Petition for Change to Ohio Residency Status - Owens Community ...

Petition for Change to Ohio Residency Status - Owens Community ...

Petition for Change to Ohio Residency Status - Owens Community ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

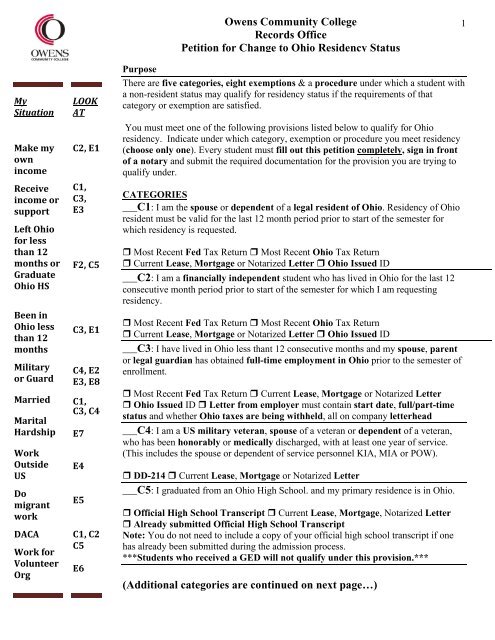

<strong>Owens</strong> <strong>Community</strong> College<br />

Records Office<br />

<strong>Petition</strong> <strong>for</strong> <strong>Change</strong> <strong>to</strong> <strong>Ohio</strong> <strong>Residency</strong> <strong>Status</strong><br />

1<br />

My<br />

Situation<br />

Make my<br />

own<br />

income<br />

Receive<br />

income or<br />

support<br />

Left <strong>Ohio</strong><br />

<strong>for</strong> less<br />

than 12<br />

months or<br />

Graduate<br />

<strong>Ohio</strong> HS<br />

Been in<br />

<strong>Ohio</strong> less<br />

than 12<br />

months<br />

Military<br />

or Guard<br />

Married<br />

Marital<br />

Hardship<br />

Work<br />

Outside<br />

US<br />

Do<br />

migrant<br />

work<br />

DACA<br />

Work <strong>for</strong><br />

Volunteer<br />

Org<br />

LOOK<br />

AT<br />

C2, E1<br />

C1,<br />

C3,<br />

E3<br />

F2, C5<br />

C3, E1<br />

C4, E2<br />

E3, E8<br />

C1,<br />

C3, C4<br />

E7<br />

E4<br />

E5<br />

C1, C2<br />

C5<br />

E6<br />

Purpose<br />

There are five categories, eight exemptions & a procedure under which a student with<br />

a non-resident status may qualify <strong>for</strong> residency status if the requirements of that<br />

category or exemption are satisfied.<br />

You must meet one of the following provisions listed below <strong>to</strong> qualify <strong>for</strong> <strong>Ohio</strong><br />

residency. Indicate under which category, exemption or procedure you meet residency<br />

(choose only one). Every student must fill out this petition completely, sign in front<br />

of a notary and submit the required documentation <strong>for</strong> the provision you are trying <strong>to</strong><br />

qualify under.<br />

CATEGORIES<br />

___C1: I am the spouse or dependent of a legal resident of <strong>Ohio</strong>. <strong>Residency</strong> of <strong>Ohio</strong><br />

resident must be valid <strong>for</strong> the last 12 month period prior <strong>to</strong> start of the semester <strong>for</strong><br />

which residency is requested.<br />

Most Recent Fed Tax Return Most Recent <strong>Ohio</strong> Tax Return<br />

Current Lease, Mortgage or Notarized Letter <strong>Ohio</strong> Issued ID<br />

___C2: I am a financially independent student who has lived in <strong>Ohio</strong> <strong>for</strong> the last 12<br />

consecutive month period prior <strong>to</strong> start of the semester <strong>for</strong> which I am requesting<br />

residency.<br />

Most Recent Fed Tax Return Most Recent <strong>Ohio</strong> Tax Return<br />

Current Lease, Mortgage or Notarized Letter <strong>Ohio</strong> Issued ID<br />

