2005 - Oil India Limited

2005 - Oil India Limited

2005 - Oil India Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

OIL beyond territorial barriers<br />

of the known field, shallower or deeper prospects within<br />

the known limit of the field, scopes for re-development for<br />

enhancing recovery of the existing field, and / or<br />

discovery of new field within the lease area based on a<br />

fresh evaluation of the prospects. These relatively high<br />

risk components do not form part of the standard<br />

valuation of the assets as only proved and probable<br />

reserves are normally taken into account in these<br />

exercises.<br />

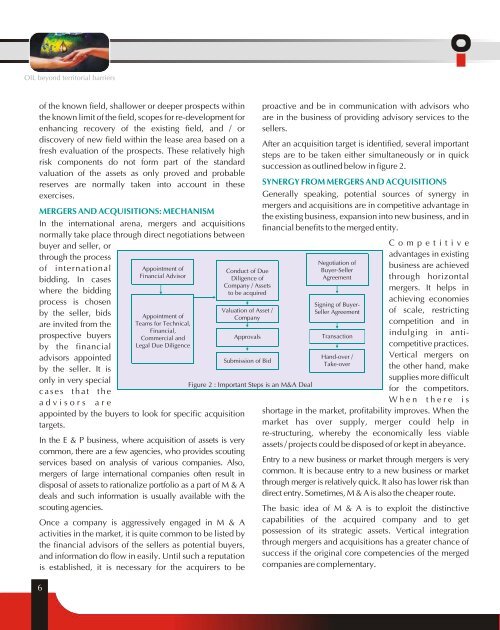

MERGERS AND ACQUISITIONS: MECHANISM<br />

In the international arena, mergers and acquisitions<br />

normally take place through direct negotiations between<br />

buyer and seller, or<br />

through the process<br />

of international<br />

bidding. In cases<br />

where the bidding<br />

process is chosen<br />

by the seller, bids<br />

are invited from the<br />

prospective buyers<br />

by the financial<br />

advisors appointed<br />

by the seller. It is<br />

only in very special<br />

cases that the<br />

advisors are<br />

6<br />

Appointment of<br />

Financial Advisor<br />

Appointment of<br />

Teams for Technical,<br />

Financial,<br />

Commercial and<br />

Legal Due Diligence<br />

appointed by the buyers to look for specific acquisition<br />

targets.<br />

In the E & P business, where acquisition of assets is very<br />

common, there are a few agencies, who provides scouting<br />

services based on analysis of various companies. Also,<br />

mergers of large international companies often result in<br />

disposal of assets to rationalize portfolio as a part of M & A<br />

deals and such information is usually available with the<br />

scouting agencies.<br />

Once a company is aggressively engaged in M & A<br />

activities in the market, it is quite common to be listed by<br />

the financial advisors of the sellers as potential buyers,<br />

and information do flow in easily. Until such a reputation<br />

is established, it is necessary for the acquirers to be<br />

Conduct of Due<br />

Diligence of<br />

Company / Assets<br />

to be acquired<br />

Valuation of Asset /<br />

Company<br />

Approvals<br />

Submission of Bid<br />

Figure 2 : Important Steps is an M&A Deal<br />

proactive and be in communication with advisors who<br />

are in the business of providing advisory services to the<br />

sellers.<br />

After an acquisition target is identified, several important<br />

steps are to be taken either simultaneously or in quick<br />

succession as outlined below in figure 2.<br />

SYNERGY FROM MERGERS AND ACQUISITIONS<br />

Generally speaking, potential sources of synergy in<br />

mergers and acquisitions are in competitive advantage in<br />

the existing business, expansion into new business, and in<br />

financial benefits to the merged entity.<br />

Negotiation of<br />

Buyer-Seller<br />

Agreement<br />

Signing of Buyer-<br />

Seller Agreement<br />

Transaction<br />

Hand-over /<br />

Take-over<br />

Competitive<br />

advantages in existing<br />

business are achieved<br />

through horizontal<br />

mergers. It helps in<br />

achieving economies<br />

of scale, restricting<br />

competition and in<br />

indulging in anticompetitive<br />

practices.<br />

Vertical mergers on<br />

the other hand, make<br />

supplies more difficult<br />

for the competitors.<br />

When there is<br />

shortage in the market, profitability improves. When the<br />

market has over supply, merger could help in<br />

re-structuring, whereby the economically less viable<br />

assets / projects could be disposed of or kept in abeyance.<br />

Entry to a new business or market through mergers is very<br />

common. It is because entry to a new business or market<br />

through merger is relatively quick. It also has lower risk than<br />

direct entry. Sometimes, M & A is also the cheaper route.<br />

The basic idea of M & A is to exploit the distinctive<br />

capabilities of the acquired company and to get<br />

possession of its strategic assets. Vertical integration<br />

through mergers and acquisitions has a greater chance of<br />

success if the original core competencies of the merged<br />

companies are complementary.