to Form 990 - The Pew Charitable Trusts

to Form 990 - The Pew Charitable Trusts

to Form 990 - The Pew Charitable Trusts

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

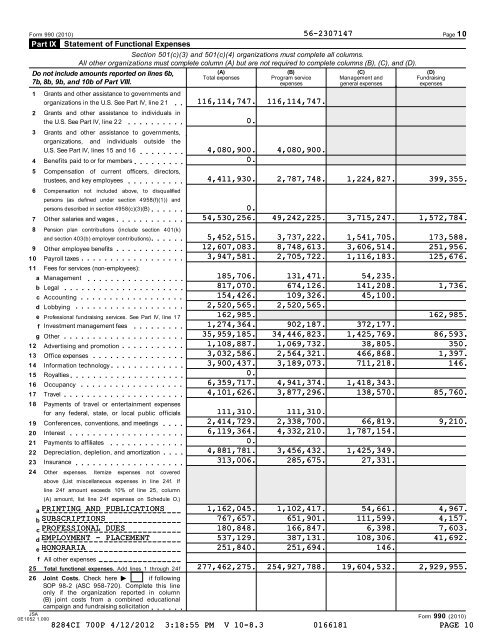

<strong>Form</strong> <strong>990</strong> (2010) Page 10<br />

Part IX<br />

Statement of Functional Expenses<br />

Section 501(c)(3) and 501(c)(4) organizations must complete all columns.<br />

All other organizations must complete column (A) but are not required <strong>to</strong> complete columns (B), (C), and (D).<br />

Do not include amounts reported on lines 6b,<br />

7b, 8b, 9b, and 10b of Part VIII.<br />

1<br />

2<br />

m m<br />

m m m m m m m m m m<br />

Grants and other assistance <strong>to</strong> governments and<br />

organizations in the U.S. See Part IV, line 2 1<br />

Grants and other assistance <strong>to</strong> individuals in<br />

the U.S. See Part IV, line 2 2<br />

3 Grants and other assistance <strong>to</strong> governments,<br />

organizations, and individuals outside the<br />

U.S. See Part IV, lines 15 and 1 6<br />

4 Benefits paid <strong>to</strong> or for members m m m m m m m m m<br />

5 Compensation of current officers, direc<strong>to</strong>rs,<br />

trustees, and key employees m m m m m m m m m m<br />

6 Compensation not included above, <strong>to</strong> disqualified<br />

persons (as defined under section 4958(f)(1)) and<br />

persons described in section 4958(c)(3)(B)m 7 Other salaries and wages m m m m m m m m m m m m<br />

8 Pension plan contributions (include section 401(k)<br />

and section 403(b) employer contributions)m 9 Other employee benefits<br />

Payroll taxes m m m m m m m m m m m m m m m m m m<br />

Fees for services (nonemployees):<br />

a Management<br />

b Legal m m m m m m m m m m m m m m m m m m m m m<br />

c Accounting<br />

d Lobbying m m m m m m m m m m m m m m m m m m m<br />

e Professional fundraising services. See Part IV, line 1 7<br />

f Investment management fees<br />

g Other m m m m m m m m m m Advertising and promotion<br />

Office expenses m m m Information technology<br />

Royaltiesm m<br />

Occupancy<br />

m m m m m m m m m m m m m m m m m m<br />

Travel m m m m m m m m m m m m m m m m m m m m m<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

a<br />

b<br />

c<br />

d<br />

e<br />

f<br />

JSA<br />

0E1052 1.000<br />

Payments of travel or entertainment expenses<br />

for any federal, state, or local public officials<br />

Conferences, conventions, and meetings<br />

Interest<br />

Payments <strong>to</strong> affiliates<br />

Depreciation, depletion, and amortization<br />

Insurance<br />

m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m<br />

Other expenses. Itemize expenses not covered<br />

above (List miscellaneous expenses in line 24f. If<br />

line 24f amount exceeds 10% of line 25, column<br />

(A) amount, list line 24f expenses on Schedule O.)<br />

All other expenses<br />

Total functional expenses. Add lines 1 through 24f<br />

Joint Costs. Check here<br />

if following<br />

SOP 982 (ASC 958720). Complete this line<br />

only if the organization reported in column<br />

(B) joint costs from a combined educational<br />

campaign and fundraising solicitation m m m m m m<br />

I<br />

562307147<br />

(A) (B) (C) (D)<br />

Total expenses<br />

Program service<br />

Management and<br />

Fundraising<br />

expenses<br />

general expenses<br />

expenses<br />

116,114,747. 116,114,747.<br />

0.<br />

4,080,900. 4,080,900.<br />

0.<br />

4,411,930. 2,787,748. 1,224,827. 399,355.<br />

0.<br />

54,530,256. 49,242,225. 3,715,247. 1,572,784.<br />

5,452,515. 3,737,222. 1,541,705. 173,588.<br />

12,607,083. 8,748,613. 3,606,514. 251,956.<br />

3,947,581. 2,705,722. 1,116,183. 125,676.<br />

185,706. 131,471. 54,235.<br />

817,070. 674,126. 141,208. 1,736.<br />

154,426. 109,326. 45,100.<br />

2,520,565. 2,520,565.<br />

162,985. 162,985.<br />

1,274,364. 902,187. 372,177.<br />

35,959,185. 34,446,823. 1,425,769. 86,593.<br />

1,108,887. 1,069,732. 38,805. 350.<br />

3,032,586. 2,564,321. 466,868. 1,397.<br />

3,900,437. 3,189,073. 711,218. 146.<br />

0.<br />

6,359,717. 4,941,374. 1,418,343.<br />

4,101,626. 3,877,296. 138,570. 85,760.<br />

111,310. 111,310.<br />

2,414,729. 2,338,700. 66,819. 9,210.<br />

6,119,364. 4,332,210. 1,787,154.<br />

0.<br />

4,881,781. 3,456,432. 1,425,349.<br />

313,006. 285,675. 27,331.<br />

PRINTING AND PUBLICATIONS 1,162,045. 1,102,417. 54,661. 4,967.<br />

SUBSCRIPTIONS 767,657. 651,901. 111,599. 4,157.<br />

PROFESSIONAL DUES 180,848. 166,847. 6,398. 7,603.<br />

EMPLOYMENT PLACEMENT 537,129. 387,131. 108,306. 41,692.<br />

HONORARIA 251,840. 251,694. 146.<br />

277,462,275. 254,927,788. 19,604,532. 2,929,955.<br />

<strong>Form</strong> <strong>990</strong> (2010)<br />

8284CI 700P 4/12/2012 3:18:55 PM V 108.3 0166181 PAGE 10