New Image Annual Report 2012 concept.indd - NZX

New Image Annual Report 2012 concept.indd - NZX

New Image Annual Report 2012 concept.indd - NZX

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to and forming part of the financial<br />

statements (continued)<br />

For the year ended 30 June <strong>2012</strong><br />

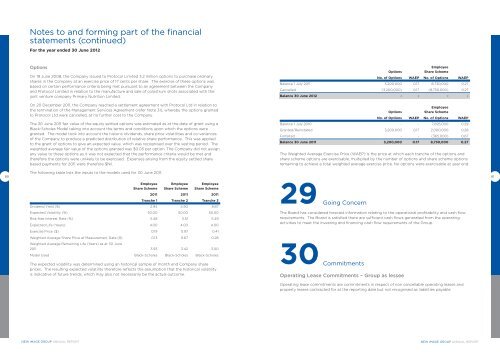

Options<br />

On 19 June 2008, the Company issued to Protocol Limited 3.2 million options to purchase ordinary<br />

shares in the Company at an exercise price of 17 cents per share. The exercise of these options was<br />

based on certain performance criteria being met pursuant to an agreement between the Company<br />

and Protocol Limited in relation to the manufacture and sale of colostrum shots associated with the<br />

joint venture company Primary Nutrition Limited.<br />

On 20 December 2011, the Company reached a settlement agreement with Protocol Ltd in relation to<br />

the termination of the Management Services Agreement (refer Note 31), whereby the options granted<br />

to Protocol Ltd were cancelled, at no further cost to the Company.<br />

The 30 June 2011 fair value of the equity settled options was estimated as at the date of grant using a<br />

Black-Scholes Model taking into account the terms and conditions upon which the options were<br />

granted. The model took into account the historic dividends, share price volatilities and co-variances<br />

of the Company to produce a predicted distribution of relative share performance. This was applied<br />

to the grant of options to give an expected value, which was recognised over the vesting period. The<br />

weighted average fair value of the options granted was $0.05 per option. The Company did not assign<br />

any value to these options as it was not expected that the performance criteria would be met and<br />

therefore the options were unlikely to be exercised. Expenses arising from the equity settled share<br />

based payments for 2011 were therefore $Nil.<br />

Employee<br />

Options<br />

Share Scheme<br />

No. of Options WAEP No. of Options WAEP<br />

Balance 1 July 2011 3,200,000 0.17 8,730,000 0.27<br />

Cancelled (3,200,000) 0.17 (8,730,000) 0.27<br />

Balance 30 June <strong>2012</strong> - - - -<br />

Employee<br />

Options<br />

Share Scheme<br />

No. of Options WAEP No. of Options WAEP<br />

Balance 1 July 2010 - - 7,095,000 0.29<br />

Granted/Reinstated 3,200,000 0.17 2,000,000 0.28<br />

Forfeited - - (365,000) 0.67<br />

Balance 30 June 2011 3,200,000 0.17 8,730,000 0.27<br />

The Weighted Average Exercise Price (WAEP) is the price at which each tranche of the options and<br />

share scheme options are exercisable, multiplied by the number of options and share scheme options<br />

remaining to achieve a total weighted average exercise price. No options were exercisable at year end.<br />

80<br />

The following table lists the inputs to the models used for 30 June 2011:<br />

81<br />

Employee<br />

Share Scheme<br />

Employee<br />

Share Scheme<br />

Employee<br />

Share Scheme<br />

2011 2011 2011<br />

Tranche 1 Tranche 2 Tranche 3<br />

Dividend Yield (%) 2.94 4.90 8.87<br />

Expected Volatility (%) 50.00 50.00 50.00<br />

Risk-free Interest Rate (%) 5.48 5.51 5.49<br />

Expected Life (Years) 4.00 4.00 4.00<br />

29<br />

Going Concern<br />

The Board has considered forecast information relating to the operational profitability and cash flow<br />

requirements. The Board is satisfied there are sufficient cash flows generated from the operating<br />

activities to meet the investing and financing cash flow requirements of the Group.<br />

Exercise Price ($) 0.19 0.97 0.41<br />

Weighted Average Share Price at Measurement Date ($) 0.13 0.67 0.28<br />

Weighted Average Remaining Life (Years) as at 30 June<br />

2011 3.93 3.42 3.00<br />

Model Used Black-Scholes Black-Scholes Black-Scholes<br />

The expected volatility was determined using an historical sample of month end Company share<br />

prices. The resulting expected volatility therefore reflects the assumption that the historical volatility<br />

is indicative of future trends, which may also not necessarily be the actual outcome.<br />

30<br />

Commitments<br />

Operating Lease Commitments – Group as lessee<br />

Operating lease commitments are commitments in respect of non cancellable operating leases and<br />

property leases contracted for at the reporting date but not recognised as liabilities payable.<br />

NEW IMAGE GROUP ANNUAL REPORT<br />

NEW IMAGE GROUP ANNUAL REPORT