Fundamentals of Private Equity and Venture Capital - PEI Media

Fundamentals of Private Equity and Venture Capital - PEI Media

Fundamentals of Private Equity and Venture Capital - PEI Media

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

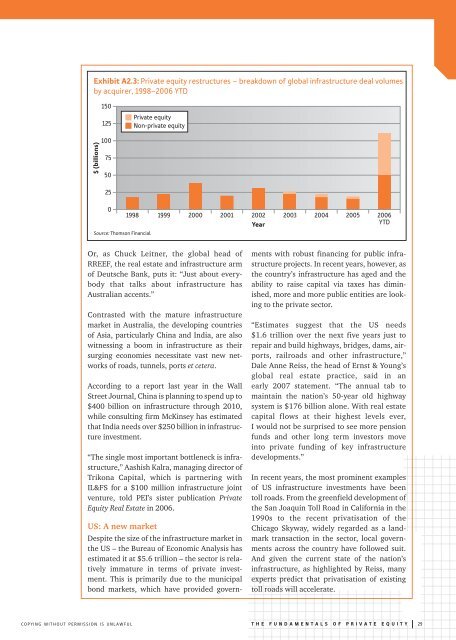

Exhibit A2.3: <strong>Private</strong> equity restructures – breakdown <strong>of</strong> global infrastructure deal volumes<br />

by acquirer, 1998–2006 YTD<br />

150<br />

125<br />

<strong>Private</strong> equity<br />

Non-private equity<br />

$ (billions)<br />

100<br />

75<br />

50<br />

25<br />

0<br />

1998 1999 2000 2001 2002 2003 2004 2005<br />

Year<br />

Source: Thomson Financial.<br />

2006<br />

YTD<br />

Or, as Chuck Leitner, the global head <strong>of</strong><br />

RREEF, the real estate <strong>and</strong> infrastructure arm<br />

<strong>of</strong> Deutsche Bank, puts it: “Just about everybody<br />

that talks about infrastructure has<br />

Australian accents.”<br />

Contrasted with the mature infrastructure<br />

market in Australia, the developing countries<br />

<strong>of</strong> Asia, particularly China <strong>and</strong> India, are also<br />

witnessing a boom in infrastructure as their<br />

surging economies necessitate vast new networks<br />

<strong>of</strong> roads, tunnels, ports et cetera.<br />

According to a report last year in the Wall<br />

Street Journal, China is planning to spend up to<br />

$400 billion on infrastructure through 2010,<br />

while consulting firm McKinsey has estimated<br />

that India needs over $250 billion in infrastructure<br />

investment.<br />

“The single most important bottleneck is infrastructure,”<br />

Aashish Kalra, managing director <strong>of</strong><br />

Trikona <strong>Capital</strong>, which is partnering with<br />

IL&FS for a $100 million infrastructure joint<br />

venture, told <strong>PEI</strong>’s sister publication <strong>Private</strong><br />

<strong>Equity</strong> Real Estate in 2006.<br />

US: A new market<br />

Despite the size <strong>of</strong> the infrastructure market in<br />

the US – the Bureau <strong>of</strong> Economic Analysis has<br />

estimated it at $5.6 trillion – the sector is relatively<br />

immature in terms <strong>of</strong> private investment.<br />

This is primarily due to the municipal<br />

bond markets, which have provided governments<br />

with robust financing for public infrastructure<br />

projects. In recent years, however, as<br />

the country’s infrastructure has aged <strong>and</strong> the<br />

ability to raise capital via taxes has diminished,<br />

more <strong>and</strong> more public entities are looking<br />

to the private sector.<br />

“Estimates suggest that the US needs<br />

$1.6 trillion over the next five years just to<br />

repair <strong>and</strong> build highways, bridges, dams, airports,<br />

railroads <strong>and</strong> other infrastructure,”<br />

Dale Anne Reiss, the head <strong>of</strong> Ernst & Young’s<br />

global real estate practice, said in an<br />

early 2007 statement. “The annual tab to<br />

maintain the nation’s 50-year old highway<br />

system is $176 billion alone. With real estate<br />

capital flows at their highest levels ever,<br />

I would not be surprised to see more pension<br />

funds <strong>and</strong> other long term investors move<br />

into private funding <strong>of</strong> key infrastructure<br />

developments.”<br />

In recent years, the most prominent examples<br />

<strong>of</strong> US infrastructure investments have been<br />

toll roads. From the greenfield development <strong>of</strong><br />

the San Joaquin Toll Road in California in the<br />

1990s to the recent privatisation <strong>of</strong> the<br />

Chicago Skyway, widely regarded as a l<strong>and</strong>mark<br />

transaction in the sector, local governments<br />

across the country have followed suit.<br />

And given the current state <strong>of</strong> the nation’s<br />

infrastructure, as highlighted by Reiss, many<br />

experts predict that privatisation <strong>of</strong> existing<br />

toll roads will accelerate.<br />

COPYING WITHOUT PERMISSION IS UNLAWFUL<br />

THE FUNDAMENTALS OF PRIVATE EQUITY 29