___C3: I have lived in <strong>Ohio</strong> less thant 12 consecutive months and my spouse, parent<br />

or legal guardian has obtained full-time employment in <strong>Ohio</strong> prior <strong>to</strong> the semester of<br />

enrollment.<br />

Most Recent Fed Tax Return Current Lease, Mortgage or Notarized Letter<br />

<strong>Ohio</strong> Issued ID Letter from employer must contain start date, full/part-time<br />

status and whether <strong>Ohio</strong> taxes are being withheld, all on company letterhead<br />

___C4: I am a US military veteran, spouse of a veteran or dependent of a veteran,<br />

who has been honorably or medically discharged, with at least one year of service.<br />

(This includes the spouse or dependent of service personnel KIA, MIA or POW).<br />

DD-214 Current Lease, Mortgage or Notarized Letter<br />

___C5: I graduated from an <strong>Ohio</strong> High School. and my primary residence is in <strong>Ohio</strong>.<br />

Official High School Transcript Current Lease, Mortgage, Notarized Letter<br />

Already submitted Official High School Transcript<br />

Note: You do not need <strong>to</strong> include a copy of your official high school transcript if one<br />

has already been submitted during the admission process.<br />

***Students who received a GED will not qualify under this provision.***<br />

(Additional categories are continued on next page…)<br />

Revised 9/2013

2<br />

Exemption Categories<br />

___E1: I am an independent student, have resided in <strong>Ohio</strong> <strong>for</strong> less than 12 consecutive months, am employed<br />

in the State of <strong>Ohio</strong> and am attending as a part-time student.<br />

Letter from employer must contain start date, full/part-time status and whether <strong>Ohio</strong> taxes are being<br />

withheld, all on company letterhead. Most Recent Fed Tax Return Current Lease, Mortgage, or<br />

Notarized Letter <strong>Ohio</strong> Issued ID<br />

_________________________________________________________________________________________<br />

___E2: I am military personnel, the spouse or dependent of a person who is on active military duty,<br />

stationed outside the state of <strong>Ohio</strong> and has maintained home of record as <strong>Ohio</strong>.<br />

Most Recent Fed Tax Return Most Recent <strong>Ohio</strong> Tax Returns Current Lease, Mortgage or Notarized Letter<br />

Copy of Military Orders Showing <strong>Ohio</strong> as Home State of Record <strong>Ohio</strong> Issued ID<br />

___E3: I am military personnel, the spouse or dependent of a person who is on active military duty and is<br />

currently stationed in <strong>Ohio</strong>.<br />

Most Recent Federal Tax Return Current Lease, Mortgage or Notarized Letter<br />

Copy of Military Orders showing stationed in State or Military Issued ID<br />

___E4: My parent, legal guardian, or I have been transferred by an employer beyond the terri<strong>to</strong>rial limits<br />

of the United States while maintaining <strong>Ohio</strong> residency.<br />

Most Recent Fed Tax Return Most Recent <strong>Ohio</strong> Tax Return Current Lease, Mortgage or Notarized Letter<br />

<strong>Ohio</strong> Issued ID Letter from Employer Verifying Transfer<br />

___E5: My parent or legal guardian is, or I am, employed as a migrant worker in the state of <strong>Ohio</strong>, and<br />

worked in <strong>Ohio</strong> <strong>for</strong> at least four months <strong>for</strong> each of the past three years.<br />

Most Recent Fed Tax Return Most Recent <strong>Ohio</strong> Tax Return <strong>Ohio</strong> Issued ID Certificate from <strong>Ohio</strong><br />

Migrant Education Center, letter from Employer, Letter from ODJFS – All must certify dates of employment or<br />

dependency.<br />

___E6: My parent, legal guardian, spouse, or I was a resident of <strong>Ohio</strong> prior <strong>to</strong> community service position<br />

(VISTA, Americorps, Peace Corps, or elected/appointed public office <strong>for</strong> up <strong>to</strong> 24 consecutive months).<br />

Most Recent Fed Tax Return Most Recent <strong>Ohio</strong> Tax Return Current Lease, Mortgage or Notarized Letter<br />

Letter from <strong>Community</strong> Service Organization verifying position held and dates of employment.<br />

<strong>Ohio</strong> Issued ID<br />

___E7: I have returned <strong>to</strong> the State of <strong>Ohio</strong> due <strong>to</strong> marital hardship and established financial dependence on<br />

my parent or legal guardian; or, I am the dependent of such an individual.<br />

Monthly Income/Expense statement listing 50% + support from Parent/Legal Guardian Copy of<br />

