New Image Annual Report 2012 concept.indd - NZX

New Image Annual Report 2012 concept.indd - NZX

New Image Annual Report 2012 concept.indd - NZX

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to and forming part of the financial<br />

statements (continued)<br />

For the year ended 30 June <strong>2012</strong><br />

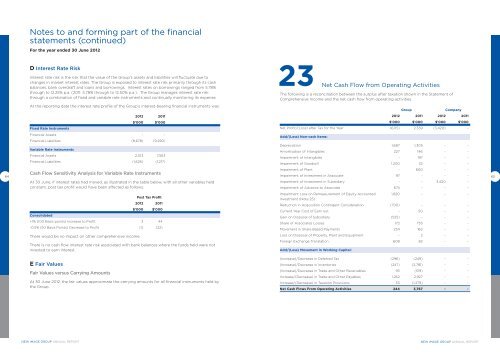

D Interest Rate Risk<br />

Interest rate risk is the risk that the value of the Group’s assets and liabilities will fluctuate due to<br />

changes in market interest rates. The Group is exposed to interest rate risk primarily through its cash<br />

balances, bank overdraft and loans and borrowings. Interest rates on borrowings ranged from 5.78%<br />

through to 12.25% p.a. (2011: 5.78% through to 12.50% p.a.). The Group manages interest rate risk<br />

through a combination of fixed and variable rate instruments and continually monitoring its expense.<br />

23 Net<br />

Cash Flow from Operating Activities<br />

The following is a reconciliation between the surplus after taxation shown in the Statement of<br />

Comprehensive Income and the net cash flow from operating activities.<br />

At the reporting date the interest rate profile of the Group’s interest-bearing financial instruments was:<br />

Group Company<br />

<strong>2012</strong> 2011<br />

<strong>2012</strong> 2011 <strong>2012</strong> 2011<br />

$’000 $’000<br />

$’000 $’000 $’000 $’000<br />

Fixed Rate Instruments<br />

Net Profit/(Loss) after Tax for the Year (6,115) 2,339 (3,420) -<br />

Financial Assets - -<br />

Financial Liabilities (8,678) (9,290)<br />

Variable Rate Instruments<br />

Financial Assets 2,013 7,563<br />

Financial Liabilities (1,626) (1,217)<br />

Add/(Less) Non-cash Items:<br />

Depreciation 1,687 1,305 - -<br />

Amortisation of Intangibles 227 146 - -<br />

Impairment of Intangibles - 197 - -<br />

Impairment of Goodwill 1,200 32 - -<br />

64<br />

Cash Flow Sensitivity Analysis for Variable Rate Instruments<br />

Impairment of Plant - 600 - -<br />

Impairment of Investment in Associate 97 - - -<br />

65<br />

At 30 June, if interest rates had moved, as illustrated in the table below, with all other variables held<br />

constant, post tax profit would have been affected as follows:<br />

Impairment of Investment in Subsidiary - - 3,420 -<br />

Impairment of Advance to Associate 674 - - -<br />

Post Tax Profit<br />

<strong>2012</strong> 2011<br />

$’000 $’000<br />

Consolidated<br />

+1% (100 Basis points) Increase to Profit 3 44<br />

-0.5% (50 Basis Points) Decrease to Profit (1) (22)<br />

Impairment Loss on Remeasurement of Equity Accounted<br />

Investment (Note 25)<br />

1,820 - - -<br />

Reduction in Acquisition Contingent Consideration (700) - - -<br />

Current Year Cost of Earn out - 50 - -<br />

Gain on Disposal of Subsidiary (525) - - -<br />

Share of Associates Losses 172 753 - -<br />

Movement in Share Based Payments 234 162 - -<br />

There would be no impact on other comprehensive income.<br />

Loss on Disposal of Property, Plant and Equipment - 2 - -<br />

There is no cash flow interest rate risk associated with bank balances where the funds held were not<br />

invested to earn interest.<br />

Foreign Exchange Translation 608 82 - -<br />

Add/(Less) Movement in Working Capital:<br />

E Fair Values<br />

(Increase)/Decrease in Deferred Tax (296) (249) - -<br />

(Increase)/Decrease in Inventories (247) (2,781) - -<br />

Fair Values versus Carrying Amounts<br />

At 30 June <strong>2012</strong>, the fair values approximate the carrying amounts for all financial instruments held by<br />

the Group.<br />

(Increase)/Decrease in Trade and Other Receivables 93 (519) - -<br />

Increase/(Decrease) in Trade and Other Payables 1,262 2,927 - -<br />

Increase/(Decrease) in Taxation Provisions 53 (1,279) - -<br />

Net Cash Flows From Operating Activities 244 3,767 - -<br />

NEW IMAGE GROUP ANNUAL REPORT<br />

NEW IMAGE GROUP ANNUAL REPORT