Overview of Capital Account Crisis - IMF

Overview of Capital Account Crisis - IMF

Overview of Capital Account Crisis - IMF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

- 13 -<br />

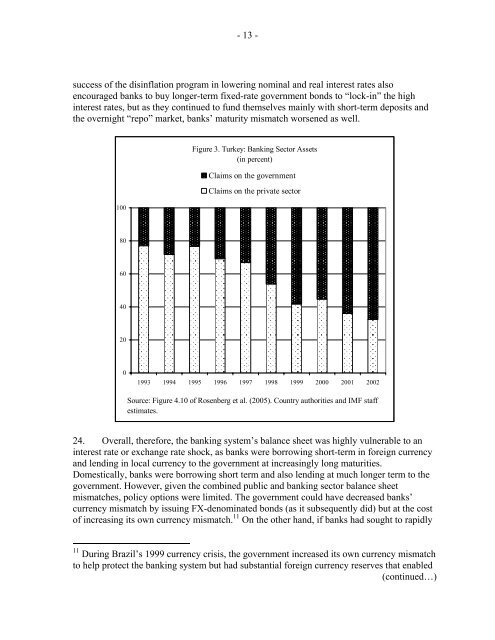

success <strong>of</strong> the disinflation program in lowering nominal and real interest rates also<br />

encouraged banks to buy longer-term fixed-rate government bonds to “lock-in” the high<br />

interest rates, but as they continued to fund themselves mainly with short-term deposits and<br />

the overnight “repo” market, banks’ maturity mismatch worsened as well.<br />

100<br />

Figure 3. Turkey: Banking Sector Assets<br />

(in percent)<br />

Claims on the government<br />

Claims on the private sector<br />

80<br />

60<br />

40<br />

20<br />

0<br />

1993 1994 1995 1996 1997 1998 1999 2000 2001 2002<br />

Source: Figure 4.10 <strong>of</strong> Rosenberg et al. (2005). Country authorities and <strong>IMF</strong> staff<br />

estimates.<br />

24. Overall, therefore, the banking system’s balance sheet was highly vulnerable to an<br />

interest rate or exchange rate shock, as banks were borrowing short-term in foreign currency<br />

and lending in local currency to the government at increasingly long maturities.<br />

Domestically, banks were borrowing short term and also lending at much longer term to the<br />

government. However, given the combined public and banking sector balance sheet<br />

mismatches, policy options were limited. The government could have decreased banks’<br />

currency mismatch by issuing FX-denominated bonds (as it subsequently did) but at the cost<br />

<strong>of</strong> increasing its own currency mismatch. 11 On the other hand, if banks had sought to rapidly<br />

11 During Brazil’s 1999 currency crisis, the government increased its own currency mismatch<br />

to help protect the banking system but had substantial foreign currency reserves that enabled<br />

(continued…)