Legal Documentation <strong>to</strong> End/Dissolve Marriage Notarized Letter from Parent <strong>Ohio</strong> Issued ID<br />

___E8: My parent, legal guardian, or spouse is, or I am, a member of the <strong>Ohio</strong> National Guard and reside<br />

in <strong>Ohio</strong>.<br />

Most Recent Fed Tax Return Most Recent <strong>Ohio</strong> Tax Return Copy Military Orders/Letter from<br />

Commander Showing <strong>Ohio</strong> National Guard Membership <strong>Ohio</strong> Issued ID<br />

(Additional categories are continued on next page…)<br />

Revised 9/2013

3<br />

Procedure Categories<br />

___F2: I was previously an <strong>Ohio</strong> resident and have not resided outside of the State of <strong>Ohio</strong> <strong>for</strong> longer than<br />

12 consecutive months and I have re-established domicile in <strong>Ohio</strong>.<br />

Independent<br />

Most Recent Fed and <strong>Ohio</strong> State Tax Return Copy of Leases, Mortgages, Notarized Letters Showing<br />

<strong>Ohio</strong> <strong>Residency</strong> Be<strong>for</strong>e You Left, residence while you were gone and current residence <strong>Ohio</strong> Issued ID<br />

Dependent<br />

Parent’s Most Recent Fed and <strong>Ohio</strong> State Tax Return Copy of Lease, Mortgage, Notarized Letter<br />

Showing <strong>Ohio</strong> <strong>Residency</strong> Be<strong>for</strong>e You Left Notarized Letter from Parent’s showing current domicile<br />

<strong>Ohio</strong> Issued ID<br />

Documentation Notes:<br />

Attach the supporting documentation that is required under the provision <strong>for</strong> which you feel you are qualified.<br />

Only the first page of any tax return needs <strong>to</strong> be submitted, income in<strong>for</strong>mation may be omitted.<br />

Lease/mortgage/notarized letter in<strong>for</strong>mation must cover 12 consecutive months prior <strong>to</strong> semester.<br />

All letters <strong>for</strong> verification of domicile must be notarized.<br />

All letters from employers or business must be on letter head with company contact in<strong>for</strong>mation.<br />

Applications with incomplete or missing documentation will not be given consideration.<br />

Only submit the requested documentation <strong>for</strong> the provision you have selected. Documentation that is<br />

not required <strong>for</strong> this application will be destroyed.<br />

If you do not meet any of these criteria, you are not an <strong>Ohio</strong> resident <strong>for</strong> tuition purposes; do not<br />

complete this <strong>for</strong>m.<br />

Submission Deadlines<br />

Mailing Address<br />

Spring semester: April 15 th Records Office<br />

Summer semester: July 15 th<br />

<strong>Owens</strong> <strong>Community</strong> College<br />

Fall semester: November 15 th PO Box 10,000, Toledo, OH 43699-1947<br />

***Requests <strong>for</strong> residency consideration <strong>for</strong> prior semesters will not be granted.<br />

For assistance<br />

If you have questions regarding this application you can send an email <strong>to</strong> residency@owens.edu or contact<br />

Oserve, your smart s<strong>to</strong>p <strong>for</strong> Registration, Records and Finance. Phone: (567) 661-7378 Fax: (567) 661-7414<br />

Directions: Please PRINT in black ink. If additional space is required <strong>for</strong> any questions, please attach a separate<br />

page.<br />

1. Name: ________________________________________________________________________<br />

(Last) (First) (Middle)<br />

2. OCID (<strong>Owens</strong> College Identification Number): __________________________________________<br />

3. SSN: ______________________________ Date of Birth: ________________________________<br />

(month / day / year)<br />

4. Indicate the semester <strong>for</strong> which you are requesting residency (select one):<br />

Summer Fall Spring Year: ________________<br />

5. I have attached required documentation <strong>for</strong> the provision selected above. Yes _____<br />

6. Reason <strong>for</strong> coming <strong>to</strong> <strong>Ohio</strong>:<br />

_________________________________________________________________________________<br />

_________________________________________________________________________________<br />

7. Have you previously filed a <strong>Petition</strong> <strong>for</strong> <strong>Change</strong> <strong>to</strong> <strong>Ohio</strong> <strong>Residency</strong> <strong>Status</strong>?<br />

