2005 - Oil India Limited

2005 - Oil India Limited

2005 - Oil India Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

OIL beyond territorial barriers<br />

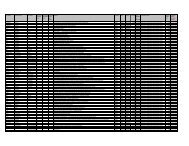

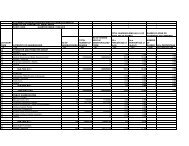

Year 2001-02, 2002-03, 2003-04 & 2004-05 (Nine<br />

Months ended Dec. 2004) is as under: -<br />

Particulars Pre ONGC Post ONGC<br />

2001-02 2002-03 2003-04 2004-05<br />

9 months<br />

Thruput MMTP 5.32 7.25 10.05 8.71<br />

Rs. Crs Rs. Crs Rs. Crs Rs. Crs<br />

PBDIT 288 319 1357 1408<br />

Interest &<br />

Finance Charges 672 567* 373 181<br />

PBDT -384 -248 984 1227<br />

Depreciation &<br />

Amortization 394 405 409 308<br />

PBT -779 -653 575 919<br />

Provision for<br />

Tax / Deferred<br />

Tax -286 -241 115 350<br />

PAT -492 -412 459 569<br />

GRM (US$/BBL) 1.74 2.04 3.90 5.62<br />

* DRP was effective from 1st July 2002.<br />

Special emphasis has been given on safety and<br />

environment protection. MRPL has been awarded 5 Star<br />

rating by British Safety Council. As on 1st February <strong>2005</strong>,<br />

accident free days are 419.<br />

Various initiatives have been taken to further reduce the<br />

interest on working capital borrowing and also term loans<br />

as under: -<br />

a) Working Capital Borrowing has been shifted from PLR<br />

(presently 10.25% p.a.) linked to Libor (around 2.5-<br />

3% p.a.) linked. Saving of around 6.5% p.a.<br />

b) ONGC's Working Capital Loan of Rs.450 Crores was<br />

refinanced by MRPL by availing Buyers credit facility<br />

with ONGC's guarantee carrying interest at around<br />

1.5% p.a.<br />

c) MRPL persuaded Saudi Aramco (Crude Supplier) to<br />

supply crude without insisting for any LC with the<br />

backing of ONGC's parental guarantee.<br />

d) Once the IOC-NIOC contract was assigned by IOC in<br />

February 2004, MRPL took up with NIOC for waiver<br />

of confirmation / handling charges pertaining to LC<br />

levied by Bank Markazi, Iran (0.10% flat for<br />

confirmation & 0.10% flat for handling). After lot of<br />

persuasion NIOC & Bank Markazi agreed to waive the<br />

confirmation charges of LCs with support of RBI.<br />

e) Long Term Loan of Rs. 2400 Crores availed from<br />

ONGC in January 2004 to refinance Facilities `A', `B'<br />

and the outstanding under facility `C', carrying interest<br />

linked to Bank Rate (Presently 6% p.a.) have been<br />

prepaid to the extent of 600 Crores.<br />

The Annual Accounts of MRPL for the year 2002-03,<br />

2003-04 were subjected to C&AG supplementing Audit<br />

U/s 619(4). C&AG have given nil report on the same.<br />

Other positive features after ONGC's entry in MRPL<br />

The short term borrowing programme of MRPL is rated at<br />

A1+rating (indicating highest safety) by ICRA on standalone<br />

basis without the benefit of comfort from ONGC.<br />

The share price of MRPL<br />

share to almost Rs.53 per<br />

share (increase of about<br />

550%) indicating the<br />

substantial improvement in<br />

Investors confidence in<br />

MRPL.<br />

Market capitalization of MRPL's equity has increased<br />

from Rs.638 Crores to approximately Rs.9000 Crores<br />

increase of 1310%.<br />

MRPL, which was virtually a sick unit at the time of<br />

acquisition of A.V. Birla's stake by ONGC, entered BSE<br />

top 30 portals on 7th January 2004.<br />

MRPL has started getting Mumbai High crude. MRPL has<br />

also started processing Nile crude. ESC for MRPL has been<br />

constituted by MOP&NG. MRPL has for the first time<br />

signed a Term Contract with Saudi Aramco (National <strong>Oil</strong><br />

Company of the Kingdom of Saudi Arabia). MOP&NG has<br />

also approved assignment of NIOC-IOC contract of 5<br />

MMTPA for import of Iran Mix crude in favour of MRPL.<br />

The crude procurement is now directly done by MRPL<br />

saving the canalizing charges / commission to the buying<br />

agent of about 3 cents per barrel.<br />

MRPL has finalized Contract of Affreightment with the<br />

help of Transchart (Ministry of Shipping) for transporting its<br />

Arab Mix / Iran Mix crude for the year 2003-04 & 2004-05<br />

at very competitive rates.<br />

12