goods are released for regime or the regime<br />

is ended:<br />

- incomplete or simplified import declarations or local clearance,<br />

- incomplete or simplified export declarations or local clearance,<br />

- authorized consignor or authorised consignee in transit regime.<br />

The scope of the CDPS will cover the lodgement of electronic or paper-based declarations (customs<br />

declaration, summary declaration as well as entry or exit summary declaration) from the trader´s External<br />

Domain to the National Domain of the customs office <strong>and</strong> the exchange of data of declarations between the<br />

Republic of Macedonia <strong>and</strong> EFTA countries or EU member states via Common Domain (on the day of<br />

accession into the Convention on a common transit procedure 15 or on the day of accession into the EU).<br />

The scope of the CDPS will also cover the lodgement of electronic entry or exit summary declaration from<br />

the trader’s External Domain to the National Domain of the customs office <strong>and</strong> the exchange of entry<br />

summary declaration information <strong>and</strong> risk information between the MS (at the latest on the day of the<br />

accession into the EU). In the last amendments of the Implementing Provisions, defining the necessary<br />

amendments of the <strong>Customs</strong> Code by Regulation (EC) 648/2005, there are new obligations in the way:<br />

- entry summary declaration shall be lodged at the customs office of entry,<br />

- exit summary declaration shall be lodged at the customs office of exit.<br />

1.4 Intended audience<br />

The intended audience are all stakeholders involved in the core CDPS process when goods are:<br />

- brought into the customs territory of Republic of Macedonia <strong>and</strong> the people who later on will establish<br />

the functional <strong>and</strong> technical specifications of the import module of CDPS,<br />

- taken off from the customs territory of Republic of Macedonia <strong>and</strong> the people who later on will establish<br />

the functional <strong>and</strong> technical specifications of the export module of CDPS,<br />

- carried through the customs territory of Republic of Macedonia <strong>and</strong> the people who later on will<br />

establish the functional <strong>and</strong> technical specifications of the transit module of CDPS.<br />

The intended audience are all stakeholders involved in the development of sub-applications linked to the<br />

CDPS, especially responsible for:<br />

- establishing the functional <strong>and</strong> technical specification for Authorisation sub-application <strong>and</strong> later on for<br />

capturing <strong>and</strong>/or management of the authorisations data,<br />

- establishing the functional <strong>and</strong> technical specification for Guarantee management sub-application <strong>and</strong><br />

later on for capturing <strong>and</strong>/or management of the guarantee data,<br />

- establishing the functional <strong>and</strong> technical specification for Risk analysis <strong>and</strong> risk management subapplication<br />

<strong>and</strong> later on for specification/creation <strong>and</strong>/or management of the risk profiles data,<br />

- establishing the functional <strong>and</strong> technical specification for Accounting management sub-application <strong>and</strong><br />

later on for management of the accounting system data,<br />

Page 13/276

DETAILED USER & TECHNICAL REQUIREMENTS FOR CDPS<br />

AND USE-CASE MODELS<br />

Ref: PHASE V<br />

- establishing the functional <strong>and</strong> technical specification for Tarim (TARIC) sub-application <strong>and</strong> later on<br />

for capturing <strong>and</strong>/or management of the Tarim (TARIC) data,<br />

- establishing the functional <strong>and</strong> technical specification for National/European Binding Tariff Information<br />

<strong>and</strong> later on for capturing <strong>and</strong>/or management of the Binding Tariff Information data,<br />

- establishing the functional <strong>and</strong> technical specification for National/European Tariff quotas <strong>and</strong> ceilings<br />

sub-application (or module in Single window sub-application) <strong>and</strong> later on for capturing <strong>and</strong>/or<br />

management of the Tariff quotas <strong>and</strong> ceilings data,<br />

- establishing the functional <strong>and</strong> technical specification for European <strong>Customs</strong> Inventory of Chemical<br />

Substances sub-application <strong>and</strong> later on for management of the European <strong>Customs</strong> Inventory of<br />

Chemical Substances data,<br />

- establishing the functional <strong>and</strong> technical specification for European Autonomous Tariff Suspensions subapplication<br />

<strong>and</strong> later on for management of the European Autonomous Tariff Suspensions data,<br />

- establishing the functional <strong>and</strong> technical specification for European surveillance of data in the<br />

framework of import - export sub-application <strong>and</strong> later on for management of the European surveillance<br />

of data in the framework of import - export data,<br />

- establishing the functional <strong>and</strong> technical specification for Single electronic access point sub-application.<br />