Yes No<br />

Revised 9/2013

8. Current address: ____________________________________________________________________<br />

Note: If using a PO Box you must also include street address on your petition <strong>to</strong> be eligible <strong>for</strong><br />

residency.<br />

9. Please list the addresses <strong>for</strong> all previous residences in the past two years Dates of residence<br />

Street Address / City / State<br />

To - From<br />

4<br />

10. Date you established residency in <strong>Ohio</strong>: / / .<br />

(month / day / year)<br />

11. Marital <strong>Status</strong><br />

Single Widowed Divorced Separated Married Date of marriage: / / .<br />

(month / day / year)<br />

12. Are you entirely self-supporting?<br />

No<br />

Yes<br />

Please indicate all employers, places of employment, periods of employment, and earnings since<br />

you became self-supporting.<br />

Employer’s Name Employer Address Dates Employed Earnings<br />

________________ ______________________ ________________ ________________<br />

________________ ______________________ ________________ ________________<br />

________________ ______________________ ________________ ________________<br />

Has anyone other than yourself claimed you as a dependent on any income tax returns in the last calendar<br />

year? No Parent(s): Name(s): _____________________________________________<br />

Spouse: Name: ________________________________________________<br />

Other: Name: ________________________ Relationship: ______________<br />

13. Sources of support<br />

a. List the names of any individuals or organizations that are providing you with support:<br />

Name Relationship Address How long at this address?<br />

-<br />

-<br />

-<br />

b. Have you received any gifts, grants, loans, student loans or scholarships from any sources during the past 12<br />

months, and/or have you applied <strong>for</strong> any future grants, loans, or scholarships (including Social Security or<br />

V.A.)?<br />

No Yes If yes, indicate the following:<br />

Source Amount Academic semester covered<br />

Revised 9/2013

14. Indicate your citizenship or immigration status.<br />

U.S. Citizen Permanent Resident (attach copy of your Permanent <strong>Residency</strong> Card)<br />

DACA (Deferred Action Childhood Arrival) (attach copy of your DACA paperwork)<br />

Other ____________ (attach copy of your visa paperwork).<br />

5<br />

15. Are you registered <strong>to</strong> vote?<br />

No Yes List city, county, and state of registration: ________________________________<br />

16. Do you have an driver’s license or state issued ID?<br />

No Yes List the state in which you are licensed: _________________________________<br />

17. Signature and notarization<br />

<strong>Ohio</strong> Revised Code Section 2921.11, Perjury, reads in part:<br />

(A) No person, in any official proceeding, shall knowingly swear or affirm the truth of a false statement previously made when<br />

either statement is material.<br />

(B) A falsification is material, regardless of its admissibility in evidence, if it can affect the course or outcome of the proceeding.<br />

It is no defense <strong>to</strong> charge under this section that the offender mistakenly believed a falsification <strong>to</strong> be immaterial.<br />

The Undersigned being first duly sworn, deposes and says that each and severally the answers and statements contained in<br />

the <strong>for</strong>egoing pages are true and correct.<br />

Subscribed and sworn <strong>to</strong> be<strong>for</strong>e me this ________ day of _________, _________<br />

_________________________________________________________<br />

Signature of Applicant<br />

Date<br />

_____________________________________<br />

Notary Public in and <strong>for</strong> this County of<br />

(SEAL)<br />

State of <strong>Ohio</strong>, County of _____________________________,<br />

State of Michigan, County of __________________________,<br />

<strong>Ohio</strong> Student <strong>Residency</strong> <strong>for</strong> State Subsidy and Tuition Surcharge Purposes<br />

<strong>Residency</strong> status is governed by the <strong>Ohio</strong> Revised Code, which states:<br />

A. Intent and Authority<br />

1. It is the intent of the <strong>Ohio</strong> Board of Regents in promulgating this rule <strong>to</strong> exclude from treatment as residents, as that term is<br />

applied here, those persons who are present in the state of <strong>Ohio</strong> primarily <strong>for</strong> the purpose of receiving the benefit of a statesupported<br />

education.<br />

2. This rule is adopted pursuant <strong>to</strong> Chapter 119 of the Revised Code, and under the authority conferred upon the <strong>Ohio</strong> Board of<br />

