Ottawa ON K1A 0E4

Ottawa ON K1A 0E4

Ottawa ON K1A 0E4

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

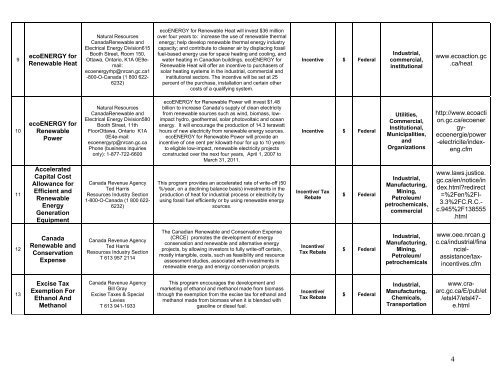

9<br />

ecoENERGY for<br />

Renewable Heat<br />

Natural Resources<br />

CanadaRenewable and<br />

Electrical Energy Division615<br />

Booth Street, Room 150,<br />

<strong>Ottawa</strong>, Ontario, <strong>K1A</strong> 0E9email:<br />

ecoenergyrhp@nrcan.gc.ca1<br />

-800-O-Canada (1 800 622-<br />

6232)<br />

ecoENERGY for Renewable Heat will invest $36 million<br />

over four years to: increase the use of renewable thermal<br />

energy; help develop renewable thermal energy industry<br />

capacity; and contribute to cleaner air by displacing fossil<br />

fuel-based energy use for space heating and cooling, and<br />

water heating in Canadian buildings. ecoENERGY for<br />

Renewable Heat will offer an incentive to purchasers of<br />

solar heating systems in the industrial, commercial and<br />

institutional sectors. The incentive will be set at 25<br />

percent of the purchase, installation and certain other<br />

costs of a qualifying system.<br />

Incentive $ Federal<br />

Industrial,<br />

commercial,<br />

institutional<br />

www.ecoaction.gc<br />

.ca/heat<br />

10<br />

11<br />

ecoENERGY for<br />

Renewable<br />

Power<br />

Accelerated<br />

Capital Cost<br />

Allowance for<br />

Efficient and<br />

Renewable<br />

Energy<br />

Generation<br />

Equipment<br />

Natural Resources<br />

CanadaRenewable and<br />

Electrical Energy Division580<br />

Booth Street, 11th<br />

Floor<strong>Ottawa</strong>, Ontario <strong>K1A</strong><br />

<strong>0E4</strong>e-mail:<br />

ecoenergyrp@nrcan.gc.ca<br />

Phone (business inquiries<br />

only): 1-877-722-6600<br />

Canada Revenue Agency<br />

Ted Harris<br />

Resources Industry Section<br />

1-800-O-Canada (1 800 622-<br />

6232)<br />

ecoENERGY for Renewable Power will invest $1.48<br />

billion to increase Canada’s supply of clean electricity<br />

from renewable sources such as wind, biomass, lowimpact<br />

hydro, geothermal, solar photovoltaic and ocean<br />

energy. It will encourage the production of 14.3 terawatt<br />

hours of new electricity from renewable energy sources.<br />

ecoENERGY for Renewable Power will provide an<br />

incentive of one cent per kilowatt-hour for up to 10 years<br />

to eligible low-impact, renewable electricity projects<br />

constructed over the next four years, April 1, 2007 to<br />

March 31, 2011.<br />

This program provides an accelerated rate of write-off (50<br />

%/year, on a declining balance basis) investments in the<br />

production of heat for industrial process or electricity by<br />

using fossil fuel efficiently or by using renewable energy<br />

sources.<br />

Incentive $ Federal<br />

Incentive/ Tax<br />

Rebate<br />

$ Federal<br />

Utilities,<br />

Commercial,<br />

Institutional,<br />

Municipalities,<br />

and<br />

Organizations<br />

Industrial,<br />

Manufacturing,<br />

Mining,<br />

Petroleum/<br />

petrochemicals,<br />

commercial<br />

http://www.ecoacti<br />

on.gc.ca/ecoener<br />

gyecoenergie/power<br />

-electricite/indexeng.cfm<br />

www.laws.justice.<br />

gc.ca/en/notice/in<br />

dex.html?redirect<br />

=%2Fen%2FI-<br />

3.3%2FC.R.C.-<br />

c.945%2F138555<br />

.html<br />

12<br />

Canada<br />

Renewable and<br />

Conservation<br />

Expense<br />

Canada Revenue Agency<br />

Ted Harris<br />

Resources Industry Section<br />

T 613 957 2114<br />

The Canadian Renewable and Conservation Expense<br />

(CRCE) promotes the development of energy<br />

conservation and renewable and alternative energy<br />

projects, by allowing investors to fully write-off certain,<br />

mostly intangible, costs, such as feasibility and resource<br />

assessment studies, associated with investments in<br />

renewable energy and energy conservation projects.<br />

Incentive/<br />

Tax Rebate<br />

$ Federal<br />

Industrial,<br />

Manufacturing,<br />

Mining,<br />

Petroleum/<br />

petrochemicals<br />

www.oee.nrcan.g<br />

c.ca/industrial/fina<br />

ncialassistance/taxincentives.cfm<br />

13<br />

Excise Tax<br />

Exemption For<br />

Ethanol And<br />

Methanol<br />

Canada Revenue Agency<br />

Bill Gray<br />

Excise Taxes & Special<br />

Levies<br />

T 613 941-1933<br />

This program encourages the development and<br />

marketing of ethanol and methanol made from biomass<br />

through the exemption from the excise tax for ethanol and<br />

methanol made from biomass when it is blended with<br />

gasoline or diesel fuel.<br />

Incentive/<br />

Tax Rebate<br />

$ Federal<br />

Industrial,<br />

Manufacturing,<br />

Chemicals,<br />

Transportation<br />

www.craarc.gc.ca/E/pub/et<br />

/etsl47/etsl47-<br />

e.html<br />

4