1.5 Structure of this document<br />

After this introduction chapter the document is composed of 7 other chapters. Chapter 2 gives an overall<br />

description of the domains used for communication, chapter 3 describes the CDPS, chapter 4 the concerned<br />

sub-applications which should be developed in parallel with core CDPS, chapter 5 gives a technical<br />

requirements of CDPS, chapter 6 describes the phasing/milestones for development of CDPS, chapter 7<br />

gives the use-case models for main parts of CDPS, chapter 8 contains the annexes of this document.<br />

1.6 Terminology<br />

<strong>User</strong> Requirements refers to the features or attributes the CDPS system should have or how it should perform<br />

from the users’ perspective. The UR describes what the proposed new system will do, but nothing about<br />

how it will be built or implemented.<br />

There are different levels of requirements:<br />

a) <strong>User</strong> Requirements<br />

Narrative descriptions <strong>and</strong> diagrams showing the services the proposed system will deliver <strong>and</strong> its<br />

limitations.<br />

b) Functional Specifications<br />

A well structured document describing the system functionality in detail. The document can be used as a<br />

“contract” between the client <strong>and</strong> the people who will build the system. This document is mainly written for<br />

the system-end users, the system architects <strong>and</strong> the software developers.<br />

c) Technical Specifications (Software specification)<br />

A detailed description which will be the basis for system design <strong>and</strong> implementation. The document is<br />

mainly written for the system architects <strong>and</strong> the software developers.<br />

A common practice is to divide the requirements into functional <strong>and</strong> qualitative requirements. Qualitative<br />

requirements can also be called non-functional requirements or constraints.<br />

According to the European Commission st<strong>and</strong>ard for UR the key words “must”, “must not”, “required”,<br />

“shall”, “shall not”, “should”, “should not”, “recommended”, “may”, <strong>and</strong> “optional” in this document are to<br />

be interpreted as follows:<br />

Page 14/276

DETAILED USER & TECHNICAL REQUIREMENTS FOR CDPS<br />

AND USE-CASE MODELS<br />

Ref: PHASE V<br />

MUST<br />

This word, or the terms "REQUIRED" or "SHALL", means that the definition is an absolute requirement of<br />

the specification.<br />

MUST NOT<br />

This phrase, or the phrase "SHALL NOT", means that the definition is an absolute prohibition of the<br />

specification.<br />

SHOULD<br />

This word, or the adjective "RECOMMENDED", means that there may exist valid reasons in particular<br />

circumstances to ignore a particular item, but the full implications must be understood <strong>and</strong> carefully weighed<br />

before choosing a different course.<br />

SHOULD NOT<br />

This phrase, or the phrase "NOT RECOMMENDED" means that there may exist valid reasons in particular<br />

circumstances when the particular behaviour is acceptable or even useful, but the full implications should be<br />

understood <strong>and</strong> the case carefully weighed<br />

MAY<br />

This word, or the adjective "OPTIONAL", means that an item is truly optional.<br />

1.7 Abbreviations used in this document<br />

AAR<br />

ATR<br />

AEO<br />

AES<br />

AIS<br />

CCN-CSI<br />

CDPS<br />

DDS<br />

DG TAXUD<br />

DTI<br />

DWS<br />

EAD<br />

EBTI<br />

ECS<br />

EDI<br />

EDIFACT<br />

EFTA<br />

END<br />

EORI<br />

EU<br />

EXD<br />

ICS<br />

IRU<br />

ITE<br />

LRN<br />

MCA<br />

MRN<br />

MS<br />

NCTS<br />

Anticipated Arrival Record<br />

Anticipated Transit Record<br />

Authorised Economic Operator<br />

Automated Export <strong>System</strong><br />

Automated Import <strong>System</strong><br />

Common Communication Network – Common <strong>System</strong> Interface<br />

<strong>Customs</strong> <strong>Declaration</strong> <strong>Processing</strong> <strong>System</strong><br />

Data Dissemination <strong>System</strong><br />

Directorate General for Taxation <strong>and</strong> <strong>Customs</strong> Union, European Commission<br />

Direct Trader Input<br />

Data Warehouse <strong>System</strong><br />

Export Accompanying Document<br />

European Binding Tariff Information<br />

Export Control <strong>System</strong><br />