Regents by Section 3333.31 of the Revised Code.<br />

B. Definitions<br />

For the purposes of this rule:<br />

1. "Resident” shall mean any person who maintains a twelve-month place or places of residence in <strong>Ohio</strong>, who is qualified as a<br />

resident <strong>to</strong> vote in <strong>Ohio</strong> and receive state public assistance, and who may be subjected <strong>to</strong> tax liability under Section 5747.02 of<br />

the Revised Code, provided such person has not, within the time prescribed by this rule, declared himself or herself <strong>to</strong> be or<br />

allowed himself or herself <strong>to</strong> remain a resident of any other state or nation <strong>for</strong> any of these or other purposes.<br />

2. "Financial support" as used in this rule, shall not include grants, scholarships and awards from persons or entities which are not<br />

related <strong>to</strong> the recipient.<br />

Revised 9/2013

6<br />

3. An "institution of higher education" shall have the same meaning as “state institution of higher education” as that term is defined in<br />

Section 3345.011 of the Revised Code, and shall also include private medical and dental colleges which receive direct subsidy<br />

from the State of <strong>Ohio</strong>.<br />

4. “Domicile” as used in this rule is a person’s permanent place of abode, so long as the person has the legal ability under federal<br />

and state law <strong>to</strong> reside permanently at that abode. For the purpose of this rule, only one domicile may be maintained at a given<br />

time.<br />

5. “Dependent” shall mean a student who was claimed by at least one parent or guardian as a dependent on that person’s Internal<br />

Revenue Service tax filing <strong>for</strong> the previous tax year.<br />

6. “<strong>Residency</strong> Officer” means the person or persons at an institution of higher education that has the responsibility <strong>for</strong> determining<br />

residency of students under this rule.<br />

7. “<strong>Community</strong> Service Position” shall mean a position volunteering or working <strong>for</strong>:<br />

(a) VISTA, AmeriCorps, City Year, the Peace Corps, or any similar program as determined by the <strong>Ohio</strong> Board of Regents; or<br />

(b) An elected or appointed public official <strong>for</strong> a period of time not exceeding 24 consecutive months.<br />

C. <strong>Residency</strong> <strong>for</strong> Subsidy and Tuition Surcharge Purposes<br />

The following persons shall be classified as residents of the state of <strong>Ohio</strong> <strong>for</strong> subsidy and tuition surcharge purposes:<br />

1. A student whose spouse, or a dependent student, at least one of whose parents or legal guardian has been a resident of the state<br />

of <strong>Ohio</strong> <strong>for</strong> all other legal purposes <strong>for</strong> twelve consecutive months or more immediately preceding the enrollment of such<br />

student in an institution of higher education.<br />

2. A person who has been a resident of <strong>Ohio</strong> <strong>for</strong> the purpose of this rule <strong>for</strong> at least twelve consecutive months immediately<br />

preceding his or her enrollment in an institution of higher education and who is not receiving, and has not directly or indirectly<br />

received in the preceding twelve consecutive months, financial support from persons or entities who are not residents of <strong>Ohio</strong><br />

<strong>for</strong> all other legal purposes.<br />

3. A dependent student of a parent or legal guardian, or the spouse of a person who, as of the first day of a term of enrollment, has<br />

accepted full-time, self-sustaining employment and established domicile in the State of <strong>Ohio</strong> <strong>for</strong> reasons other than gaining the<br />

benefit of favorable tuition rates.<br />

Documentation of full-time employment and domicile shall include both of the following documents:<br />

a. A sworn statement from the employer or the employer's representative on the letterhead of the employer or the employer's<br />

representative certifying that the parent, legal guardian or spouse of the student is employed full-time in <strong>Ohio</strong>.<br />

b. A copy of the lease under which the parent, legal guardian or spouse is the lessee and occupant of rented residential property<br />

in <strong>Ohio</strong>; a copy of the closing statement on residential real property located in <strong>Ohio</strong> of which the parent, legal guardian or<br />

spouse is the owner and the occupant; or if the parent, legal guardian or spouse is not the lessee or owner of the residence in<br />

which he or she has established domicile, a notarized letter from the owner of the residence certifying that the parent, legal<br />

guardian or spouse resides at that residence.<br />

4. A veteran, and the veteran’s spouse and any dependent of the veteran, who meets both of the following conditions:<br />

