New Image Annual Report 2012 concept.indd - NZX

New Image Annual Report 2012 concept.indd - NZX

New Image Annual Report 2012 concept.indd - NZX

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to and forming part of the financial<br />

statements (continued)<br />

For the year ended 30 June <strong>2012</strong><br />

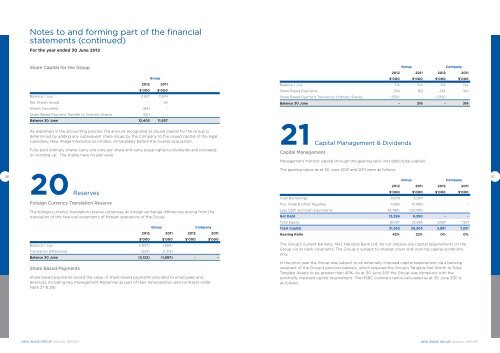

Share Capital for the Group<br />

Group<br />

<strong>2012</strong> 2011<br />

$’000 $’000<br />

Balance 1 July 11,937 11,874<br />

Net Shares Issued - 63<br />

Shares Cancelled (84) -<br />

Share Based Payment Transfer to Ordinary Shares 550 -<br />

Balance 30 June 12,403 11,937<br />

As explained in the accounting policies, the amount recognised as issued capital for the Group is<br />

determined by adding any subsequent share issues by the Company to the issued capital of the legal<br />

subsidiary, <strong>New</strong> <strong>Image</strong> International Limited, immediately before the reverse acquisition.<br />

Fully paid ordinary shares carry one vote per share and carry equal rights to dividends and proceeds<br />

on winding up. The shares have no par value.<br />

Group Company<br />

<strong>2012</strong> 2011 <strong>2012</strong> 2011<br />

$’000 $’000 $’000 $’000<br />

Balance 1 July 316 154 316 154<br />

Share Based Payments 234 162 234 162<br />

Share Based Payment Transfer to Ordinary Shares (550) - (550) -<br />

Balance 30 June - 316 - 316<br />

21 Capital<br />

Capital Management<br />

Management & Dividends<br />

Management monitor capital through the gearing ratio (net debt/total capital).<br />

56<br />

20 Reserves<br />

Foreign Currency Translation Reserve<br />

The foreign currency translation reserve comprises all foreign exchange differences arising from the<br />

translation of the financial statements of foreign operations of the Group.<br />

Group Company<br />

<strong>2012</strong> 2011 <strong>2012</strong> 2011<br />

$’000 $’000 $’000 $’000<br />

Balance 1 July (1,897) (684) - -<br />

Translation Differences (225) (1,213) - -<br />

Balance 30 June (2,122) (1,897) - -<br />

Share Based Payments<br />

Share based payments record the value of share based payments provided to employees and<br />

directors, including Key Management Personnel as part of their remuneration and contracts (refer<br />

Note 27 & 28).<br />

The gearing ratios as at 30 June <strong>2012</strong> and 2011 were as follows:<br />

Group Company<br />

<strong>2012</strong> 2011 <strong>2012</strong> 2011<br />

$’000 $’000 $’000 $’000<br />

Total Borrowings 8,678 9,290 - -<br />

Plus Trade & Other Payables 11,386 10,090 - -<br />

Less Cash and Cash Equivalents (6,768) (13,030) - -<br />

Net Debt 13,296 6,350 - -<br />

Total Equity 18,057 22,955 3,981 7,251<br />

Total Capital 31,353 29,305 3,981 7,251<br />

Gearing Ratio 42% 22% 0% 0%<br />

The Group’s current bankers, ANZ National Bank Ltd, do not impose any capital requirements on the<br />

Group via its bank covenants. The Group is subject to interest cover and working capital conditions<br />

only.<br />

In the prior year the Group was subject to an externally imposed capital requirement via a banking<br />

covenant of the Group’s previous bankers, which required the Group’s Tangible Net Worth to Total<br />

Tangible Assets to be greater than 40%. As at 30 June 2011 the Group was compliant with the<br />

externally imposed capital requirement. The HSBC covenant ratios calculated as at 30 June 2011 is<br />

as follows:<br />

57<br />

NEW IMAGE GROUP ANNUAL REPORT<br />

NEW IMAGE GROUP ANNUAL REPORT