2005 - Oil India Limited

2005 - Oil India Limited

2005 - Oil India Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

OIL beyond territorial barriers<br />

Merger and Acquisition for Synergy in Petroleum Business<br />

By J. M . BUJOR BARUAH<br />

Shri J. M. B. Baruah, a Petroleum and Management<br />

Consultant, was the Chairman and Managing Director of<br />

Bongaigaon Refinery and Petrochemicals Ltd. He was also the<br />

Director (Exploration and Development), <strong>Oil</strong> <strong>India</strong> <strong>Limited</strong>,<br />

and former Managing Director of Prize Petroleum Co. Ltd.<br />

BACK-GROUND<br />

For about three decades, I was closely associated with <strong>Oil</strong><br />

<strong>India</strong> <strong>Limited</strong> as an employee in various capacities. I was<br />

naturally delighted when I got an opportunity to share<br />

some of my thoughts on certain aspects of future growth<br />

potential of the company through the pages<br />

of SYNERGY.<br />

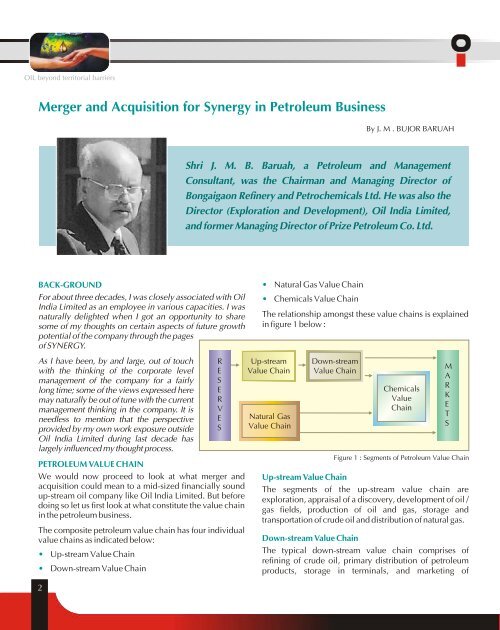

• Natural Gas Value Chain<br />

• Chemicals Value Chain<br />

The relationship amongst these value chains is explained<br />

in figure 1 below :<br />

As I have been, by and large, out of touch<br />

with the thinking of the corporate level<br />

management of the company for a fairly<br />

long time; some of the views expressed here<br />

may naturally be out of tune with the current<br />

management thinking in the company. It is<br />

needless to mention that the perspective<br />

provided by my own work exposure outside<br />

<strong>Oil</strong> <strong>India</strong> <strong>Limited</strong> during last decade has<br />

largely influenced my thought process.<br />

PETROLEUM VALUE CHAIN<br />

We would now proceed to look at what merger and<br />

acquisition could mean to a mid-sized financially sound<br />

up-stream oil company like <strong>Oil</strong> <strong>India</strong> <strong>Limited</strong>. But before<br />

doing so let us first look at what constitute the value chain<br />

in the petroleum business.<br />

The composite petroleum value chain has four individual<br />

value chains as indicated below:<br />

• Up-stream Value Chain<br />

• Down-stream Value Chain<br />

2<br />

R<br />

E<br />

S<br />

E<br />

R<br />

V<br />

E<br />

S<br />

Up-stream<br />

Value Chain<br />

Natural Gas<br />

Value Chain<br />

Down-stream<br />

Value Chain<br />

Chemicals<br />

Value<br />

Chain<br />

Figure 1 : Segments of Petroleum Value Chain<br />

Up-stream Value Chain<br />

The segments of the up-stream value chain are<br />

exploration, appraisal of a discovery, development of oil /<br />

gas fields, production of oil and gas, storage and<br />

transportation of crude oil and distribution of natural gas.<br />

Down-stream Value Chain<br />

The typical down-stream value chain comprises of<br />

refining of crude oil, primary distribution of petroleum<br />

products, storage in terminals, and marketing of<br />

M<br />

A<br />

R<br />

K<br />

E<br />

T<br />

S