(a) The veteran either (i) served one or more years on active military duty and was honorably discharged or received a medical<br />

discharge that was related <strong>to</strong> the military service or (ii) was killed while serving on active military duty or has been declared <strong>to</strong> be<br />

missing in action or a prisoner of war.<br />

(b) If the veteran seeks residency status <strong>for</strong> tuition surcharge purposes, the veteran has established domicile in this state as of the<br />

first day of term of enrollment in an institution of higher education. If the spouse or a dependent of the veteran seeks residency<br />

status <strong>for</strong> tuition surcharge purposes, the veteran and the spouse or dependent seeking residency status have established domicile in<br />

this state as of the first day of a term of enrollment in an institution of higher education, except that if the veteran was killed while<br />

serving on active military duty or has been declared <strong>to</strong> be missing in action or a prisoner of war, only the spouse or dependent<br />

seeking residency status shall be required <strong>to</strong> have established domicile in accordance with this division.<br />

Domicile as used in paragraph (C)(4)(b) of this rule shall have the same meaning as used in paragraph (C)(3)(b) of this rule.<br />

5. OBR rules state, “The rules of the chancellor <strong>for</strong> determining student residency shall grant residency status <strong>to</strong> a person who,<br />

while a resident of the state <strong>for</strong> state subsidy and tuition surcharge purposes, graduated from a high school in the state, if the person<br />

enrolls in an institution of higher education and establishes domicile in the state, regardless of the student’s residency prior <strong>to</strong> that<br />

enrollment.” Rule 10 which amplifies ORC 3333.31 (statute that contains the <strong>for</strong>ever buckeye language) defines domicile.<br />

“Domicile” as used in this rule is a person’s permanent place of abode, so long as the person has the legal ability under federal and<br />

state law <strong>to</strong> reside permanently at that abode. For the purpose of this rule, only one domicile may be maintained at a given time.<br />

D. Additional criteria which may be considered by residency officers in determining residency may include but are not<br />

Limited <strong>to</strong> the following:<br />

1. Criteria evidencing residency:<br />

a. If a person is subject <strong>to</strong> tax liability under Section 5747.02 of the Revised Code;<br />

b. If a person qualifies <strong>to</strong> vote in <strong>Ohio</strong>;<br />

c. If a person is eligible <strong>to</strong> receive <strong>Ohio</strong> public assistance;<br />

d. If a person has an <strong>Ohio</strong> driver's license and/or mo<strong>to</strong>r vehicle registration.<br />

Revised 9/2013

7<br />

2. Criteria evidencing lack of residency:<br />

a. If a person is a resident of or intends <strong>to</strong> be a resident of another state or nation <strong>for</strong> the purposes of tax liability, voting, receipt<br />

of public assistance, or student loan benefits (if student qualified <strong>for</strong> that loan program by being a resident of that state or<br />

nation);<br />

b. If a person is a resident or intends <strong>to</strong> be a resident of another state or nation <strong>for</strong> any purpose other than tax liability, voting,<br />

or receipt of public assistance (see paragraph (D)(2)(a) of this rule).<br />

3. For the purpose of determining residency <strong>for</strong> tuition surcharge purposes at <strong>Ohio</strong>’s state-assisted colleges and universities, and<br />

individual’s immigration status will not preclude an individual from obtaining resident status if that individual has the current<br />

legal status <strong>to</strong> remain permanently in the United States.<br />

E. Exceptions <strong>to</strong> the general rule of residency <strong>for</strong> subsidy and tuition surcharge purposes<br />

1. A person who is living and is gainfully employed on a full-time or part-time and self-sustaining basis in <strong>Ohio</strong> and who is<br />

pursuing a part-time program of instruction at an institution of higher education shall be considered a resident of <strong>Ohio</strong> <strong>for</strong> these<br />

purposes.<br />

2. A person who enters and currently remains upon active duty status in the United States military service while a resident of <strong>Ohio</strong><br />

<strong>for</strong> all other legal purposes and his or her dependents shall be considered residents of <strong>Ohio</strong> <strong>for</strong> these purposes as long as <strong>Ohio</strong><br />

remains the state of such person's domicile.<br />

3. A person on active duty status in the United States military service who is stationed and resides in <strong>Ohio</strong> and his or her<br />

dependents shall be considered residents of <strong>Ohio</strong> <strong>for</strong> these purposes.<br />

4. A person who is transferred by his employer beyond the terri<strong>to</strong>rial limits of the fifty states of the United States and the District<br />

of Columbia while a resident of <strong>Ohio</strong> <strong>for</strong> all other legal purposes and his or her dependents shall be considered residents of<br />

<strong>Ohio</strong> <strong>for</strong> these purposes as long as <strong>Ohio</strong> remains the state of such person's domicile as long as such person has fulfilled his or<br />

her tax liability <strong>to</strong> the state of <strong>Ohio</strong> <strong>for</strong> at least the tax year preceding enrollment.<br />

5. A person who has been employed as a migrant worker in the state of <strong>Ohio</strong> and his or her dependents shall be considered a<br />

resident <strong>for</strong> these purposes provided such person has worked in <strong>Ohio</strong> at least four months during each of the three years<br />

preceding the proposed enrollment.<br />

6. A person who was considered a resident under this rule at the time the person started a community service position as defined<br />

under this rule, and his or her spouse and dependents, shall be considered a resident of <strong>Ohio</strong> while in service and upon<br />

completion of service in the community service position.<br />

7. A person who returns <strong>to</strong> the State of <strong>Ohio</strong> due <strong>to</strong> marital hardship, takes or has taken legal steps <strong>to</strong> end a marriage, and<br />

reestablishes financial dependence upon a parent or legal guardian (receives greater than 50% of his or her support from the<br />

parent or legal guardian), and his or her dependents shall be considered residents of <strong>Ohio</strong>.<br />

8. A person who is a member of the <strong>Ohio</strong> National Guard and who is domiciled in <strong>Ohio</strong>, and his or her spouse and dependents,<br />

shall be considered residents of <strong>Ohio</strong> while the person is in <strong>Ohio</strong> National Guard service.<br />

F. Procedures<br />

1. A dependent person classified as a resident of <strong>Ohio</strong> <strong>for</strong> these purposes under the provisions of paragraph (C)(1) of this rule and<br />

who is enrolled in an institution of higher education when his or her parents or legal guardian removes their residency from the<br />

state of <strong>Ohio</strong> shall continue <strong>to</strong> be considered a resident during continuous full-time enrollment and until his or her completion<br />

of any one academic degree program.<br />

2. In considering residency, removal of the student or the student's parents or legal guardian from <strong>Ohio</strong> shall not, during a period<br />

of twelve months following such removal, constitute relinquishment of <strong>Ohio</strong> residency status otherwise established under<br />

paragraph (C)(1) or (C)(2) of this rule.<br />

3. For students who qualify <strong>for</strong> residency status under paragraph (C)(3) of this rule, residency status is lost immediately if the<br />

employed person upon whom resident student status was based accepts employment and establishes domicile outside <strong>Ohio</strong> less<br />

than 12 months after accepting employment and establishing domicile in <strong>Ohio</strong>.<br />

4. Any person once classified as a nonresident, upon the completion of twelve consecutive months of residency, must apply <strong>to</strong> the<br />

institution he or she attends <strong>for</strong> reclassification as a resident of <strong>Ohio</strong> <strong>for</strong> these purposes if such person in fact wants <strong>to</strong> be<br />

reclassified as a resident. Should such person present clear and convincing proof that no part of his or her financial support is<br />

or in the preceding twelve consecutive months has been provided directly or indirectly by persons or entities who are not<br />

residents of <strong>Ohio</strong> <strong>for</strong> all other legal purposes, such person shall be reclassified as a resident. Evidentiary determinations under<br />

this rule shall be made by the institution, which may require among other things, the submission of documentation regarding the<br />

sources of a student's actual financial support.<br />

5. Any reclassification of a person who was once classified as a nonresident <strong>for</strong> these purposes shall have prospective application<br />

only from the date of such reclassification.<br />

6. Any institution of higher education charged with reporting student enrollment <strong>to</strong> the <strong>Ohio</strong> Board of Regents <strong>for</strong> state subsidy<br />

purposes and assessing the tuition surcharge shall provide individual students with a fair and adequate opportunity <strong>to</strong> present<br />

proof of his or her <strong>Ohio</strong> residency <strong>for</strong> purposes of this rule. Such an institution may require the submission of affidavits and<br />

other documentary evidence, which it may deem necessary <strong>to</strong> a full and complete determination under this rule<br />

Revised 9/2013